As you're getting close to launching your vehicle-sharing business, one of the important decisions is what payment gateway to use. Without one, you won't be able to collect payments from users via app. But choosing the right solution might feel daunting since so many options are available.

The good news is – we've got you covered.

In this article, you'll find an overview of what payment gateways are, what payment processing solutions integrate with ATOM Mobility, and the key factors to consider when choosing a payment gateway for your shared mobility venture.

What is a payment gateway?

Simply put, a payment gateway is the “bridge” between the customers' payment method and your bank account. It's the tool that validates your customer's card details or credentials for online payment methods (e.g., digital wallets such as ApplePay) to ensure that funds can be transferred to you, the operator.

For ATOM Mobility users, there's an option to choose between two types of payment gateways:

Hosted, when the client is taken to an external payment page hosted by the payment gateway provider to enter their payment details, such as credit card information or login credentials (e.g., PayPal or local bank integrations). In our case, the payment page opens in-app, meaning that the end customer won't know the payment takes place outside of the app.

Self-hosted/native SDK integration is when the payment gateway system is integrated into the app, allowing the client to complete the payment without leaving the site.

Most businesses nowadays use such hosted and integrated payment solutions – those are quick and easy to set up, and the solution provider takes responsibility for transaction validation and security.

How do hosted and integrated payment gateways work?

Your business most likely has a bank account used to manage the company's cash flow. It's, for example, where you make and receive payments for invoices issued.

Now, to start accepting payments at scale, you need to set up a payment gateway that will allow you to automate the process of collecting payments. It's impossible to manually prepare and send an invoice to every customer for every ride – those could be thousands of invoices a day for relatively small amounts.

Payment gateways link your bank account with the customer's chosen payment method that they'll be asked to add when downloading your app. From then on, whenever clients use your shared mobility solution, your payment gateway will collect the money, then transfer it to your bank account within few days.

For their service, payment gateway service providers charge a processing fee, which can be either a specific amount or a percentage of the transaction value. The fees vary depending on the service provider, the type of card the client has added, and more.

For example, Stripe’s regualar fee is 1.5% + €0.25 for European cards. For a €4 transaction, they'd charge 1.5% of €4 + €0.25. That's a €0.265 commission in total.

As you estimate your business' expenses and potential profits, such processing fees must be carefully considered. In the shared mobility industry, such microcharges can quickly add up and “eat” as much as 6.6% of your revenue (see the Stripe example above).

Payment gateway providers that integrate with ATOM Mobility

The ATOM Mobility platform integrates with a number of payment gateway solutions, which will allow you to collect payments wherever your business is based. Once you've chosen the one that's right for your business and set up the account, you can connect it to your ATOM Mobility account.

But first things first – here are the many options available to you:

Stripe

Stripe is one of the most popular payment processing solutions worldwide, allowing businesses to accept and manage online payments. It enables businesses to accept credit and debit card payments, digital payments, and more. Stripe also supports Apple Pay, Google Pay, Bancontact, iDEAL and more.

Pros

- Supports 135+ currencies

- Easy to set up, with an intuitive user interface

- Supports a wide range of payment methods

- Transparent pricing – flat rate per transaction, no monthly fees

- With the help of ATOM Mobility, you can get a significant discount on transaction fees

Cons

- Doesn't operate everywhere in the world

- Fees for international transactions can be higher than competitors'

Payment processing fee (without discounts provided to ATOM Mobility clients):

- 1.5% + €0.25 for European cards

- 2.5% + €0.25 for UK cards

- 3.25% + €0.25 for international cards

Adyen

Adyen is among the largest companies in the payment processing market. This payment processor supports over 250 payment methods, including Apple Pay, Google Pay, PayPal, and Klarna.

Pros:

- Supports 187 currencies

- A wide range of payment methods and currencies supported

- No monthly or setup fees

Cons:

- Transaction fees may be a bit unpredictable, as they vary a lot depending on the payment method

- Adyen requires new merchants to have at least 1 000 000 EUR in annual turnover, so it may be complicated to open an account. ATOM Mobility can assist with special conditions, as our customers have no minimum threshold.

Payment processing fee:

- €0.11 + payment method fee (see here)

Checkout.com

Checkout.com allows merchants to accept payments from a variety of payment methods, including credit and debit cards, various alternative payment methods (PayPal, digital wallets), as well as various local payment methods. Checkout.com has great coverage where Adyen or Stripe do not operate.

