In 2024, the global car-sharing market was valued at approximately €8.9 billion, with Europe accounting for over 50.2% of that total. Analysts forecast it will grow at a CAGR of 11.8% between 2025 and 2033, reaching roughly €24.4 billion by 2033. This blend of urbanization, environmental regulation and a growing preference for flexible mobility continues to create fertile ground for operators - yet not every service finds a clear path to profitability.

Success hinges on your location, business model, fleet, operations and local market dynamics. There are strong success stories, but also many high-profile failures. Here’s a closer look at what really affects profitability in today’s car-sharing market - and what you can learn from real-world cases.

What makes a car-sharing business profitable?

Profitability in car sharing boils down to securing enough paid usage while keeping costs under control. Every unused hour or unnecessary expense erodes margins.

Key factors:

- Fleet utilization – the most important metric. Cars need to be in use several hours each day to cover fixed costs.

- Operational efficiency – cleaning, charging, relocation, maintenance and insurance add up quickly.

- Fleet acquisition – leasing usually optimizes cash flow and scalability, but still carries fixed monthly expenses.

- Pricing and competition – too low cuts margins; too high drives away users. Finding the right balance is essential.

- Tech stack – a robust platform automates operations, improves customer experience and reduces support costs.

The operators who win are those who combine solid daily usage with lean operations.

❌ PANEK S.A. suspends its car-sharing service to focus on rental

29 March 2025 marked the end of Panek’s car-sharing experiment. Despite peaking at 2 700–3 000 vehicles, Panek never turned a profit in over seven years.

About Panek

- Launch: Car sharing added in 2017 by Maciej Panek, entirely internally funded (no VC)

- Fleet mix: City cars, hybrids, EVs, cargo vans and vintage models

- 2023 acquisition: Regional Rent (+ 45% fleet), making Panek Poland’s largest integrated rental/operator

2024 performance

- Revenue split: Car sharing ≈ 20 % of total. Traditional rental 80 %

- Utilization: 0.7–1.0 rides/car/day

- Maintenance & overhead: Up to €690/car-month

- Profitability: Negative since inception

Why it failed

- Under-utilization: < 1 ride/day vs. ~ 2-4 rides/day needed to cover fixed costs

- Price wars: Fierce competition in Warsaw eroded margins and drove up customer-acquisition costs

- High OPEX: Parking, maintenance, insurance and vandalism pushed costs > €690 per car each month

- Tech drag: Two-year outsourced app development cycle meant poor UX and slow feature delivery

- No public support: Missed out on parking incentives or EV subsidies

Faced with persistent losses, Panek’s leadership refocused on profitable core segments: daily/weekly rentals, corporate leasing and Fleet-as-a-Service.

🚗 WiBLE Spain finds its profitable lane in Madrid

WiBLE (50/50 joint venture between Kia Europe and Repsol) launched in 2018 and has just closed its second consecutive year with positive EBITDA.

- Fleet: 600+ plug-in hybrids (Kia Niro, XCeed, Ceed Tourer)

- 2024 revenue: €6.93 million (+ 5% vs. 2023)

- Usage: ~1 500 trips/day ⇒ 2.5 rides/car/day

- Diversification: Monthly rentals (€599+) now 5% of revenue

- Market share: ~19% of Madrid’s car-sharing market

Key enablers:

- Higher utilization – rides up 15% YoY, driving a 10% lift in core revenue

- Fleet scale efficiencies – added 150 vehicles in 2 years, lowering per-unit costs

- Service diversification – multi-day and monthly rental options opened new revenue streams

After five years of absorbing fixed-cost drag and depreciation, WiBLE now leverages Madrid’s regulatory environment (low-emission zones, parking benefits) and delivers lean, tech-driven operations.

🚗 SOCAR South Korea: scale + longer rentals

SOCAR (backed by SoftBank, SK Inc. and Lotte Group) operates 20 000 vehicles, generates nearly €300 million in annual turnover and has 20% of South Koreans signed up.

- Model: Station-based, pay-per-minute with average rental duration of a whoping 12 hrs

- Segmentation trick: Aging cars shift from on-demand sharing to long-term monthly rentals (10% of revenue), extending resale life with minimal depreciation impact

By pairing massive scale with savvy car lifecycle management, extra-long rental duration, SOCAR converts high utilization into robust profitability.

🚗 Carguru (Latvia)

30 August 2024: Carguru (est. 2017) acquired EV-focused OX Drive (est. 2021), adding 200+ Tesla to the fleet.

- Growth: From just 30 cars and total budget below 500 000 EUR (2017) to over 1 000 cars (mid-2025) via leasing and strategic partnerships

- 2023 turnover: €4 million; 435 000 trips (+35.9 %); 7 million km driven; profit €375 600

Outcome: A combined ICE, hybrid and EV fleet—backed by local expertise and strategic acquisitions - has driven strong growth and high utilization.

