The mobility industry is growing at a rapid rate, with innovations happening across cars, bikes and scooter sharing alike. This article explores the most recent advancements in the market and how industry leaders are finding new ways to compete. Learn about the different models for Mobility as a Service and what it means for the future of transportation.

Car Sharing Services

According to research by the Internet of Things, the number of carsharing service users across the world is expected to grow from 50.4 million people in 2018 to 227.1 million in 2023. The number of cars used for car sharing services is also forecasted to increase from 332,000 at the end of 2018 to 1.2 million by 2023. The rising demand for these services has driven more companies towards developing methods of sharing that go beyond traditional single use cars.

Image source: Internet of Things

Free Floating

A new model of car sharing that has recently grown in popularity is free floating carsharing, which allows users to pick up a car in one location and return it anywhere within a predefined Home Zone. Challenging the idea of ownership, this service currently has 3 million users worldwide, with over 30 thousand vehicles available across more than 50 cities.

there are currently over 30 thousand vehicles equipped with this service across more than 50 cities worldwide

Dailmer and BMW became a leader in the free floating industry when they merged their two car sharing services, Car2Go and DriveNow, in February 2019 to form SHARE NOW. With over four million members, the free floating car rental service is available in 18 major cities across Europe with a fleet of 20,500 vehicles to choose from. Members register through a mobile app, gaining access to the services for the cost of $0.32 per minute. The company covers the fixed costs of car loans, car insurance and car maintenance so users are able to enjoy the freedom of driving without the responsibility of ownership.

The largest benefit of free float car sharing is the higher demand that can be met on average per ride and car each day. However, this model still includes a lot of operational day-to-day tasks such as maintenance, relocating, fueling/charging that can require a larger team.

Station Based

The traditional model of car sharing services is station based, where users can pick-up vehicles from a fixed rental station after filling out paperwork in person or through a mobile app. After signing an agreement, the renter is able to drive the car wherever they would like. The lease ends once the car is returned to a designated rental station that has been approved by the provider. This model does not provide the same flexibility to users that newer offerings have, however, it remains one of the best ways for providers to track the vehicles without developing complex systems.

Enterprise CarShare is an example of traditional station based car sharing services. Offering users three membership levels to choose from, the pricing varies based on hourly, daily and overnight rates as well as kilometers driven. Depending on the membership, hourly rates are around $8, daily rates $75 and overnight rates start at $29. The vehicles are available for pick-up at designated stations or lots and can be returned at the discretion of the user to any Enterprise location at the end of their trip.

Compared to free float services, station based car sharing has lower operational costs since only a few fixed stations need to be monitored and checked each day. Right now this model is most profitable in the market, once free float operators enter on a wider scale it will be harder to keep up with the high demand.

Peer-to-Peer

Peer-to-peer car sharing services have experienced large growth in the past few years. Research found that by 2017, more than 2.9 million people in North America were using these services renting over 131,336 vehicles. Peer-based car-sharing fleets expanded by 80 percent between 2016 and 2017 and memberships doubled.

The peer-to-peer car sharing model allows users to list their own vehicles on a sharing platform, connecting hosts to guests looking to rent. This style of sharing allows users to set their own rental rates, while giving members who are looking to rent a wider selection of vehicles to choose from.

Turo is a leader in the peer-to-peer sharing industry, serving as a marketplace where guests can book any car they want from hosts across the US, Canada, the UK and Germany. The guests are able to choose from a unique selection of cars within their area, while allowing the hosts an opportunity to earn extra money to offset the costs of ownership. The company currently has over 10 million users, with more than 350,000 vehicles listed for rent.

Image source: cnet

The rates for Turo are charged by the hour and are subject to adjustments made either by the company’s own algorithm or the specific daily rates charged by each host.

In this model, the operator acts as an aggregator without ownership over the vehicles, which makes it easier to scale the business without the need for huge capital investments. However, it becomes more difficult to control the quality of the experience since every car cannot be checked on a regular basis. It is important to establish a strong customer support team to help resolve any issues that occur.

Autonomous

The future of car sharing is focused on eliminating the driver all together. Autonomous vehicles are beginning to make their way into the marketplace, with the hope being that fleets of self-driving cars will be able to pick-up users at any given location and return to the designated charging area all on their own.

