The shared mobility industry has experienced significant growth and transformation in 2023, with various segments such as ride-sharing, vehicle rental, and micro-mobility witnessing substantial changes.

From the rise of ride-hailing services to the increasing popularity of shared vehicles, the industry's landscape is evolving rapidly. This article presents 32 key statistics from 2023 that provide valuable insights into the current state and future prospects of the shared mobility sector, offering a comprehensive overview for industry stakeholders and observers.

General – Shared mobility industry

The global shared mobility market is expanding rapidly, projecting a substantial increase in revenues and ridership. By 2030, it is poised to double its share of urban transport journeys from 2023. Additionally, the number of individuals earning from shared mobility services is forecasted to rise notably.

In Europe, shared vehicle services demonstrate considerable growth, with an increase in multi-mobility users. At the same time, European cities are the strictest shared micromobility regulators, limiting the number of operators and implementing various rules.

Global

- The shared mobility market worldwide revenue was projected to reach US$1.43T in 2023. Statista

- Shared mobility is expected to make up 7% of all urban transport journeys globally by 2030, up from 3% in 2023. Shared Mobility's Global Impact

- The global shared mobility market size is expected to grow at a CAGR of 41.65% from 2023 until 2030. Shared Mobility Market Analysis Report

- More than nine million people were estimated to earn an income from shared mobility services in 2023, and the number is forecasted to grow to 16M by 2030. Shared Mobility's Global Impact

- In the shared vehicles market, the number of users is expected to amount to 5.09B users by 2027. Statista

- The average revenue per user (ARPU) was expected to amount to US$180.90 in 2023. Statista

- In global comparison, most revenue from shared mobility is generated in China (US$358B in 2023). Statista

- Africa has the strongest income growth from shared mobility services: jobs are expected to increase by 113% from 2023 to 2030. Shared Mobility's Global Impact

- Ride-hailing drivers typically earn above the minimum wage in Europe (+37% in Berlin and +91% in Tallinn) and above the wages for jobs with comparable skill levels in Africa (up to +130% in South Africa and Nigeria). Shared Mobility's Global Impact

Europe & UK

- There is a significant growth in the use of shared vehicle services, with a 221% increase recorded. Free Now report

- The number of multi-mobility users has also grown by 27%. Free Now report

- Comparing Q3 2022 and Q3 2023, shared mobility ridership is up 1%, and fleets are down 2%, meaning Total Vehicle Distance (TVD) slightly improved across the board. Q3 2023 European Shared Mobility Index

- Out of 32 European authorities that regulate shared micromobility operations, more than two-thirds have implemented rules on geofencing (26), parking (25), removal or repositioning of vehicles (25), fleet size limits (24), and fleet rebalancing and redistribution (22). POLIS report on How European Cities are regulating Shared Micromobility

- Around half of the European authorities limit the number of operators, demand insurance, set speed limits, specify conditions for vehicles and their maintenance, and have instructions for the end of operations. POLIS report on How European Cities are regulating Shared Micromobility

- Juniper Research has ranked Berlin as the leading smart city in Europe in 2023 thanks to its mobility-as-a-service (MaaS) app Jelbi, which incorporates public and private transport. Other cities in the European top five are London, Barcelona, Rome and Madrid. Cities Today

Cars

Shared car ridership has increased significantly, with notable upward trends in Q3 2023. The global ride-hailing market is also projected to witness substantial growth, with increased user numbers and an uptick in popularity over taxis in the United States. In Europe, German cities, led by Berlin, continue to dominate in total shared car ridership.

- Shared car ridership has grown by 22% from Q3 2022 to Q3 2023. Q3 2023 European Shared Mobility Index

- The car-sharing market size was worth USD 2.9B in 2022 and is estimated to showcase around 20% CAGR from 2023 to 2032. Global Market Insights

- The biggest increase of car ridership in Europe in 2023 happened in Riga, thanks to the emergence of Bolt Drive. Antwerp saw the 2nd most growth due to the introduction of Miles Mobility Q3 2023 European Shared Mobility Index

- German cities continue to dominate the rankings for total ridership per city. In Berlin, there are 30% more shared cars on the streets than in 2022. Q3 2023 European Shared Mobility Index

- The ride-hailing market worldwide is projected to grow by 6.97% (2023-2028), resulting in a market volume of US$215.70B in 2028. Statista

- Ride-hailing services were anticipated to hit a record number of users in 2023, with an additional 6.6M users in the US, representing a 10.1% increase and finally recouping its pandemic-era losses. Insider Intelligence

- In the United States, ride-hailing is reported to be used more frequently than taxis, with around a fifth of respondents being occasional users of ride-sharing services. Statista

Electric scooters and mopeds

Electric scooter (e-scooter) ridership has declined, although it remains the predominant shared mobility choice, constituting 42% of total ridership. Moped ridership in Europe has similarly decreased, influenced by exits of key market players.