🎯 Core suggestions for aspiring operators

- Target 2–4 rides/day per vehicle

- Leverage dynamic/off-peak pricing, B2B partnerships (hotels, offices) and event tie-ins.

- Contain OPEX via automation

- Use predictive maintenance, remote diagnostics and gig-economy cleaning/relocation.

- Secure municipal support early

- Negotiate parking incentives, EV charging access and low-emission zone permits.

- Choose your tech wisely

- Build an in-house development team for full control with higher costs, or adopt a proven white-label platform for speed to market, stability and lower costs.

- Validate unit economics before scaling

- Prove break-even utilization in one zone before expanding to others.

With clear benchmarks and smart execution - drawing on lessons from Panek, WiBLE, SOCAR and Carguru - car sharing can still be a highly profitable component of a modern mobility portfolio.

If you’re planning to start or improve your service, ATOM Mobility is ready to help. We’ve built the platform and supported dozens of teams worldwide - reach out, and we’ll share what we’ve learned.

Image credit: https://kursors.lv/2018/03/13/carguru-palielina-autoparku-un-paplasina-darbibas-zonas-mikrorajonos

Click below to learn more or request a demo.

🚗📲 Whether you're renting out cars, bikes or scooters, the best rental businesses in 2025 are fully digital. No more paper contracts or office keys – just tap, unlock, and go. In our latest article, we explore top apps (like Donkey Republic, MOBY Bikes and Forest) that show what a modern rental experience looks like. Plus, we explain where a full platform like ATOM Mobility fits in when you're ready to scale.

Running a rental or sharing business today means delivering a smooth, digital-first experience. Whether you rent cars, bikes, scooters or other vehicles – users expect to book online, pay, verify identity if needed, unlock a vehicle, and ride or drive without extra friction.

To make that happen reliably, you need good vehicle rental software or platform backing your service. Below are some successful examples of apps and platforms that show how this works and what is possible.

Donkey Republic

Operates in several European cities offering shared bikes and e‑bikes. Users find a bike in the app, unlock it with a smartphone, ride, then park at a designated drop‑off spot and end the rental. Pay‑as‑you‑go, daily rates or memberships are all handled via the app.

MOBY Bikes

Targets electric bicycles and e‑cargo bikes across certain regions, with a “tap‑and‑ride” system that uses its proprietary app for booking, unlocking, and rental management. The platform supports mixed-use fleets (shared bikes, cargo bikes, delivery fleet, even B2B rentals), which illustrates flexibility – useful for operators exploring different business models beyond simple consumer rentals.

Forest

It is a dockless e‑bike sharing operator in London. It runs a large fleet and offers bike‑sharing through a mobile app. The service demonstrates how a relatively simple, dockless rental model can scale at urban level using app‑based rentals, unlocking, and flexible parking.

These examples show how micromobility‑focused services already rely on booking, payment, unlocking and fleet management tech – the same core capabilities needed by any modern vehicle rental business.

What makes these apps work – and what to borrow from them

From these operators you can observe several useful traits that a good rental/sharing software should provide:

- Seamless user journey: crate account in seconds → search → book → unlock → ride/drive → return. Users don’t need paper contracts or to meet staff to get a vehicle.

- Flexible pricing & rental models: per-minute, hourly, daily, subscription, memberships – enables both occasional users and frequent commuters.

- Smart access control and vehicle tracking: unlocking via app or smart lock, GPS tracking, drop‑off in defined zones or docking stations, helps maintain order, reduce theft, and support dockless models.

- Support for different vehicle types: from bikes to e‑bikes and cargo bikes – showing that underlying software can be agnostic to vehicle type, useful if you plan a mixed fleet.

- Scalable fleet operations and maintenance: availability updates, booking history, maintenance logs, geofencing or parking zones – these help manage many vehicles across zones without chaos.

These are exactly the kinds of features you need when you move from small‑scale operation to proper fleet business.

Why to choose ATOM Mobility

If you plan to just test the market or to operate a larger and more complex fleet - multiple vehicle types, multiple cities, or advanced operational requirements - a full-stack platform like ATOM Mobility becomes essential.

ATOM Mobility is designed for operators who need full control over the entire mobility operation: booking flows, unlocking logic, payments, KYC/ID verification, backend administration, fleet analytics, dynamic pricing, and multi-modal rentals across cars, scooters, bikes, and more.