A leader in this next step of mobility is Waymo, a company that emerged from Google’s self-driving car project. The company launched their first commercial self-driving-car service in December 2018, in Phoenix. The self-driving cars operate in an approximately 100-square-mile radius, serving the towns of Chandler, Gilbert, Mesa and Tempe. Available to a select few pre-approved riders, the hope is that driverless vehicles will be a main part of transportation in the future. There are currently around 1,500 monthly active users helping with the testing program.

In theory, the economics of this model should be great as there is no driver costs or relocating costs, keeping operational requirements to a minimum. These vehicles will however be heavily regulated, with limited access in the near future.

Bike Sharing Services

The demand for accessible transportation in cities has expanded beyond traditional motor vehicles. Across the world, urban areas are beginning to adapt bike sharing programs that allow citizens to use both standard bicycles and e-bikes as a form of travel. The bikes are usually selected from one docking station, and later returned to another across the city. There is currently believed to be nearly 900 bike-sharing systems available globally, with continuous advancements being made each year.

The bike sharing market is expected to grow from a $2.7 billion dollar industry to $5 billion by 2025, according to a report by Research and Markets. That in mind, bike sharing companies across the world should approach expansion with caution to avoid over extending their services. In 2018, Chinese bike sharing start-up Ofo experienced financial decline due to their costly global expansion that was not supported by commercial success. The company was unable to maintain the accessibility of its competitors who partnered with mobile app providers, offering them a wider reach for their services. Without support from an investment partner, Ofo could no longer sustain the maintenance of its bike sharing fleets, let alone compete in the market.

We believe you can build a successful bike share company once you have the right strategy in place. It is important to be operationally efficient when starting out, initially launching a smaller fleet and growing organically with the demand. If you start by scaling wide without having the matching demand, your resources will be spread too thin. The most successful bike share programs work with the local municipalities and cities to determine revenue streams and find the best options to connect with riders.

Dockless Bike Sharing

The dockless bike sharing model offers users access to bicycles that do not require a docking station. Dockless systems allow the bikes to be located and unlocked through a mobile app then returned to a designated district at a bike rack or along the sidewalk. This model is designed for short term use, ideal when travelling or visiting somewhere as a tourist. Most dockless sharing services offer single rides for $1 or monthly fees for continuous use.

Lime was one of the first companies to offer dockless bike services. Users access the bikes at designated areas through the company’s mobile app, initially they are charged a fixed rate to unlock the vehicle and then per minute for the duration of their trip. The rates and promotions available vary based on location and time. Program packages are also offered for users who wish to make monthly payments or have the services available to their employees on a regular basis.

This model of bike sharing is ideal for users because it is easily accessible and convenient to employ every day. There are high operational costs that come with this type of service, as well as a larger risk for vandalism or damage to the bikes.

Station Based

Traditional bike share programs include docking stations where the bicycles are locked until a user purchases a ride. The user pays at a nearby pay station before unlocking the vehicle for a short term trip, later returning it to any available docking station when finished. There are typically two types of payment options available, a flat membership fee or pass that allows access to the bikes for a certain period of time and then a usage fee that charges for the amount of time you spend riding.

San Francisco is one of the first cities to create a regulatory and permitting framework around the trend of bike-sharing. In December 2019, 4,000 e-bikes were launched as part of the Bay Area bike sharing program, designed to make mobility easily accessible to citizens. The program provides rides with the option to purchase a single ride, starting at $2, through Lyft’s mobile ride-sharing app. There are over 300 docking stations available throughout the city, allowing users to travel across the Bay Area more efficiently.

The Capital Bikeshare, in Washington D.C. has a membership fee of $85 annually offering lower usage charges throughout the year. For the first 30 minutes a ride, members aren’t charged, they then receive a rate of $1.50 for the next 30, $3 for the third and finally an additional $6 for every other 30 minute period. For non-members, the first 30 minutes also has no charge but they experience higher fees for every 30 minutes after that. The higher usage fees are balanced out by lower costs at the start -- a daily Capital Bikeshare pass is only $8 and a monthly pass comes to $28.