E-scooters have emerged as an environmentally friendly alternative, with 10% of rides directly replacing car journeys. Citizen referendums in Paris and evolving regulations in Amsterdam reflect the dynamic landscape of the electric scooter and moped market.

- E-scooter ridership has fallen by 14% from Q3 2022 to Q3 2023. That said, scooters are still the most popular shared mobility transport mode, with 42% total ridership. Q3 2023 European Shared Mobility Index

- Moped ridership in Europe has fallen by 28% from Q3 2022 to Q3 2023 due to the departure of some players in key markets. Q3 2023 European Shared Mobility Index

- Electric scooter usage patterns show 10% of rides directly replace car journeys. Shared Mobility's Global Impact

- Thus, e-scooters have contributed to a reduction of up to 120M car-kilometers traveled, helping to reduce car-related emissions by an estimated 30,000 tons of CO2e. Shared Mobility's Global Impact

- On 2 April 2023, Paris held a referendum on shared e-scooters, and 90% of voters gave their vote against renewing the contract of three shared micromobility companies to operate around 5,000 e-scooters each. CNBC

- In Amsterdam, moped ridership has grown by 22% despite new regulations on helmets being brought into effect. Q2 2023 European Shared Mobility Index

Bikes

The global bike-sharing market shows significant growth. In Europe, station-based bikes have increased in popularity. Dockless bikes experienced an impressive surge as well, following the 2023 scooter ban in Paris. Overall, bike fleets and ridership are expanding across major European cities, contributing to a robust Trips/Vehicle/Day (TVD) ratio.

- The global bike-sharing market is projected to reach US$12.68 billion by 2027, growing at a CAGR of 10.71% from 2023 to 2027. Statista

- Station-based bike ridership in Europe has grown by 11% from Q3 2022 to Q3 2023. Station-based bikes are the second most popular shared mobility transport mode, with 30% total ridership. Q3 2023 European Shared Mobility Index

- After the 2023 scooter ban in Paris, dockless bikes have boomed 144%. Dockless bike ridership more than doubled YoY in September (x2.5) and October 2023 (x2.3). Q3 2023 European Shared Mobility Index

- Fleets and ridership are growing across Europe, especially in cities like Paris, London,Copenhagen and Antwerp. The combined TVD of dockless and station-based bikes is a very healthy 2.9. Q3 2023 European Shared Mobility Index

Rolling into 2024

The shared mobility market continues to expand. With ride-sharing and micro-mobility playing pivotal roles, the future of shared mobility appears promising. The insights gathered from these statistics are crucial for understanding the shared mobility market's trajectory and its implications for the broader transportation ecosystem.

Let's make 2024 a year of shared mobility!

Click below to learn more or request a demo.

The micromobility industry doesn’t need another generic mobility conference. 🚫🎤 It needs real conversations between operators who are actually in the field. ⚙️ That’s exactly what ATOM Connect 2026 is built for. 🎯🤝

The shared mobility industry is evolving rapidly. Operators are navigating scaling challenges, regulatory complexity, hardware decisions, fleet optimization, and new integration models, all while aiming for sustainable growth.

That’s exactly why ATOM Mobility is organizing ATOM Connect 2026.

Our previous edition of ATOM Connect brought together professionals from the car sharing and rental industry for focused, high-quality discussions and networking. This year, we are narrowing the focus and dedicating the entire event to one fast-moving segment of the industry: shared micromobility.

ATOM Connect 2026 is designed specifically for operators, partners, and decision-makers working in shared micromobility. It is not a broad mobility conference or a public exhibition. It is a curated space for industry professionals to exchange practical experience, insights, and lessons learned.

On May 14th, 2026 in Riga, we will once again bring the community together, this time with a clear focus on micromobility.

What to expect

This year’s agenda will address the real operational and strategic questions shaping shared micromobility today:

- Scaling fleets sustainably

- Multi-vehicle operations beyond scooters

- Regulatory cooperation and long-term city partnerships

- Data-driven fleet optimization

- MaaS integration and ecosystem collaboration

- Marketing and automation for growth

As usual, we aim to host both local and international operators from smaller, fast-growing fleets to established large-scale players alongside hardware providers and ecosystem partners.

On stage, you’ll hear from leading shared mobility companies - including Segway on hardware partnerships, Umob on MaaS integration, Anadue on data-driven fleet intelligence, Elerent on multi-vehicle operational realities and more insightful discussions.

The goal is simple: meaningful discussions with people who understand the operational realities of the industry.

A curated, industry-focused event

ATOM Connect is free to attend, but participation is industry-focused (each submission is manually reviewed and verified). We are intentionally keeping the audience relevant and aligned to ensure high-quality conversations and valuable networking.