The platform provides a unified backend that supports cars, scooters, e-bikes, mopeds, and additional vehicle types within a single system. Operators can manage bookings, payments, users, smart locks or connected vehicles, fleet health, and city-level scaling without fragmenting their tech stack as the business grows.

This approach offers far greater flexibility than single-vehicle or bike-only solutions and removes the need to migrate systems when expanding into new vehicle categories or markets. Check out the full service here.

How to choose: when to use franchising vs full platform

Join a franchising when you:

- prefer operating under an established brand

- value a clear operational playbook and central support

- want simpler marketing thanks to brand recognition

- are comfortable with limited control over technology and product decisions

- accept franchise fees or revenue sharing in exchange for convenience

- don’t need heavy customization or experimentation

Use a full platform (like ATOM Mobility) when you:

- aim to manage a larger, mixed fleet (cars, scooters, bikes, e-bikes)

- need full backend control (admin, analytics, pricing, reporting)

- require payments, KYC/ID verification, and automation built in

- want freedom to customize booking flows, pricing, and partnerships

- plan to scale across cities or add new vehicle types over time

- prioritise brand ownership and customer relationship control

- want no revenue sharing or franchise fees

There isn’t a one‑size‑fits‑all solution

For simple bike or e-bike fleets, the technology barrier is already low. Joining a franchise can be a fast way to get operations running with minimal setup.

However, operators with long-term ambitions - expanding into multiple vehicle types, scaling across locations, or maintaining consistent service quality - typically outgrow narrow tools. In those cases, a full-stack platform like ATOM Mobility offers the flexibility and control needed to support growth without rebuilding the tech foundation later.

Some operators start small and migrate as complexity increases. Others choose to build on a full platform from day one to avoid future transitions. The right choice depends on how clearly you define your growth path, desired level of control, and operational complexity from the start.

📱AI in shared mobility isn’t a future trend – it’s already here, and for good. From detecting car damage to forecasting demand and verifying parking in real time, operators are using AI to reduce manual work and run more efficient fleets. In this new article, we break down 3 real use cases already live on the ATOM Mobility platform: 👁️ Vision AI, 🔍 Precision AI, 📊 Prediction AI. See how AI is changing shared mobility, and how you can start using it now.

Artificial intelligence is no longer just a trend in mobility. For modern vehicle sharing and rental services, AI is already solving real operational problems and unlocking new ways to grow. At ATOM Mobility, several AI-powered features have already been implemented into live products and tested by operators across Europe.

This article shares three real-world AI use cases that are already helping operators reduce manual work, improve asset control, and better match vehicle availability to demand.

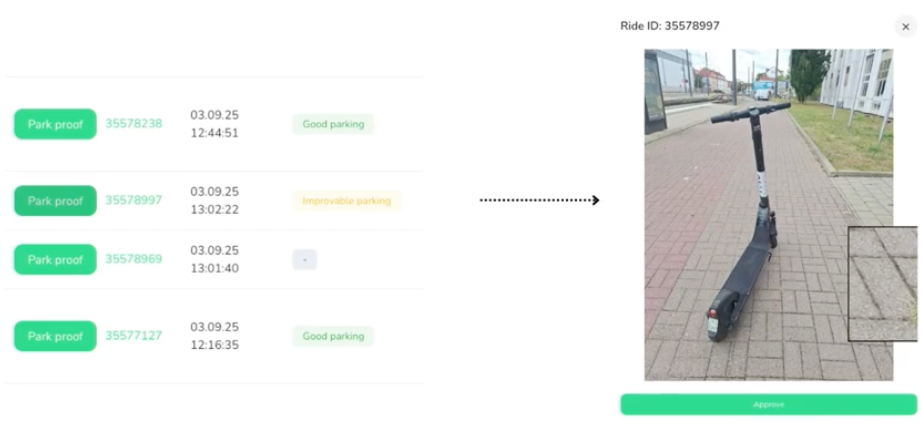

1. Vision AI: Camera-based parking control for micromobility

Micromobility parking continues to be a challenge in cities where dockless vehicles can end up blocking sidewalks, crossings or entrances. Manual checks are costly and often too slow to solve the problem in real time.

ATOM Mobility now uses computer vision to solve this. With Vision AI, riders take a photo when ending their ride. The system analyses the image using a neural network to understand if the vehicle is parked correctly – within a designated zone and without creating obstructions. If not, the app notifies the user and prevents trip completion until the parking is corrected.Each parking photo is automatically tagged as “Good parking”, “Improvable parking” (the user receives guidance on how to improve the parking), or “Bad parking” (the user is asked to re-park).

