The mobile sharing industry is projected to grow at a rapid rate over the next several years. The economic shift towards micro mobility has shown that bike and scooter use is going to grow from USD $2.5 billion in 2019 to USD $10.1 billion by 2027. With an increasing demand for affordable mobility services, industry leaders are making adjustments to their financial models to accommodate changing regulations, as well as, growing production costs.

We put together a breakdown of the expenses that are currently going in to establishing a profitable MaaS company along with some other considerations to keep in mind.

What are the current pricing levels for leaders in Scooter and Bike Sharing?

The pricing levels for different services being offered around the world vary based upon initial upfront costs, cost per allotted time and total ride duration. These prices are also subject to change depending on the regulatory requirements of each location.

Scooter sharing:

Bike sharing:

At ATOM Mobility we have a specific calculation to determine the total income a scooter or bike sharing service makes based on ride time and pricing fees. This allows adjustments to be made for the different price levels each company offers.

Income Equation: (Unlock Fee + (Average Ride Time X Minutes)) = x

x = Average Price per Ride

How does vehicle ridership impact the financial model?

Ridership is impacted by a multitude of factors, including availability to travel lanes, density of charging/docking stations, level of integration within the overall transportation network, along with the extent of rider outreach and vendor education. Vehicle use rates tend to increase based on volume of available scooters/bikes and ease of access to stations. The systems with larger fleets, as well as wider spread sharing infrastructure tend to experience higher ridership.

According to research conducted by the National Association of City Transportation Officials, scooters are making up to two times more rides per vehicle per day compared to bikes. Bike services complete anywhere from 0.5 to 2.5 rides per day at an average of 1, with trends showing a shift away from traditional pedal bicycles as the interest in e-vehicles continues to grow.

Image source: nacto.org

The region where services are being offered can also influence ridership. Across our partners at ATOM Mobility for scooters, we are seeing from 1.8 to even 5 rides per vehicle per day, with even higher rates in colder regions where the proper infrastructure is in place.

Image source: City of Chicago, E-scooter Pilot Evaluation

An evaluation of the City of Chicago’s E-scooter pilot program found that over time the number of trips per day decreased from an average of 3.7 to 2.5. This aligns with the seasonality of mobility vehicles, which has been proven to impact ridership. Our research found that there can be decreases between 30 to 50 percent during the off-season.

The average rides per day you can count on for bike sharing services is 0.5 to 2.5, and 1.8 to 5 for scooter sharing services.

What additional factors need to be taken into consideration?

Once we have determined how many rides are being taken and the average price, we can calculate the average income per vehicle per month and outline cost positions. To begin growing revenue, mobility companies need to determine ways to extend the lifespan of their vehicles or off-set the costs once the limit is met. These factors are a major component in developing a successful financial model. In addition, it’s important to review the other expenses that impact vehicle maintenance and usage when constructing an accurate forecast.

Seasonality

Seasonality refers to the time of year a service operates as a result of environmental or weather factors. For mobility services, the usage season usually begins when the average temperature in a month is +10 Celsius or more.

Rides Per Vehicle Per Day

The number of rides each vehicle is taking in a day will impact both revenue but also maintenance and lifespan costs.

Rides

The rate for each ride will need to be considered when developing an overall financial plan for a company.

Maintenance Costs (ex. 13 percent of cost per ride)

Maintenance of the vehicle fleets is required and may vary depending on usage, as well as vehicle model.

Charging Costs (ex. 21 percent of cost per ride)

Whether the fleet uses docking stations or offers free floating services, the cost of charging the vehicles is necessary for continued use.

Bank Commission (ex. 3 percent cost per ride)

This includes any of the banking fees that are acquired.

Marketing (ex. 4 percent cost per ride)

Promoting the services being offered is an essential expense for business growth and expansion within the market.

Customer Support (ex. 5 percent cost per ride)

Most mobility services are offered through mobile apps that require regular support from customer service representatives to resolve customer inquiries and help with reputation management for the company.

IT System Support (ex. 5 percent cost per ride)

These services include IoT systems, sim cards, data, software and other technological requirements needed for the vehicles to operate.