Pros

- Supports transactions in 150+ currencies

- Easy to set up, clean and intuitive interface

- Quick payouts

Cons

- The pricing structure is a bit complex & fees may vary depending on transaction volume

- Supports 18 payment methods – less than their competitors

Payment processing fees:

- 0.95% + $0.20 for European cards

- 2.90% + $0.20 for non-European cards

HyperPay

HyperPay provides payment processing solutions for businesses of all sizes and enables operators to accept both card and digital payments. HyperPay covers the MENA area – Middle East North Africa – and integrates with the ATOM Mobility system.

Pros

- Easy to set up and integrated with the operator's website or mobile app

- Supports a wide range of payment options – payment cards, digital wallets, MADA, bank transfers

Cons

- The pricing structure is a bit complex & fees may vary depending on the payment method and the volume of transactions

- You can't just create an account – you must get in touch with HyperPay to do it

Payment processing fees:

Depends on the currency and payment method; not stated on the website.

Bambora

A payment processing solution that's available in multiple countries around the world. It offers a range of payment options, including credit and debit cards, e-wallets such as PayPal and Alipay, and more.

Pros

- Supports payments in multiple currencies

- Supports a variety of payment options – including AliPay, which is widely popular in China

Cons:

- Not available in all countries

- Setting up Bambora can be a bit complex for those with limited technical expertise

- $49 set-up fee

Payment processing fees:

Fixed fee ($0.10-$0.30) + percentage fee (1.7%-3.9%)

Regional payment solutions

ATOM Mobility integrates with several regional payment gateways, which is helpful for businesses focusing on specific markets. Providing users with an option to pay for your services in their local currency and with a payment method they're familiar with, helps ensure customer satisfaction and loyalty.

A payment gateway for businesses in Latin America. Processing fees depend on the country and payment method but typically are between 2.5% and 5% per transaction.

A payment gateway for businesses in Africa. Transaction fees depend on the payment method and the volume of transactions – usually between 2.9% and 3.8% per transaction.

A payment system is primarily available in Ukraine and other countries in Eastern Europe. Payment processing fee – 1.5% per transaction.

A payment processing platform that's primarily available to businesses based in Ukraine. Fees for card transactions range from 1.5% to 3%.

A payment solution for businesses in the Baltic region of Europe. It allows users to make a payment by simply entering their phone numbers. Payment transaction fees start at 1.3% or min. €0.10.

A payment gateway that provides online payment solutions for businesses in Azerbaijan. The fee for card transactions is 5%.

Local bank integrations

Another option is to offer your clients to pay through their local bank integration. Since people tend to prefer payment solutions they are familiar with, offering your clients the option to pay through their local bank integration may help you convince new users to give your ride-sharing service a try.

A bank integration primarily for businesses operating in Azerbaijan, Bulgaria and Albania. Fees for card transactions typically range from 0.7% to 1.5%.

A bank integration primarily for businesses operating in Ukraine. Fees for card transactions typically range from 1.5% to 2.5%

A bank integration for businesses primarily operating across the Caribbean and Central America. Fees for card transactions vary – contact the bank for more information.

New integrations

Currently, the ATOM team is working on 3 new payment integrations so our clients have more options and can find the most suitable solution for them. If you have a preference regarding the payment gateway, you can talk to our team, and we will plan the integration process together.

Key factors to consider when choosing a payment gateway

As you see, there are dozens of payment gateway solutions available. But which one is the one and only for your business?

Before you make your decision, here are six crucial things to consider:

- Stability and SLA - how secure and stable the solution is. This should be the first criterion, as cooperating with an unstable solution will lead to losses. Do other similar businesses use them? Do they have case studies? Does their support answer within a reasonable time?

- Costs and fees – what will it cost you to set the solution up? How big are the transaction fees? Are there any additional monthly fees? Try to estimate the volume and value of your monthly transactions – for many payment gateway solution providers, the fees depend on these factors.

- Payment methods supported – people are different, and so are their preferences regarding online payments. Some prefer to pay with digital wallets, while others only trust banks and their integrations. The more payment methods you'll be able to offer, the larger audience you'll be able to attract.