If you work in shared micromobility and would like to join the event, you can find the full agenda and register here:

👉 https://www.atommobility.com/atom-connect-2026

In the coming weeks, we will be revealing more speakers and additional agenda updates. We look forward to bringing the industry together again.

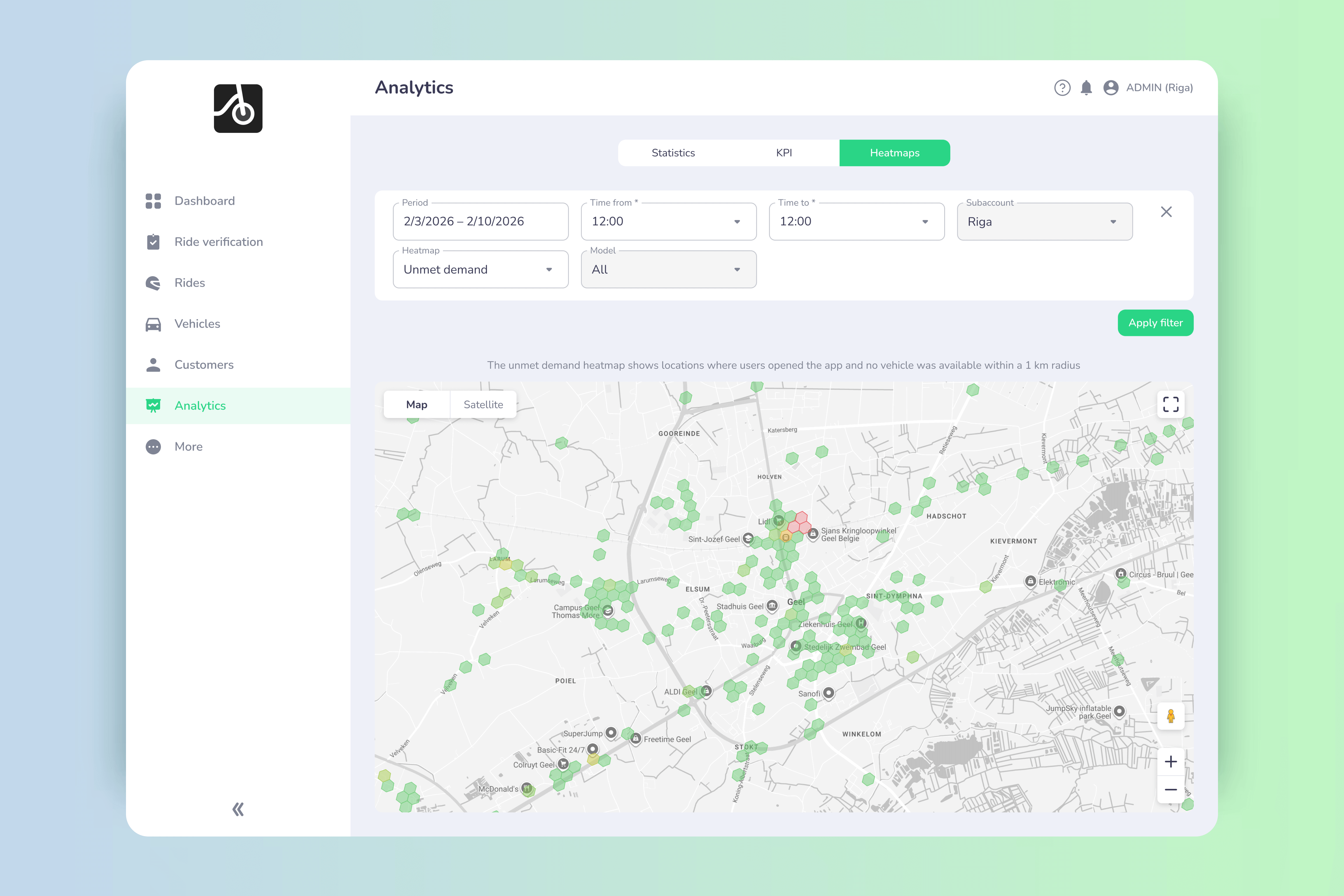

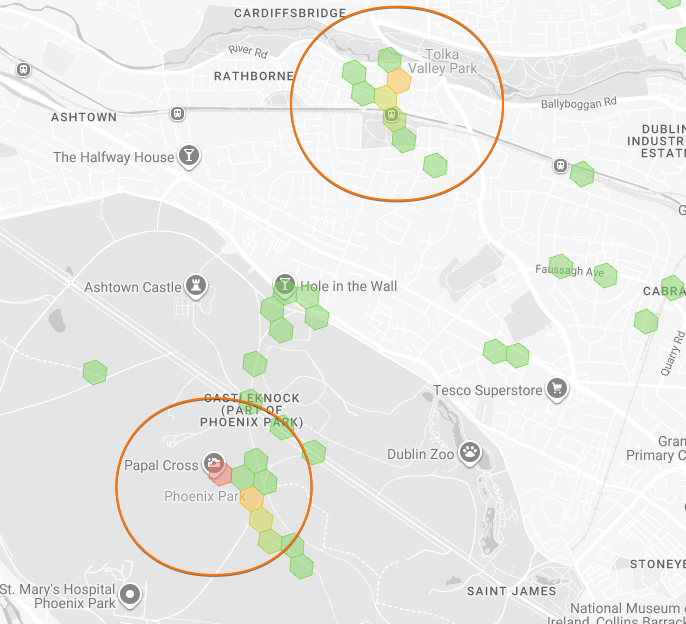

📉 Every unmet search is lost revenue. The unmet demand heatmap shows where users actively searched for vehicles but none were available - giving operators clear, search-based demand signals to rebalance fleets 🚚, improve conversions 📈, and grow smarter 🧠.

Fleet operators don’t lose revenue because of lack of demand - they lose it because demand appears in the wrong place at the wrong time. That’s exactly the problem the Unmet demand heatmap solves.

This new analytics layer from ATOM Mobility shows where users actively searched for vehicles but couldn’t find any within reach. Not guesses. Not assumptions. Real, proven demand currently left on the table.

What is the unmet demand heatmap?

The unmet demand heatmap highlights locations where:

- A user opened the app

- Actively searched for available vehicles

- No vehicle was found within the defined search radius

In other words: high-intent users who wanted to ride, but couldn’t. Unlike generic “app open” data, unmet demand is recorded only when a real vehicle search happens, making this one of the most actionable datasets for operators.

Why unmet demand is more valuable than app opens

Many analytics tools track where users open the app (ATOM Mobility provides this data too). That’s useful - but incomplete. Unmet demand answers a much stronger question:

Where did users try to ride and failed? That difference matters.

Unmet demand data is:

✅ Intent-driven (search-based, not passive)

✅ Directly tied to lost revenue

✅ Immediately actionable for rebalancing and expansion

✅ Credible for discussions with cities and partners

How it works

Here’s how the logic is implemented under the hood:

1. Search-based trigger. Unmet demand is recorded only when a user performs a vehicle search. No search = no data point.

2. Distance threshold. If no vehicle is available within 1,000 meters, unmet demand is logged.

- The radius can be customized per operator

- Adaptable for dense cities vs. suburban or rural areas