Station based bike sharing can help bring a stable ROI for every bike since operational costs are low, and there is a minimal need for maintenance, relocation or charging. As dockless bikes continue to expand in the market, this model risks losing loyal users in the long-run.

Sponsored by Corporate

Some bike share programs operate in partnership with corporations who sponsor the vehicles. Operating like a standard bike share program, these vehicles operate in conjunction with the local municipalities.

In London, the city offers a public bicycle hire scheme funded by Santander UK. With more than 750 docking stations and 11,500 bikes available for hire around the city, users have easy access to the vehicles. The program operates 24 hours a day, year-round with an initial cost of 2 Euros for a daily trip, charging an additional 2 Euros per half hour after the first 30 minutes. Users have the option to hire a bike using their bank card at the docking station, or through the official mobile app.

This model is great for any operator that can find a reliable partner who is interested in establishing this type of deal, however, you still run the risk of losing that partner later on.

Scooter Sharing Services

The fastest growing trend in mobility is the advent of e-scooters. They are inexpensive, accessible through mobile apps similar to bike sharing and available in over 100 cities worldwide. According to the US National Association of City Transportation Officials, riders took 38.5 million trips on shared electric scooters in 2018 compared to the 36.5 million trips on docked bikes. The Boston Consulting Group estimates that the global e-scooter market will grow to US$50 billion by 2025, with approximately 50% of the users being located in Europe and the USA. Micro-mobility is quickly becoming the preferred method for short term travel and companies have already begun to emerge as leaders in the market.

Image source: nacto.org

Station Based

Similar to station based bikes, some e-scooter providers offer docking stations where the scooters can be unlocked through a mobile app and then returned later to any available docking station.

DASH Scooters operates out of Nashville, TN, offering docked e-scooters styled like vespas that can be rented at set rates through their mobile app. Starting at $40 for two hours, the rates increase based on time travelled and day of the week. The brand launched after the emergence of other leaders such as Bird, Lime and Spin, who have set the bar for innovation in e-scooters. Their app allows users to locate nearby docking stations where the scooters can be returned to at the end of a trip.

The best way for operators to get a high return on their business is to have a combination of station based and dockless scooters. This will help maintain growth over time, while keeping up the high demand.

Dockless Scooters

Leaders in the mobility industry have begun to focus on the possibilities of dockless scooters. This model involves e-scooters that do not require a docking stations, but instead can be rented from a designated location and then returned anywhere in another.

Spin operates in 62 cities and 20 campuses across the United States, offering fleets of electric scooters for easy, short term travel. Users are able to unlock the scooters through their mobile app, once the ride is complete they can leave the scooter at any designated location and the cost will appear on the app. Charges vary depending on the length of the ride.

This model is currently experiencing high demand due to its convenience and ease of access for users. There are a large amount of maintenance and operational costs required, similar to other dockless mobility services, as well as increasing regulations across cities.

Hotel Services

While the future of e-scooters in cities is an on-going process, the services have begun to expand into the tourism sector. Hotels and resorts have begun to offer scooter sharing services to allow guests to easily travel throughout the location, or explore local surroundings. The options vary between station based and dockless scooters, with pricing packages being dependent on the destination.

Rentskoot is a start-up in Finland that offers small fleets of electric scooters to hotels. Guests are then able to rent the scooters from the hotel premises as a unique way to experience the local neighbourhoods. The company provides operational training to staff, free maintenance and the ability to advertise the hotel’s logo on the scooters. Travelling at a maximum speed of 25 km/h, the compact size and battery life makes this service ideal for short term use within cities.

By focusing on hotels, this model allows businesses to be more innovative with their designs while keeping a consistent demand amongst the growing market. An agreement will need to be made with the hotel in advance regarding guidelines for use and overall costs distribution.

What does this mean for the future of mobility?

The car sharing industry is projected to reach a 16.5 billion USD revenue by 2024, with an annual increase of 34.8% every year. A trend towards electric vehicles is also predicted as the demand for lithium-ion batteries has been predicted to increase by 380% by 2025. In addition, the bike and scooter rental market is expected to grow from USD $2.5 billion in 2019 to USD $10.1 billion by 2027, at a CAGR of 18.9 percent. Dockless systems will most likely continue to dominate the market, as their flexibility and ease has historically made them the more popular option for riders.