- Regions operating in – does the chosen payment gateway even work in your region? Also, if you're aiming to build a global ride-sharing business, you may want to select a payment gateway with a worldwide presence.

- Holding time – how long can the funds be cleared and transferred to your bank account take? For most payment gateways, it's usually 3-7 days. Generally, the sooner you receive your money, the easier it will be for you to manage your business.

- Currencies supported – check whether your payment gateway supports payments in different currencies. People want to pay in their local currency, so you want to ensure they have such an option.

- Security – as a rule of thumb, you want your payment gateway to be level-1 PCI DSS compliant and have fraud detection features.

To sum up

Choosing the most appropriate and cost-efficient payment gateway may feel daunting at first, but the secret to making this process easier is just knowing exactly what you want and need.

Where is your business going to operate?

How big is your target market?

How much can you make in your first year in business? Be realistic.

Where do you see your venture in 3-5 years?

By answering these questions, you'll have a clearer picture of what you need from your payment gateway solution provider.

Good luck!

Click below to learn more or request a demo.

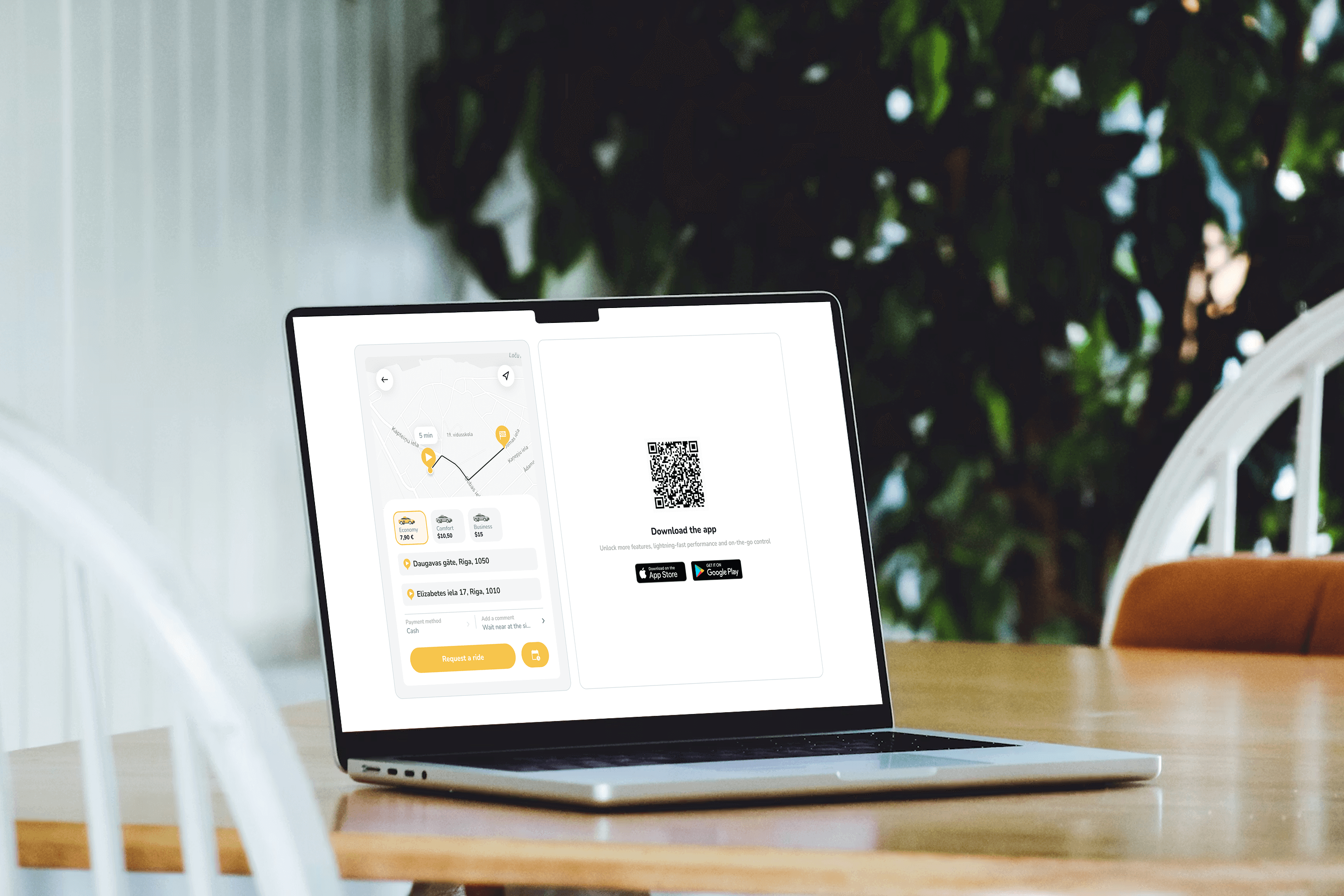

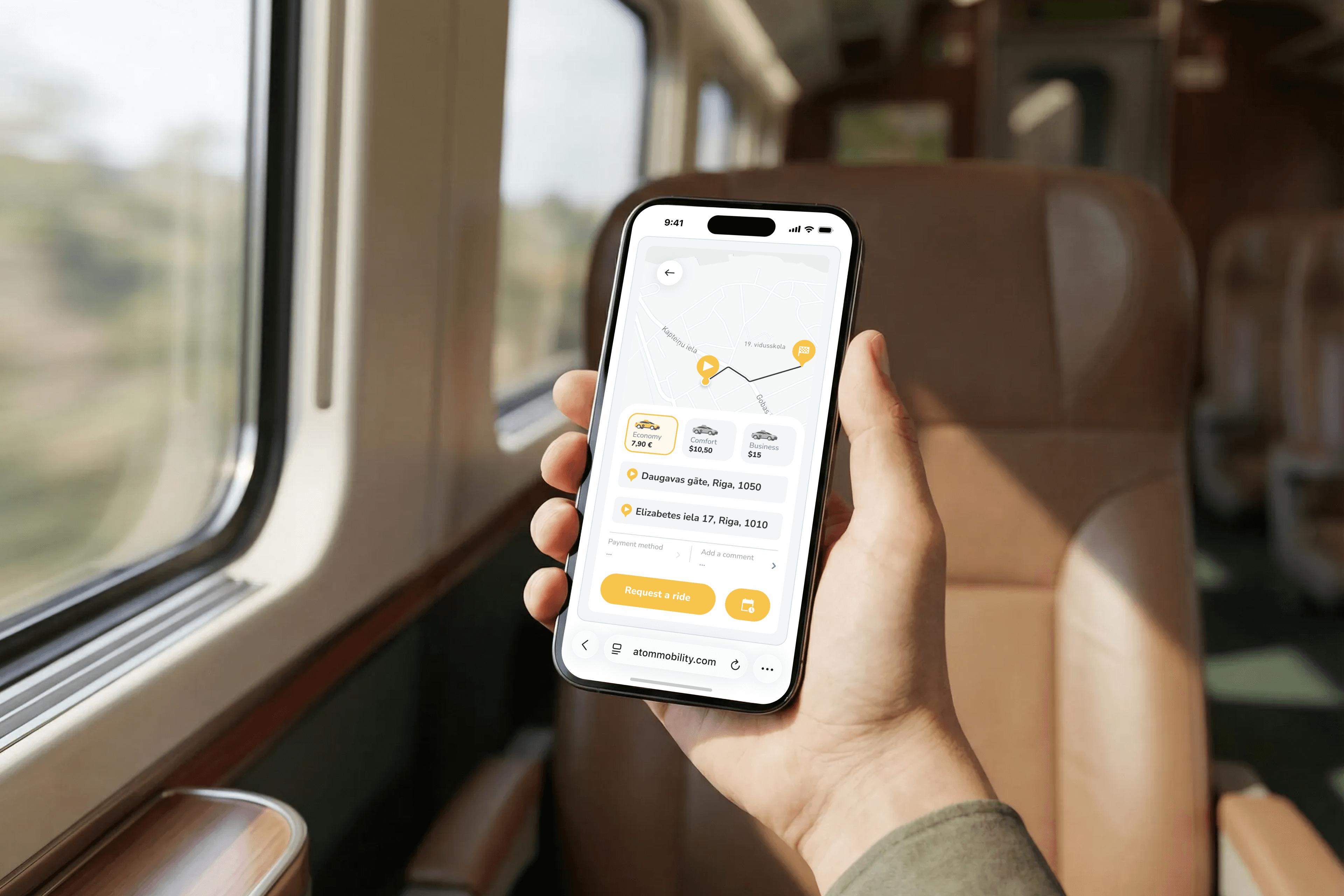

🚕 Web-booker is a lightweight ride-hail widget that lets users book rides directly from a website or mobile browser - no app install required. It reduces booking friction, supports hotel and partner demand, and keeps every ride fully synced with the taxi operator’s app and dashboard.

