Shared mobility companies Bird and Micromobility.com (formerly Helbiz) stormed onto the scene by introducing innovative and convenient transportation solutions, capturing the attention of urban dwellers worldwide.

However, as the micromobility industry enters a more mature phase, companies like Bird and Micromobility.com continue to grapple with obstacles when it comes to attaining financial stability. This has prompted them to reassess their excessively ambitious expansion strategies.

What factors contribute to these challenges, and what implications does this hold for the industry as a whole? Could local micromobility ventures provide a superior solution to meet the increasing demand for these services? Let's delve further into the financial predicament of Bird and Micromobility.com to gain a better understanding.

Bird: downsizing and struggles in the stock market

Established in 2017, Bird is a micromobility company that provides electric transportation solutions in the USA and Europe. Their range of shared vehicles includes e-scooters and e-bikes. The company also sells vehicles to distributors, retailers, and direct customers. With its headquarters located in Miami, Florida, Bird currently employs 425 individuals and operates in 105 cities.

Recently, Bird's first-quarter 2023 financials revealed challenges in maintaining ridership and revenue. Despite implementing cost-cutting measures, the company's performance failed to convince investors of its ability to achieve profitability – the company's stock plummeted nearly 19% after announcing its first-quarter earnings.

In 2022, Bird faced a challenging year. The company announced plans to completely exit Germany, Sweden, and Norway, as well as wind down operations in numerous other markets, primarily small to mid-sized, across the U.S., Europe, the Middle East, and Africa. They also reduced their staff by 23%.

Despite a positive revenue increase of 12.06% in 2022, the company faced substantial losses totaling $358.74 million, marking a significant 66.9% increase compared to 2021. The challenges continued in 2023 as Bird witnessed a decline in rides and deployed vehicles. With a net loss of $44.3 million recorded at the end of Q1 2023, it’s likely that the company will continue to downsize its operations.

Micromobility.com: similar woes despite the acquisition of Wheels and rebranding

Founded in 2015 and headquartered in New York, Micromobility.com delivers micromobility services in Italy, the United States, and Singapore (43 cities in total), which include e-scooters, e-bicycles, and e-mopeds. It also operates Helbiz Kitchen, a delivery-only ghost kitchen restaurant, and the Helbiz Live streaming platform. The company currently employs 284 people.

In 2023, the company, formerly known as Helbiz, underwent a rebranding and transformed into Micromobility.com Inc. This rebranding coincided with the plans to launch retail stores across the United States.

In 2022, Micromobility.com successfully completed its acquisition of Wheels, a shared micromobility operator, along with promises to its investors that the merger would lead to a doubling of annual revenue and facilitate the path to profitability. The company set its sights on capitalizing on Wheels' extensive user base of 5 million riders and venturing into untapped markets.

Despite these hopes, Micromobility.com experienced less than stellar financial results in 2022. The company achieved a revenue of $15.54 million, indicating a 21.07% growth compared to the previous year's $12.83 million. However, the company also incurred losses amounting to -$82.07 million, reflecting a 13.3% increase compared to 2021.

In 2023, Micromobility.com announced a reverse stock split to meet Nasdaq Capital Market's minimum bid price requirement and make their common stock more attractive to investors. This move didn't come as a surprise, considering that the company received a delisting warning from Nasdaq in 2022. Coupled with its enduring track record of operating losses and negative cash flows over time, the overall outlook of the company's financial performance is rather discouraging.

Why are Bird and Micromobility.com facing financial difficulties and exiting markets?

The difficulties faced by Bird and Micromobility.com can be partly explained by their venture capital-backed business model. They witnessed swift expansion while hemorrhaging substantial amounts of money. And the more they expanded, the more money they bled. Now, it’s unsurprising to witness their heavily subsidized business models shifting their priorities from aggressive growth to mitigating losses and striving for profitability.