Additional Costs (ex. 3 percent cost per ride)

Mobility companies like any other vehicle service are subject to additional costs such as insurance, city permits and/or other resources.

Our Excel-based Model

To help determine the overall impact of fluctuating costs for scooter and bike services, we developed a financial model that breaks down costs based on a percentage. Through this Excel-based Model we are able to maintain a proportionate evaluation of the expenses for each service.

source: ATOM Mobility

To make calculations we assume an average ride time of 20 minutes then apply that to our Excel-based Model. Costs are shown as a percent from the ride price. Since cost and prices differ country by country, this model allows for the proportions to remain the same. For accurate forecast planning, we recommend using the average of two to four rides per vehicle per day on a period of wholesale. To learn more about our model, please email us.

Where do we go from here?

Mobility as a service is expected to continue growing as additional opportunities for expansion and profitability open in the market. At ATOM Mobility, we want to help your business thrive in the exciting new world of transportation services. There has not been a better time to join other industry leaders than right now. Reach out to us today so we can start building for the future, starting with our scooter sharing software.

Click below to learn more or request a demo.

The micromobility industry doesn’t need another generic mobility conference. 🚫🎤 It needs real conversations between operators who are actually in the field. ⚙️ That’s exactly what ATOM Connect 2026 is built for. 🎯🤝

The shared mobility industry is evolving rapidly. Operators are navigating scaling challenges, regulatory complexity, hardware decisions, fleet optimization, and new integration models, all while aiming for sustainable growth.

That’s exactly why ATOM Mobility is organizing ATOM Connect 2026.

Our previous edition of ATOM Connect brought together professionals from the car sharing and rental industry for focused, high-quality discussions and networking. This year, we are narrowing the focus and dedicating the entire event to one fast-moving segment of the industry: shared micromobility.

ATOM Connect 2026 is designed specifically for operators, partners, and decision-makers working in shared micromobility. It is not a broad mobility conference or a public exhibition. It is a curated space for industry professionals to exchange practical experience, insights, and lessons learned.

On May 14th, 2026 in Riga, we will once again bring the community together, this time with a clear focus on micromobility.

What to expect

This year’s agenda will address the real operational and strategic questions shaping shared micromobility today:

- Scaling fleets sustainably

- Multi-vehicle operations beyond scooters

- Regulatory cooperation and long-term city partnerships

- Data-driven fleet optimization

- MaaS integration and ecosystem collaboration

- Marketing and automation for growth

As usual, we aim to host both local and international operators from smaller, fast-growing fleets to established large-scale players alongside hardware providers and ecosystem partners.

On stage, you’ll hear from leading shared mobility companies - including Segway on hardware partnerships, Umob on MaaS integration, Anadue on data-driven fleet intelligence, Elerent on multi-vehicle operational realities and more insightful discussions.

The goal is simple: meaningful discussions with people who understand the operational realities of the industry.

A curated, industry-focused event

ATOM Connect is free to attend, but participation is industry-focused (each submission is manually reviewed and verified). We are intentionally keeping the audience relevant and aligned to ensure high-quality conversations and valuable networking.

If you work in shared micromobility and would like to join the event, you can find the full agenda and register here:

👉 https://www.atommobility.com/atom-connect-2026

In the coming weeks, we will be revealing more speakers and additional agenda updates. We look forward to bringing the industry together again.