What if ordering a taxi was as easy as booking a room or clicking “Reserve table” on a website?

Meet Web-booker - a lightweight ride-hail booking widget that lets users request a cab directly from a website, without installing or opening the mobile app.

Perfect for hotels, business centers, event venues, airports, and corporate partners.

👉 Live demo: https://app.atommobility.com/taxi-widget

What is Web-booker?

Web-booker is a browser-based ride-hail widget that operators can embed or link to from any website.

The booking happens on the web, but the ride is fully synchronized with the mobile app and operator dashboard.

How it works (simple by design)

No redirects. No app-store friction. No lost users.

- Client places a button or link on their website

- Clicking it opens a new window with the ride-hail widget

- The widget is branded, localized, and connected directly to the operator’s system

- Booking instantly appears in the dashboard and mobile app

Key capabilities operators care about

🎨 Branded & consistent

- Widget color automatically matches the client’s app branding

- Feels like a natural extension of the operator’s ecosystem

- Fully responsive and optimized for mobile browsers, so users can book a ride directly from their phone without installing the app

📱 App growth built in

- QR code and App Store / Google Play links shown directly in the widget

- Smooth upgrade path from web → app

⏱️ Booking flexibility

- Users can request a ride immediately or schedule a ride for a future date and time

- Works the same way across web, mobile browser, and app

- Scheduled bookings are fully synchronized with the operator dashboard and mobile app

🔄 Fully synced ecosystem

- Country code auto-selected based on user location

- Book via web → see the ride in the app (same user credentials)

- Dashboard receives booking data instantly

- Every booking is tagged with Source:

- App

- Web (dashboard bookings)

- Booker (website widget)

- API

🔐 Clean & secure session handling

- User is logged out automatically when leaving the page

- No persistent browser sessions

💵 Payments logic

- New users: cash only

- Existing users: can choose saved payment methods

- If cash is not enabled → clear message prompts booking via the app

This keeps fraud low while preserving conversion.

✅ Default rollout

- Enabled by default for all ride-hail merchants

- No extra setup required

- Operators decide where and how to use it (hotel partners, landing pages, QR posters, etc.)

Why this matters in practice

Web-booker addresses one of the most common friction points in ride-hailing: users who need a ride now but are not willing to download an app first. By allowing bookings directly from a website, operators can capture high-intent demand at the exact moment it occurs - whether that is on a hotel website, an event page, or a partner landing page.

At the same time, Web-booker makes partnerships with hotels and venues significantly easier. Instead of complex integrations or manual ordering flows, partners can simply place a button or link and immediately enable ride ordering for their guests. Importantly, this approach does not block long-term app growth. The booking flow still promotes the mobile app through QR codes and store links, allowing operators to convert web users into app users over time - without forcing the install upfront.

Web-booker is not designed to replace the mobile app. It extends the acquisition funnel by adding a low-friction entry point, while keeping all bookings fully synchronized with the operator’s app and dashboard.

👉 Try the demo

https://app.atommobility.com/taxi-widget

Want to explore a ride-hail or taxi solution for your business - or migrate to a more flexible platform? Visit: https://www.atommobility.com/products/ride-hailing

🚲 Cleaner air, less traffic, and better city living - bike-sharing apps are making it happen. With seamless apps, smart integration, and the right infrastructure, shared bikes are becoming a real alternative to cars in cities across Europe.💡 See how bike-sharing supports sustainable mobility and what cities and operators can do to get it right.

Bike-sharing apps are reshaping urban mobility. What began as a practical way to get around without owning a bike is now part of a bigger shift toward sustainable transport.

These services are doing more than replacing short car trips. They help cities cut emissions, reduce congestion, improve health, and connect better with public transport.

As more cities rethink how people move, bike sharing continues to grow as one of the fastest and most affordable tools to support this change.