In recent years, there has been a surge in the popularity of shared mobility special purpose acquisition companies (SPAC). These companies are created solely for the purpose of raising capital through an initial public offering and have no commercial operations of their own. The ultimate goal of a SPAC is to acquire or merge with an existing company.

Financial struggles have become a common theme among shared mobility SPACs This can be attributed to the rush of companies going public without first establishing a sustainable business model – and Bird and Micromobility.com are no exception to this trend. The challenges faced by these companies emphasize the significance of building a strong and viable foundation prior to entering the public market.

The relentless pursuit of expansion has proven to be an ineffective strategy. For instance, some experts suggest that Bird's decision to outsource its operations to franchises made it harder to persuade cities and secure contracts. Their emphasis on breadth rather than depth resulted in a lack of understanding regarding local communities and the nuances of local legislation. As a result, major players like Bird and Micromobility.com have been withdrawing their fleets from “less profitable” cities.

The soaring shared micromobility market: a golden opportunity for local entrepreneurs

According to a McKinsey study, the shared micromobility market has the potential to reach a staggering $50 billion to $90 billion by 2030, with an estimated annual growth rate of approximately 40% between 2019 and 2030. By 2030, shared micromobility could constitute around 10% of the overall shared mobility market.

In this context, the recent financial challenges faced by Bird and Micromobility.com should not be seen as indicative of a bleak future for the entire industry. Instead, these setbacks highlight the inherent unsustainability of aggressive and expansive business models within the shared micromobility landscape.

Local operators with smaller ground teams enjoy a notable edge over companies like Bird and Micromobility.com. By focusing on underserved markets and having an intimate understanding of their communities, these operators can deliver superior service while maintaining lower costs and stable profit margins.

Returning to Bird's Q1 2023 financial report, they also reported 0.9 rides per deployed vehicle per day. Now, let's compare this figure to other operators. We conducted a survey involving two EU-based operators that make use of Atom Mobility:

- Operator 1: With a fleet of 4,000+ vehicles across over 10 cities, they recorded an average ride per vehicle of 0.9 in Q1 2023

- Operator 2: Operating in a single city with a fleet of 200 vehicles, they achieved an average ride per vehicle of 2.7 in Q1 2023

As fleet sizes increase, the average ride per vehicle tends to decrease, as seen with Operator 1 and Bird. However, the figure from Operator 2 highlights the potential for local operators to thrive in underserved cities that larger shared mobility companies may neglect.

We have seen examples of this – Go Green City, a Swiss electric moped-sharing company, presently provides its services in Zurich and Basel. Their small, tightly-knit team prioritizes local knowledge, enabling them to operate with enhanced flexibility and agility – a level of service that larger companies like Bird or Micromobility.com will find challenging to match. Overall, more than 100 projects have successfully launched their shared mobility ventures with Atom Mobility's assistance, operating in over 140 cities across the globe.

As the desire for shared micromobility services grows – with a focus on community safety and the ethical integration of these modes of transportation into the overall urban transit system – it seems that local operators have a distinct edge over large multinationals.

Click below to learn more or request a demo.