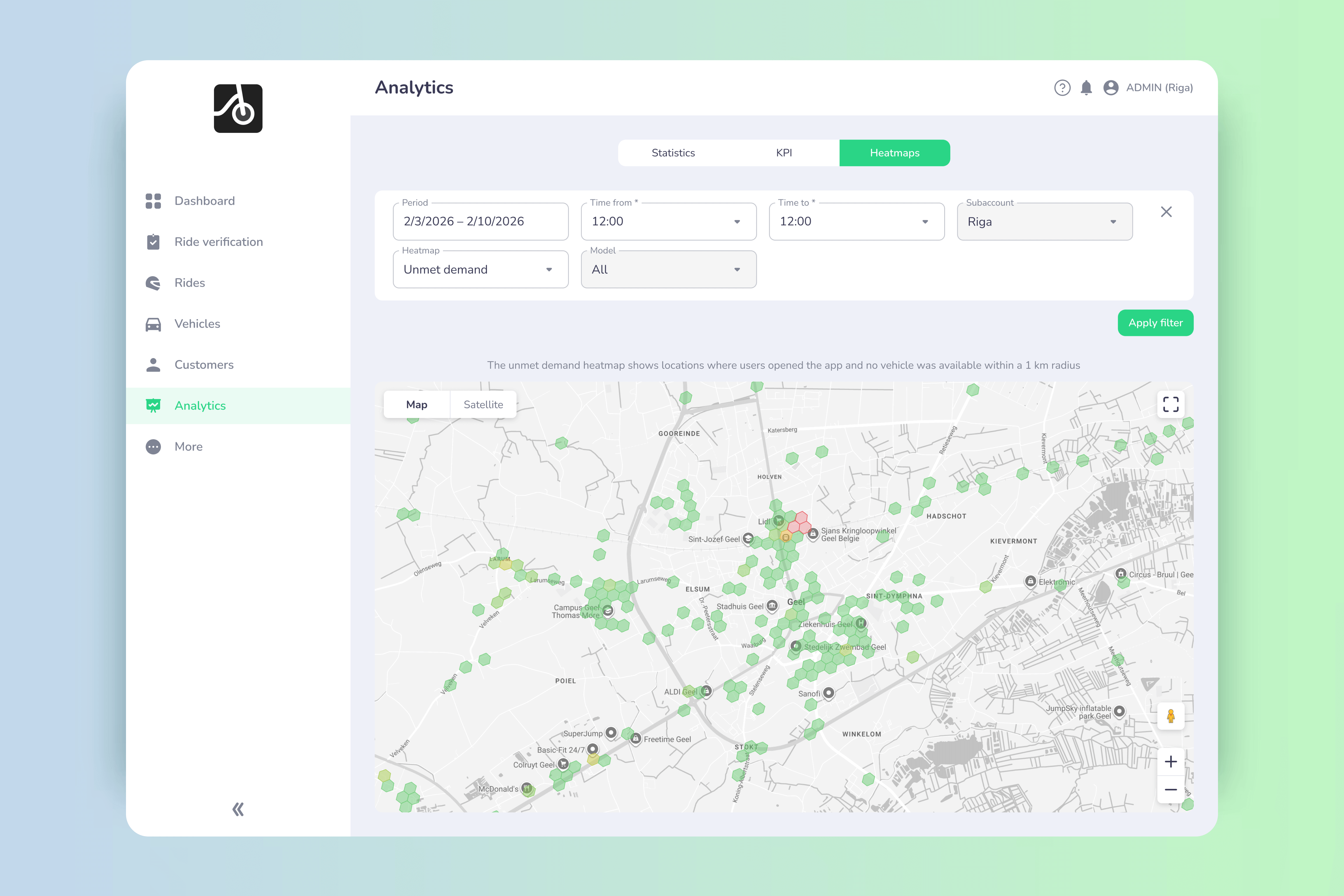

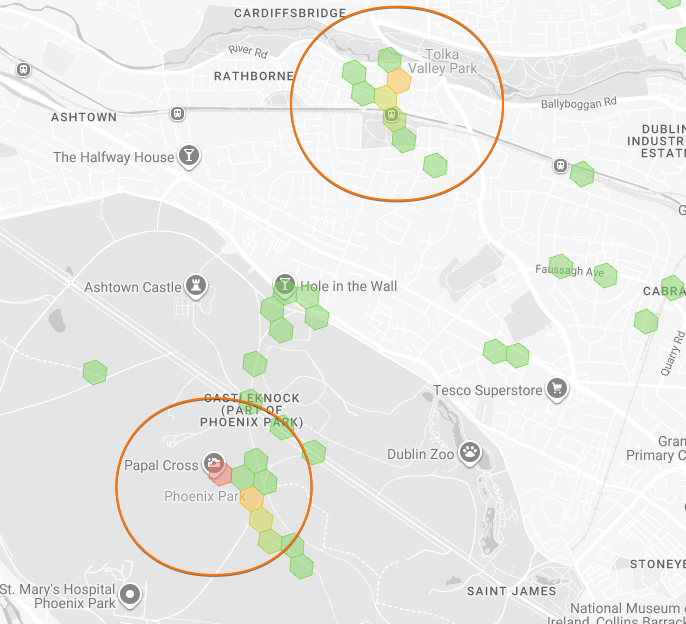

📉 Every unmet search is lost revenue. The unmet demand heatmap shows where users actively searched for vehicles but none were available - giving operators clear, search-based demand signals to rebalance fleets 🚚, improve conversions 📈, and grow smarter 🧠.