Every sector of MaaS has one thing in common: the desire to make transportation easier for riders. Ultimately each service compliments the other by providing different options for mobility that can each work together to get a user from point A to point B and back. If someone arrives in the city by train, they could then travel to work using an e-bike or e-scooter to avoid traffic. When returning home late at night a car sharing service could be used to get them there in one trip. The hope is that the future of mobility will consist of a connected network designed for safe, efficient and easily accessible travel.

With this quickly growing market on the rise, there hasn’t been a better time to become a leader in mobility. Start your journey in 20 days with ATOM!

Click below to learn more or request a demo.

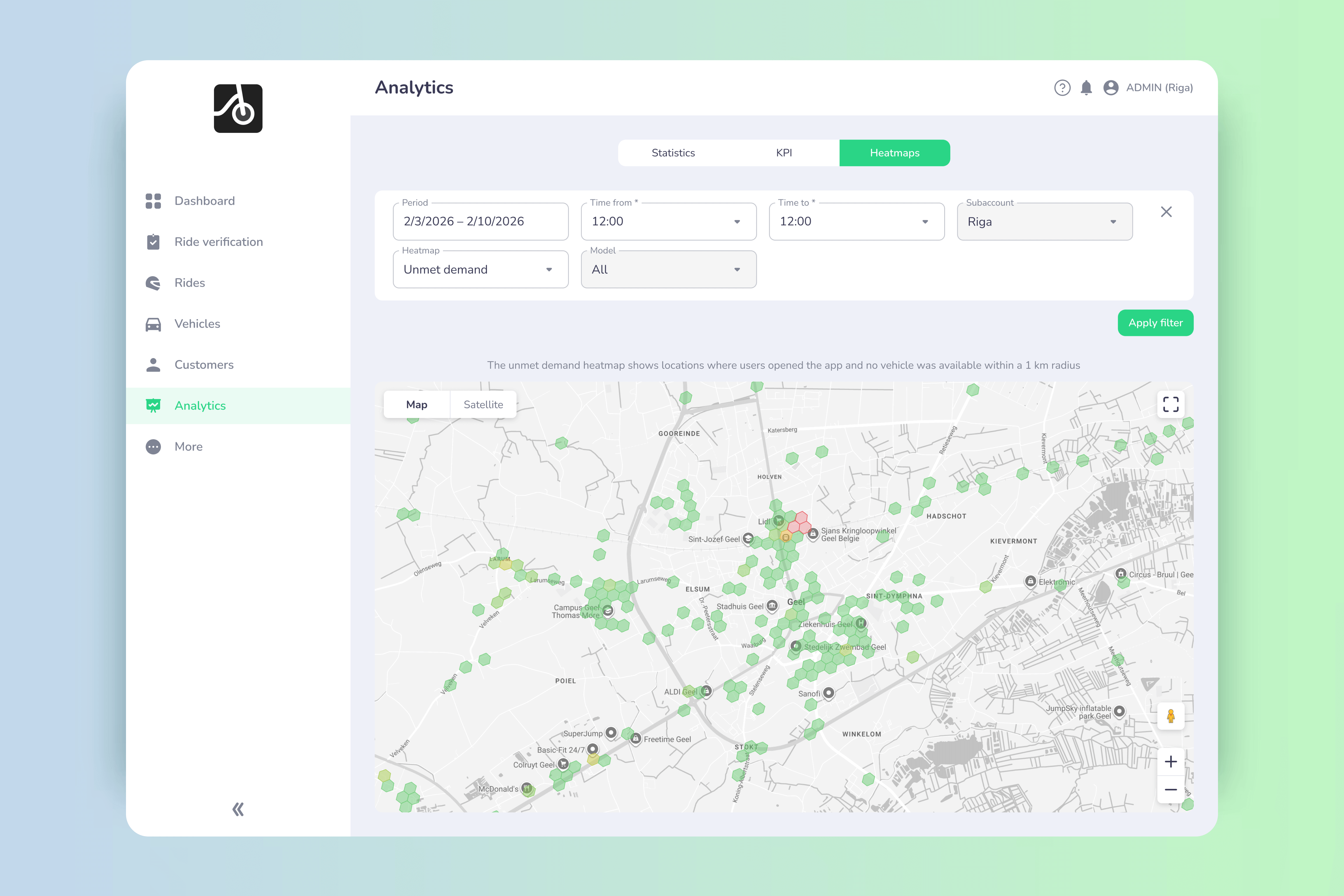

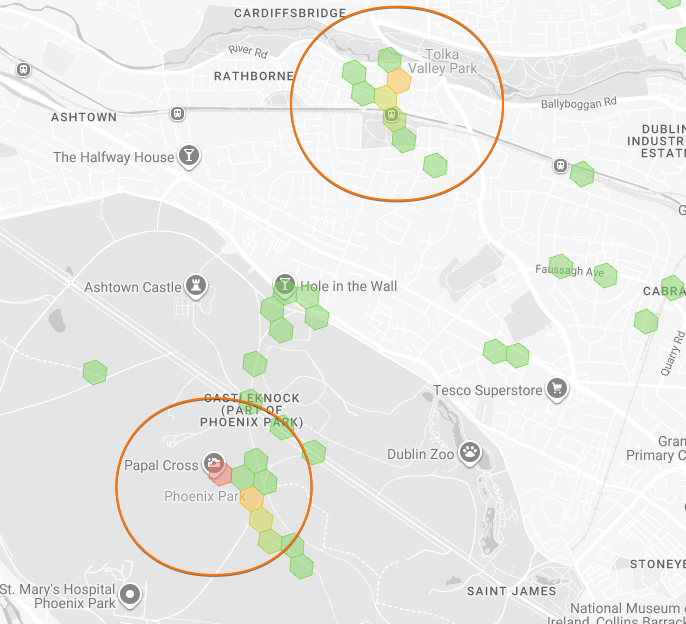

📉 Every unmet search is lost revenue. The unmet demand heatmap shows where users actively searched for vehicles but none were available - giving operators clear, search-based demand signals to rebalance fleets 🚚, improve conversions 📈, and grow smarter 🧠.

Fleet operators don’t lose revenue because of lack of demand - they lose it because demand appears in the wrong place at the wrong time. That’s exactly the problem the Unmet demand heatmap solves.

This new analytics layer from ATOM Mobility shows where users actively searched for vehicles but couldn’t find any within reach. Not guesses. Not assumptions. Real, proven demand currently left on the table.

What is the unmet demand heatmap?

The unmet demand heatmap highlights locations where:

- A user opened the app

- Actively searched for available vehicles

- No vehicle was found within the defined search radius