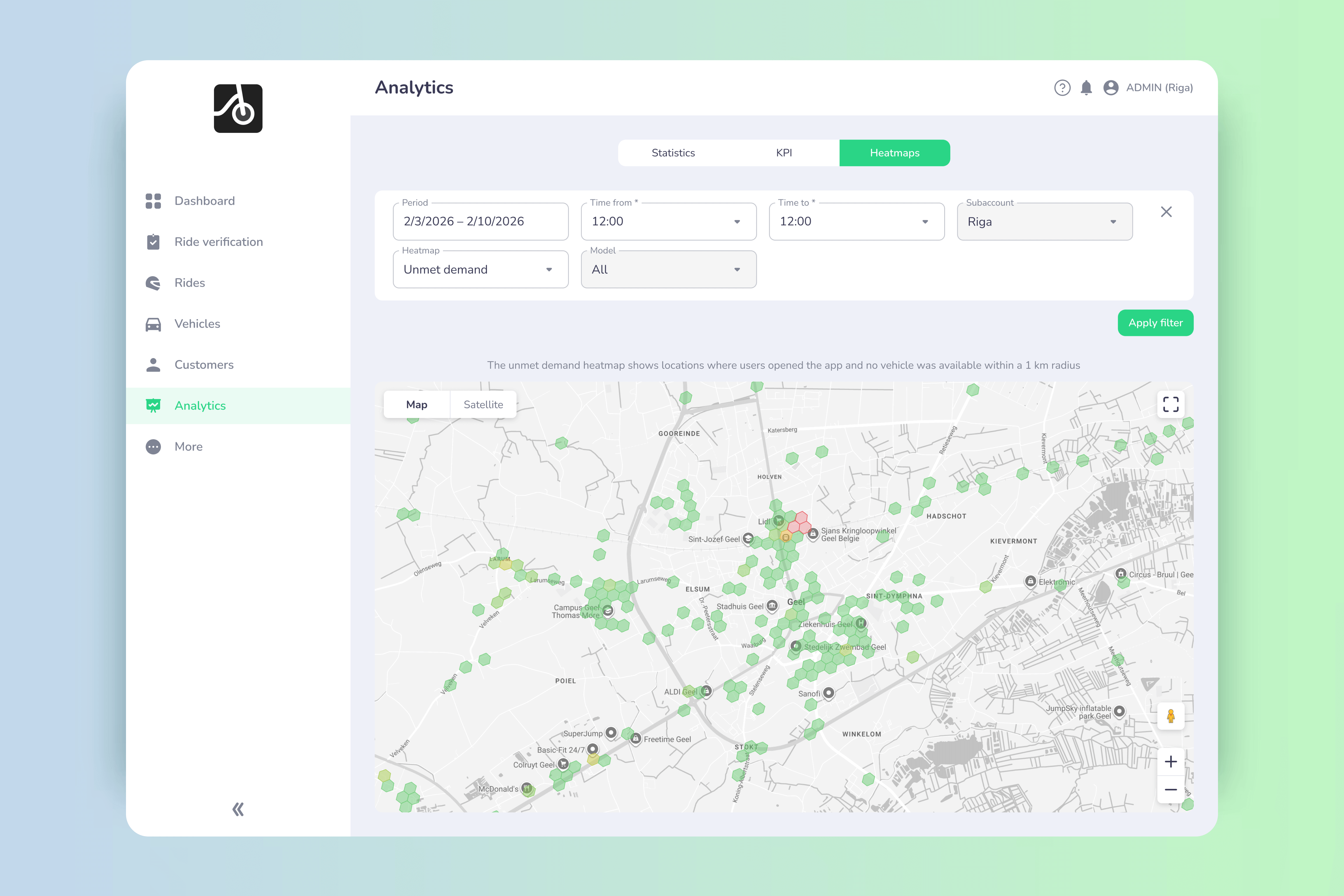

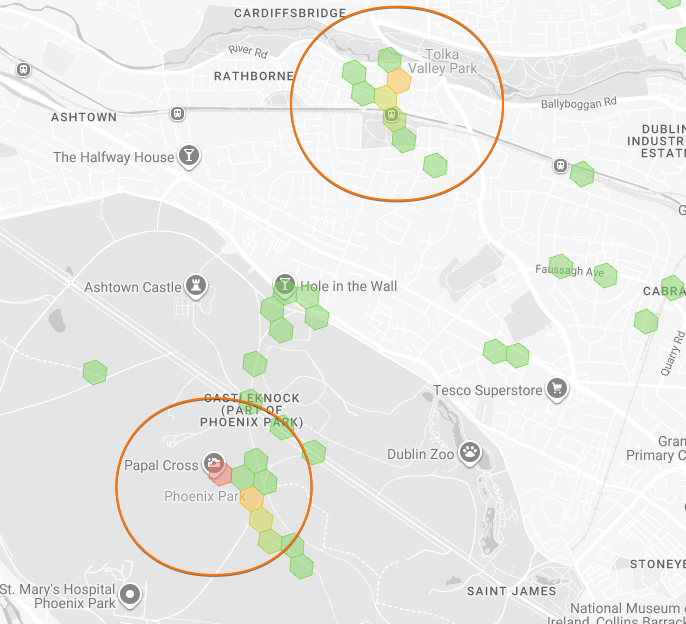

📉 Every unmet search is lost revenue. The unmet demand heatmap shows where users actively searched for vehicles but none were available - giving operators clear, search-based demand signals to rebalance fleets 🚚, improve conversions 📈, and grow smarter 🧠.

Fleet operators don’t lose revenue because of lack of demand - they lose it because demand appears in the wrong place at the wrong time. That’s exactly the problem the Unmet demand heatmap solves.

This new analytics layer from ATOM Mobility shows where users actively searched for vehicles but couldn’t find any within reach. Not guesses. Not assumptions. Real, proven demand currently left on the table.

What is the unmet demand heatmap?

The unmet demand heatmap highlights locations where:

- A user opened the app

- Actively searched for available vehicles

- No vehicle was found within the defined search radius

In other words: high-intent users who wanted to ride, but couldn’t. Unlike generic “app open” data, unmet demand is recorded only when a real vehicle search happens, making this one of the most actionable datasets for operators.

Why unmet demand is more valuable than app opens

Many analytics tools track where users open the app (ATOM Mobility provides this data too). That’s useful - but incomplete. Unmet demand answers a much stronger question:

Where did users try to ride and failed? That difference matters.

Unmet demand data is:

✅ Intent-driven (search-based, not passive)

✅ Directly tied to lost revenue

✅ Immediately actionable for rebalancing and expansion

✅ Credible for discussions with cities and partners

How it works

Here’s how the logic is implemented under the hood:

1. Search-based trigger. Unmet demand is recorded only when a user performs a vehicle search. No search = no data point.

2. Distance threshold. If no vehicle is available within 1,000 meters, unmet demand is logged.

- The radius can be customized per operator

- Adaptable for dense cities vs. suburban or rural areas

3. Shared + private fleet support. The feature tracks unmet demand for:

- Shared fleets