3. Shared + private fleet support. The feature tracks unmet demand for:

- Shared fleets

- Private / restricted fleets (e.g. corporate, residential, campus)

This gives operators a full picture across all use cases.

4. GPS validation. Data is collected only when:

- GPS is enabled

- Location data is successfully received

This ensures accuracy and avoids noise.

Smart data optimization (no inflated demand)

To prevent multiple searches from the same user artificially inflating demand, the system applies intelligent filtering:

- After a location is stored, a 30-minute cooldown is activated

- If the same user searches again within 30 minutes And within 100 meters of the previous location → the record is skipped

- After 30 minutes, a new record is stored - even if the location is unchanged

Result: clean, realistic demand signals, not spammy heatmaps.

Why this matters for operators

📈 Increase revenue

Unmet demand shows exactly where vehicles are missing allowing you to:

- Rebalance fleets faster

- Expand into proven demand zones

- Reduce failed searches and lost rides

🚚 Smarter rebalancing

Instead of guessing where to move vehicles, teams can prioritize:

- High-intent demand hotspots

- Time-based demand patterns

- Areas with repeated unmet searches

🏙 Stronger city conversations

Unmet demand heatmaps are powerful evidence for:

- Permit negotiations

- Zone expansions

- Infrastructure requests

- Data-backed urban planning discussions

📊 Higher conversion rates

Placing vehicles where users actually search improves:

- Search → ride conversion

- User satisfaction

- Retention over time

Built for real operational use

The new unmet demand heatmap is designed to work alongside other analytics layers, including:

- Popular routes heatmap

- Open app heatmap

- Start & end locations heatmap

Operators can also:

- Toggle zone visibility across heatmaps

- Adjust time periods (performance-optimized)

- Combine insights for strategic fleet planning

From missed demand to competitive advantage

Every unmet search is a signal. Every signal is a potential ride. Every ride is revenue. With the unmet demand heatmap, operators stop guessing and start placing vehicles exactly where demand already exists.

👉 If you want to see how unmet demand can unlock growth for your fleet, book a demo with ATOM Mobility and explore how advanced heatmaps turn data into decisions.