In other words: high-intent users who wanted to ride, but couldn’t. Unlike generic “app open” data, unmet demand is recorded only when a real vehicle search happens, making this one of the most actionable datasets for operators.

Why unmet demand is more valuable than app opens

Many analytics tools track where users open the app (ATOM Mobility provides this data too). That’s useful - but incomplete. Unmet demand answers a much stronger question:

Where did users try to ride and failed? That difference matters.

Unmet demand data is:

✅ Intent-driven (search-based, not passive)

✅ Directly tied to lost revenue

✅ Immediately actionable for rebalancing and expansion

✅ Credible for discussions with cities and partners

How it works

Here’s how the logic is implemented under the hood:

1. Search-based trigger. Unmet demand is recorded only when a user performs a vehicle search. No search = no data point.

2. Distance threshold. If no vehicle is available within 1,000 meters, unmet demand is logged.

- The radius can be customized per operator

- Adaptable for dense cities vs. suburban or rural areas

3. Shared + private fleet support. The feature tracks unmet demand for:

- Shared fleets

- Private / restricted fleets (e.g. corporate, residential, campus)

This gives operators a full picture across all use cases.

4. GPS validation. Data is collected only when:

- GPS is enabled

- Location data is successfully received

This ensures accuracy and avoids noise.

Smart data optimization (no inflated demand)

To prevent multiple searches from the same user artificially inflating demand, the system applies intelligent filtering:

- After a location is stored, a 30-minute cooldown is activated

- If the same user searches again within 30 minutes And within 100 meters of the previous location → the record is skipped

- After 30 minutes, a new record is stored - even if the location is unchanged

Result: clean, realistic demand signals, not spammy heatmaps.