- Private / restricted fleets (e.g. corporate, residential, campus)

This gives operators a full picture across all use cases.

4. GPS validation. Data is collected only when:

- GPS is enabled

- Location data is successfully received

This ensures accuracy and avoids noise.

Smart data optimization (no inflated demand)

To prevent multiple searches from the same user artificially inflating demand, the system applies intelligent filtering:

- After a location is stored, a 30-minute cooldown is activated

- If the same user searches again within 30 minutes And within 100 meters of the previous location → the record is skipped

- After 30 minutes, a new record is stored - even if the location is unchanged

Result: clean, realistic demand signals, not spammy heatmaps.

Why this matters for operators

📈 Increase revenue

Unmet demand shows exactly where vehicles are missing allowing you to:

- Rebalance fleets faster

- Expand into proven demand zones

- Reduce failed searches and lost rides

🚚 Smarter rebalancing

Instead of guessing where to move vehicles, teams can prioritize:

- High-intent demand hotspots

- Time-based demand patterns

- Areas with repeated unmet searches

🏙 Stronger city conversations

Unmet demand heatmaps are powerful evidence for:

- Permit negotiations

- Zone expansions

- Infrastructure requests

- Data-backed urban planning discussions

📊 Higher conversion rates

Placing vehicles where users actually search improves:

- Search → ride conversion

- User satisfaction

- Retention over time

Built for real operational use

The new unmet demand heatmap is designed to work alongside other analytics layers, including:

- Popular routes heatmap

- Open app heatmap

- Start & end locations heatmap

Operators can also:

- Toggle zone visibility across heatmaps

- Adjust time periods (performance-optimized)

- Combine insights for strategic fleet planning

From missed demand to competitive advantage

Every unmet search is a signal. Every signal is a potential ride. Every ride is revenue. With the unmet demand heatmap, operators stop guessing and start placing vehicles exactly where demand already exists.