Why bike sharing is important

Bike-sharing services now operate in over 150 European cities, with more than 438,000 bikes in circulation. These systems help prevent around 46,000 tonnes of CO₂ emissions annually and reduce reliance on private cars in dense urban areas. They also improve air quality, lower noise levels, and make cities more pleasant to live in.

A recent study by EIT Urban Mobility and Cycling Industries Europe, carried out by EY, found that bike-sharing services generate around €305 million in annual benefits across Europe. This includes reduced emissions, lower healthcare costs, time saved from less congestion, and broader access to jobs and services.

For cities, the numbers speak for themselves: every euro invested yields a 10% annual return, generating €1.10 in positive externalities. By 2030, these benefits could triple to €1 billion if bike-sharing is prioritized.

Connecting with public transport

Bike sharing works best when it fits into the wider transport system. Most car trips that bike sharing replaces are short and often happen when public transport doesn’t quite reach the destination. That last kilometer between a bus stop and your home or office can be enough to make people choose the car instead.

Placing shared bikes near metro stations, tram stops, or bus terminals makes it easier for people to leave their cars behind. This “last-mile” connection helps more people use public transport for the long part of their trip and hop on a bike for the short part. Over time, that encourages more consistent use of both bikes and transit.

In cities where bike sharing is integrated into travel passes or mobility platforms, users can combine modes in a single journey. That flexibility supports wider access and makes shared bikes part of everyday mobility, not just something used occasionally.

What the app brings to the experience

The digital experience behind bike sharing is a big part of why it works. People can check availability, unlock a bike, pay, and end their trip – all in one app. This makes it quick, simple, and consistent.

Good bike-sharing apps also offer:

- Real-time vehicle status

- Contactless ID verification and onboarding

- Support for short trips and subscriptions

- Usage history and cost tracking

- Optional features like carbon savings or route suggestions

When users don’t need to think twice about how the system works, they’re more likely to build regular habits around it. That habit shift is what makes a long-term difference for both users and cities.

Wider city-level benefits

Bike sharing isn’t just a transport service. It helps cities meet public goals – cleaner air, lower traffic, healthier residents, and better access to services. When someone chooses a bike instead of a car, it reduces the demand for fuel, parking, and space on the road.

The €305 million annual benefit includes health savings due to increased physical activity, avoided emissions, time gained from reduced congestion, and the creation of jobs tied to fleet operations. Many bike-sharing schemes also improve equity by giving people access to mobility in areas that are underserved by public transport or where car ownership isn’t affordable.

Shared bikes are especially useful in mid-sized cities where distances are manageable and car traffic still dominates. With the right policy support, even small fleets can have a noticeable impact on mobility patterns and public health.

What makes a system work well

Not every bike-sharing system succeeds. To be reliable and scalable, a few things must work together:

- Safe, protected bike lanes

- Well-placed stations near high-demand areas

- Bikes that are easy to maintain and manage

- Operators that monitor usage and shift bikes to where they’re needed

- City policies that support cycling and reduce reliance on cars

Successful systems often grow in partnership with city governments, public transport agencies, and private operators who bring technology, logistics, and know-how.

The role of software and operations

Reliable software is what keeps all parts of the system connected. From unlocking a bike to seeing usage trends across the city, operators need tools that are stable, flexible, and easy to manage. For those launching or scaling a fleet, platforms like ATOM Mobility offer ready-made solutions that handle booking, payments, ID checks, live tracking, and fleet control in one place.

The platform supports both electric and mechanical bikes, offers branded apps, and integrates with smart locks or IoT modules for remote vehicle access. It also lets operators adjust pricing, monitor vehicle health, and manage customer support in real time. That means smaller teams can launch faster and scale smarter, without having to build every tool from scratch.

A small change with a big effect

Bike sharing won’t replace all car trips, but even a small shift makes a difference. A few short rides per week can reduce emissions, improve fitness, and save time spent in traffic. When these trips are supported by good infrastructure, public awareness, and seamless apps, the impact grows.

As cities continue to prioritise sustainability, shared micromobility will play a bigger role in helping people move in cleaner, healthier, and more flexible ways. With the right technology and planning, bike sharing becomes more than a service – it becomes a habit that supports better cities for everyone.