Why this matters for operators

📈 Increase revenue

Unmet demand shows exactly where vehicles are missing allowing you to:

- Rebalance fleets faster

- Expand into proven demand zones

- Reduce failed searches and lost rides

🚚 Smarter rebalancing

Instead of guessing where to move vehicles, teams can prioritize:

- High-intent demand hotspots

- Time-based demand patterns

- Areas with repeated unmet searches

🏙 Stronger city conversations

Unmet demand heatmaps are powerful evidence for:

- Permit negotiations

- Zone expansions

- Infrastructure requests

- Data-backed urban planning discussions

📊 Higher conversion rates

Placing vehicles where users actually search improves:

- Search → ride conversion

- User satisfaction

- Retention over time

Built for real operational use

The new unmet demand heatmap is designed to work alongside other analytics layers, including:

- Popular routes heatmap

- Open app heatmap

- Start & end locations heatmap

Operators can also:

- Toggle zone visibility across heatmaps

- Adjust time periods (performance-optimized)

- Combine insights for strategic fleet planning

From missed demand to competitive advantage

Every unmet search is a signal. Every signal is a potential ride. Every ride is revenue. With the unmet demand heatmap, operators stop guessing and start placing vehicles exactly where demand already exists.

👉 If you want to see how unmet demand can unlock growth for your fleet, book a demo with ATOM Mobility and explore how advanced heatmaps turn data into decisions.