👉 If you want to see how unmet demand can unlock growth for your fleet, book a demo with ATOM Mobility and explore how advanced heatmaps turn data into decisions.

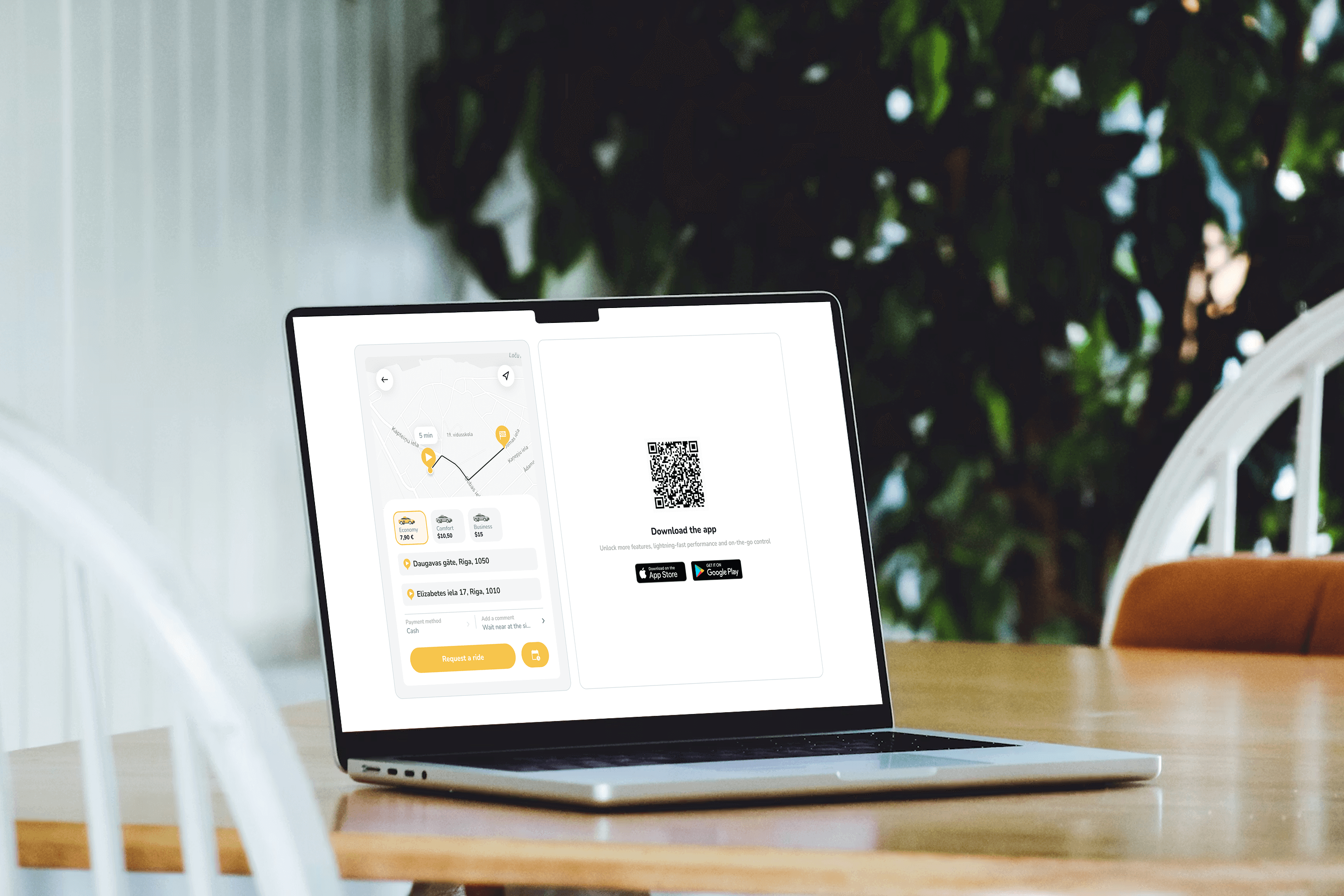

🚕 Web-booker is a lightweight ride-hail widget that lets users book rides directly from a website or mobile browser - no app install required. It reduces booking friction, supports hotel and partner demand, and keeps every ride fully synced with the taxi operator’s app and dashboard.

What if ordering a taxi was as easy as booking a room or clicking “Reserve table” on a website?

Meet Web-booker - a lightweight ride-hail booking widget that lets users request a cab directly from a website, without installing or opening the mobile app.

Perfect for hotels, business centers, event venues, airports, and corporate partners.

👉 Live demo: https://app.atommobility.com/taxi-widget

What is Web-booker?

Web-booker is a browser-based ride-hail widget that operators can embed or link to from any website.

The booking happens on the web, but the ride is fully synchronized with the mobile app and operator dashboard.

How it works (simple by design)

No redirects. No app-store friction. No lost users.

- Client places a button or link on their website

- Clicking it opens a new window with the ride-hail widget

- The widget is branded, localized, and connected directly to the operator’s system

- Booking instantly appears in the dashboard and mobile app

Key capabilities operators care about

🎨 Branded & consistent

- Widget color automatically matches the client’s app branding

- Feels like a natural extension of the operator’s ecosystem

- Fully responsive and optimized for mobile browsers, so users can book a ride directly from their phone without installing the app

📱 App growth built in

- QR code and App Store / Google Play links shown directly in the widget

- Smooth upgrade path from web → app

⏱️ Booking flexibility

- Users can request a ride immediately or schedule a ride for a future date and time

- Works the same way across web, mobile browser, and app

- Scheduled bookings are fully synchronized with the operator dashboard and mobile app