If the user fails to submit a “Good parking” photo after several attempts, the system will accept the photo with its current tag (“Improvable” or “Bad parking”) and flag it in the dashboard for further customer support review.

This solution has been live with many operators already. It helps reduce complaints, improve compliance with city regulations, and lowers the need for manual reviews.

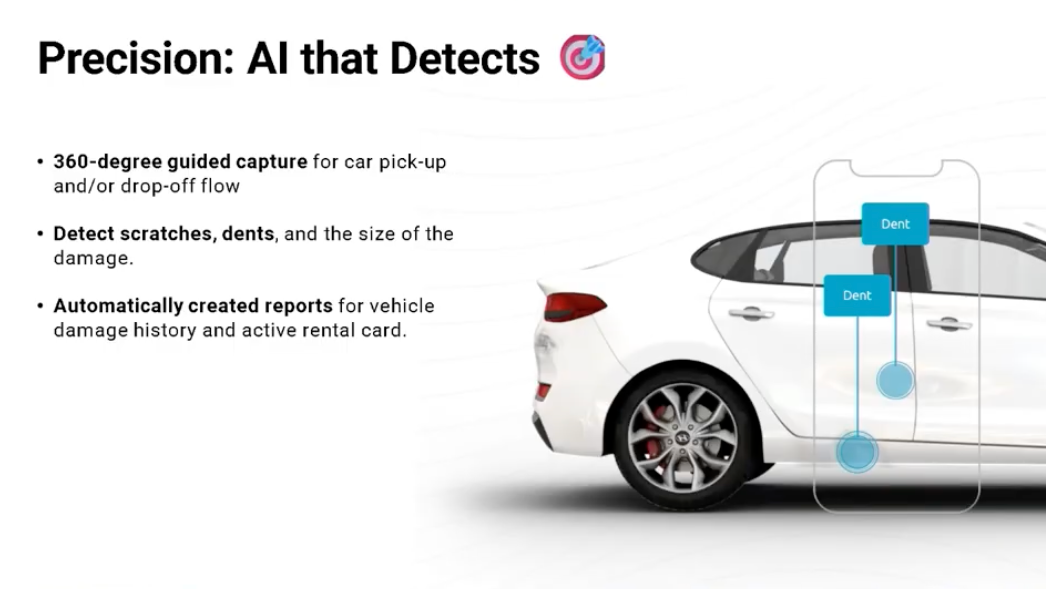

2. Precision AI: Detecting car rental damages with cameras and machine learning

In traditional car rental, damage inspection is slow, manual, and often inconsistent. With self-service rentals becoming more popular, operators need a smarter and faster way to verify a vehicle’s condition between trips.

ATOM Mobility has integrated AI-powered damage detection using computer vision. Customers scan the vehicle at pick-up and drop-off. The app compares images and flags scratches, dents, or other visible damage with high accuracy. This allows operators to quickly assess responsibility and reduce disputes.

The system helps protect the fleet, lowers repair costs, and adds trust for both users and operators. It’s especially useful for car sharing and self-service rental models where physical handovers are skipped.

3. Prediction AI: Forecasting demand and automating vehicle relocation

One of the biggest cost factors in shared mobility is rebalancing the fleet. If scooters or cars are idle in the wrong location, revenue is lost. At the same time, relocating vehicles manually is expensive and not always efficient.

ATOM’s AI models use historical trip data, usage trends and contextual signals (such as day of the week or weather) to forecast demand and suggest the best relocation zones. This gives operators a map of where and when to move vehicles – improving utilisation and saving time.

The system can even be combined with automated relocation logic, where users are incentivised to park in high-demand areas. This shifts part of the rebalancing cost from operators to riders and keeps the fleet productive.

Why this matters now

AI tools are finally reaching the stage where they can operate reliably, even in complex environments like cities. These examples are not abstract ideas or lab tests. They’re active features helping ourcustomers run leaner, smarter fleets today.

For micromobility operators, Vision AI reduces complaints and ensures regulatory compliance. For car rental providers, Precision AI saves hours of staff time and improves trust. And for both, Prediction AI improves margins by making sure vehicles are where users need them.

What’s up next?

These are just the first steps. AI in mobility will continue to expand with smarter pricing engines, voice-based support, predictive maintenance, and more. But the examples above already prove that even small AI integrations can bring major improvements.

At ATOM Mobility, we continue building these tools directly into our platform so that operators don’t need to develop them in-house. If you want to see how these AI-powered features work in action, get in touch with our team.

AI in shared mobility is not about replacing people. It’s about giving operators better tools to run faster, smarter, and more efficient services.