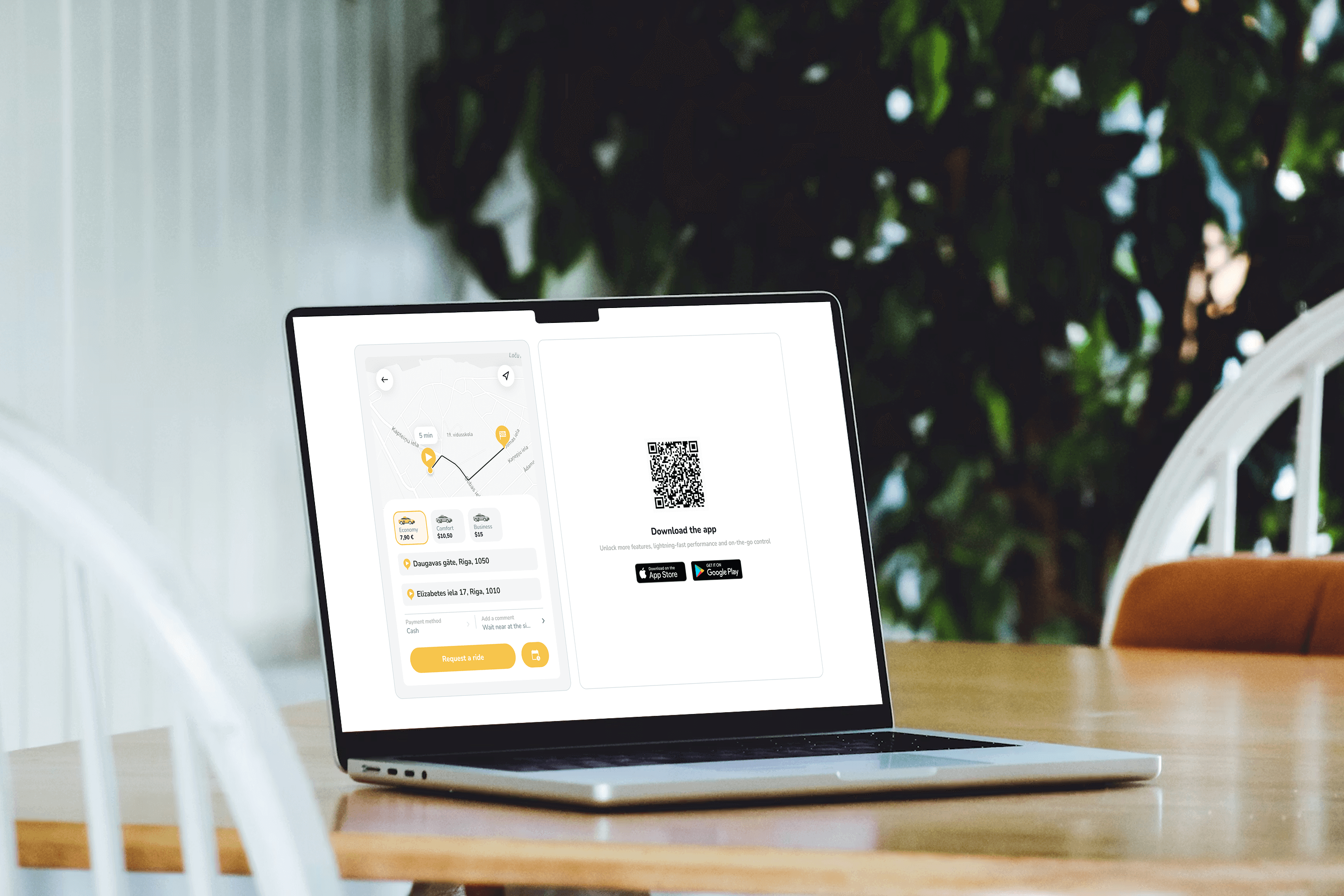

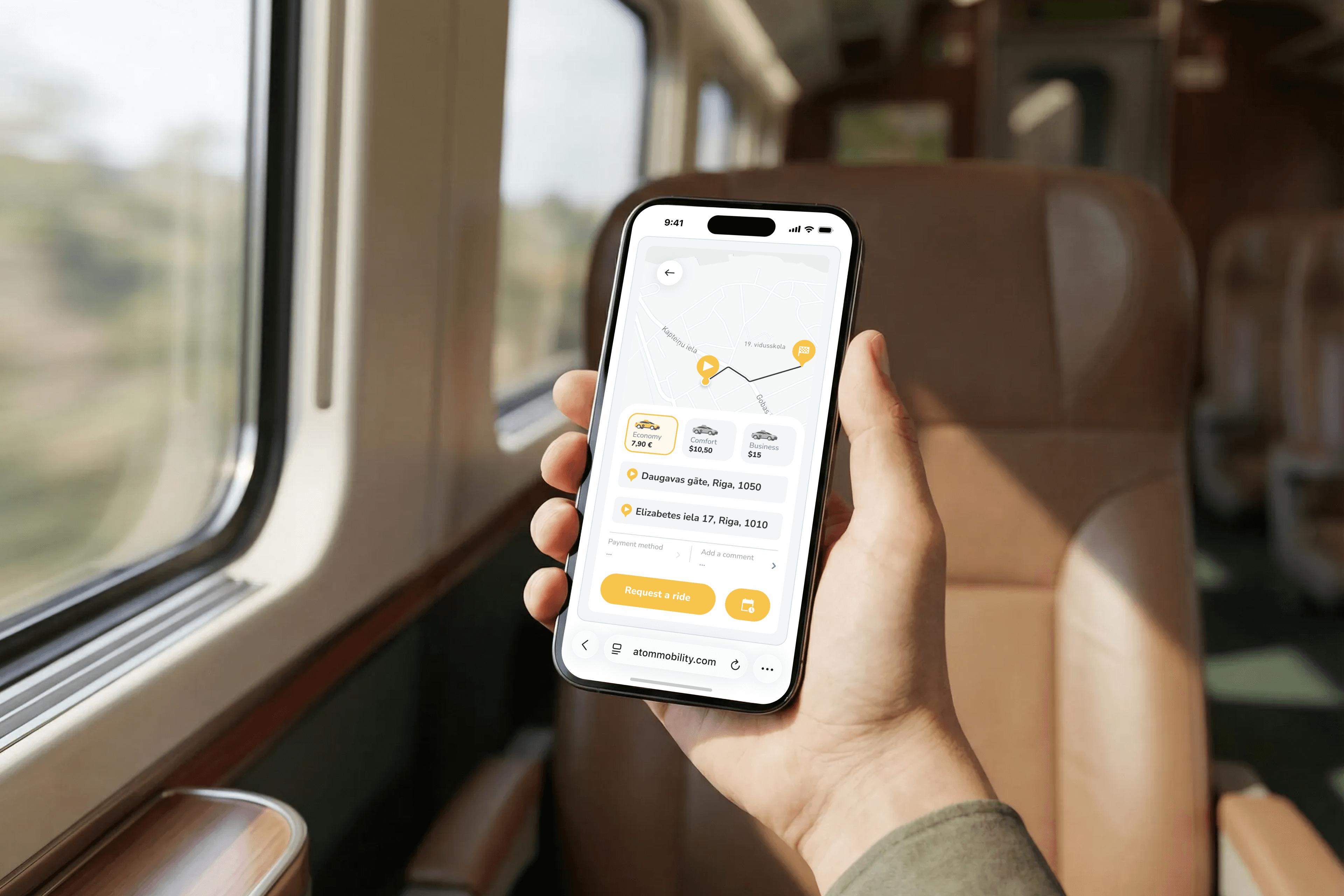

🚕 Web-booker is a lightweight ride-hail widget that lets users book rides directly from a website or mobile browser - no app install required. It reduces booking friction, supports hotel and partner demand, and keeps every ride fully synced with the taxi operator’s app and dashboard.

What if ordering a taxi was as easy as booking a room or clicking “Reserve table” on a website?

Meet Web-booker - a lightweight ride-hail booking widget that lets users request a cab directly from a website, without installing or opening the mobile app.

Perfect for hotels, business centers, event venues, airports, and corporate partners.

👉 Live demo: https://app.atommobility.com/taxi-widget

What is Web-booker?

Web-booker is a browser-based ride-hail widget that operators can embed or link to from any website.

The booking happens on the web, but the ride is fully synchronized with the mobile app and operator dashboard.

How it works (simple by design)

No redirects. No app-store friction. No lost users.

- Client places a button or link on their website

- Clicking it opens a new window with the ride-hail widget

- The widget is branded, localized, and connected directly to the operator’s system

- Booking instantly appears in the dashboard and mobile app

Key capabilities operators care about

🎨 Branded & consistent

- Widget color automatically matches the client’s app branding

- Feels like a natural extension of the operator’s ecosystem

- Fully responsive and optimized for mobile browsers, so users can book a ride directly from their phone without installing the app

📱 App growth built in

- QR code and App Store / Google Play links shown directly in the widget

- Smooth upgrade path from web → app

⏱️ Booking flexibility

- Users can request a ride immediately or schedule a ride for a future date and time

- Works the same way across web, mobile browser, and app

- Scheduled bookings are fully synchronized with the operator dashboard and mobile app

🔄 Fully synced ecosystem