🔄 Fully synced ecosystem

- Country code auto-selected based on user location

- Book via web → see the ride in the app (same user credentials)

- Dashboard receives booking data instantly

- Every booking is tagged with Source:

- App

- Web (dashboard bookings)

- Booker (website widget)

- API

🔐 Clean & secure session handling

- User is logged out automatically when leaving the page

- No persistent browser sessions

💵 Payments logic

- New users: cash only

- Existing users: can choose saved payment methods

- If cash is not enabled → clear message prompts booking via the app

This keeps fraud low while preserving conversion.

✅ Default rollout

- Enabled by default for all ride-hail merchants

- No extra setup required

- Operators decide where and how to use it (hotel partners, landing pages, QR posters, etc.)

Why this matters in practice

Web-booker addresses one of the most common friction points in ride-hailing: users who need a ride now but are not willing to download an app first. By allowing bookings directly from a website, operators can capture high-intent demand at the exact moment it occurs - whether that is on a hotel website, an event page, or a partner landing page.

At the same time, Web-booker makes partnerships with hotels and venues significantly easier. Instead of complex integrations or manual ordering flows, partners can simply place a button or link and immediately enable ride ordering for their guests. Importantly, this approach does not block long-term app growth. The booking flow still promotes the mobile app through QR codes and store links, allowing operators to convert web users into app users over time - without forcing the install upfront.

Web-booker is not designed to replace the mobile app. It extends the acquisition funnel by adding a low-friction entry point, while keeping all bookings fully synchronized with the operator’s app and dashboard.

👉 Try the demo

https://app.atommobility.com/taxi-widget

Want to explore a ride-hail or taxi solution for your business - or migrate to a more flexible platform? Visit: https://www.atommobility.com/products/ride-hailing