- Country code auto-selected based on user location

- Book via web → see the ride in the app (same user credentials)

- Dashboard receives booking data instantly

- Every booking is tagged with Source:

- App

- Web (dashboard bookings)

- Booker (website widget)

- API

🔐 Clean & secure session handling

- User is logged out automatically when leaving the page

- No persistent browser sessions

💵 Payments logic

- New users: cash only

- Existing users: can choose saved payment methods

- If cash is not enabled → clear message prompts booking via the app

This keeps fraud low while preserving conversion.

✅ Default rollout

- Enabled by default for all ride-hail merchants

- No extra setup required

- Operators decide where and how to use it (hotel partners, landing pages, QR posters, etc.)

Why this matters in practice

Web-booker addresses one of the most common friction points in ride-hailing: users who need a ride now but are not willing to download an app first. By allowing bookings directly from a website, operators can capture high-intent demand at the exact moment it occurs - whether that is on a hotel website, an event page, or a partner landing page.

At the same time, Web-booker makes partnerships with hotels and venues significantly easier. Instead of complex integrations or manual ordering flows, partners can simply place a button or link and immediately enable ride ordering for their guests. Importantly, this approach does not block long-term app growth. The booking flow still promotes the mobile app through QR codes and store links, allowing operators to convert web users into app users over time - without forcing the install upfront.

Web-booker is not designed to replace the mobile app. It extends the acquisition funnel by adding a low-friction entry point, while keeping all bookings fully synchronized with the operator’s app and dashboard.

👉 Try the demo

https://app.atommobility.com/taxi-widget

Want to explore a ride-hail or taxi solution for your business - or migrate to a more flexible platform? Visit: https://www.atommobility.com/products/ride-hailing