Fleet operators don’t lose revenue because of lack of demand - they lose it because demand appears in the wrong place at the wrong time. That’s exactly the problem the Unmet demand heatmap solves.

This new analytics layer from ATOM Mobility shows where users actively searched for vehicles but couldn’t find any within reach. Not guesses. Not assumptions. Real, proven demand currently left on the table.

What is the unmet demand heatmap?

The unmet demand heatmap highlights locations where:

- A user opened the app

- Actively searched for available vehicles

- No vehicle was found within the defined search radius

In other words: high-intent users who wanted to ride, but couldn’t. Unlike generic “app open” data, unmet demand is recorded only when a real vehicle search happens, making this one of the most actionable datasets for operators.

Why unmet demand is more valuable than app opens

Many analytics tools track where users open the app (ATOM Mobility provides this data too). That’s useful - but incomplete. Unmet demand answers a much stronger question:

Where did users try to ride and failed? That difference matters.

Unmet demand data is:

✅ Intent-driven (search-based, not passive)

✅ Directly tied to lost revenue

✅ Immediately actionable for rebalancing and expansion

✅ Credible for discussions with cities and partners

How it works

Here’s how the logic is implemented under the hood:

1. Search-based trigger. Unmet demand is recorded only when a user performs a vehicle search. No search = no data point.

2. Distance threshold. If no vehicle is available within 1,000 meters, unmet demand is logged.

- The radius can be customized per operator

- Adaptable for dense cities vs. suburban or rural areas

3. Shared + private fleet support. The feature tracks unmet demand for:

- Shared fleets

- Private / restricted fleets (e.g. corporate, residential, campus)

This gives operators a full picture across all use cases.

4. GPS validation. Data is collected only when:

- GPS is enabled

- Location data is successfully received

This ensures accuracy and avoids noise.

Smart data optimization (no inflated demand)

To prevent multiple searches from the same user artificially inflating demand, the system applies intelligent filtering:

- After a location is stored, a 30-minute cooldown is activated

- If the same user searches again within 30 minutes And within 100 meters of the previous location → the record is skipped

- After 30 minutes, a new record is stored - even if the location is unchanged

Result: clean, realistic demand signals, not spammy heatmaps.

Why this matters for operators

📈 Increase revenue

Unmet demand shows exactly where vehicles are missing allowing you to:

- Rebalance fleets faster

- Expand into proven demand zones

- Reduce failed searches and lost rides

🚚 Smarter rebalancing

Instead of guessing where to move vehicles, teams can prioritize:

- High-intent demand hotspots

- Time-based demand patterns

- Areas with repeated unmet searches

🏙 Stronger city conversations

Unmet demand heatmaps are powerful evidence for:

- Permit negotiations

- Zone expansions

- Infrastructure requests

- Data-backed urban planning discussions

📊 Higher conversion rates

Placing vehicles where users actually search improves:

- Search → ride conversion

- User satisfaction

- Retention over time

Built for real operational use

The new unmet demand heatmap is designed to work alongside other analytics layers, including:

- Popular routes heatmap

- Open app heatmap

- Start & end locations heatmap

Operators can also:

- Toggle zone visibility across heatmaps

- Adjust time periods (performance-optimized)

- Combine insights for strategic fleet planning

From missed demand to competitive advantage

Every unmet search is a signal. Every signal is a potential ride. Every ride is revenue. With the unmet demand heatmap, operators stop guessing and start placing vehicles exactly where demand already exists.

👉 If you want to see how unmet demand can unlock growth for your fleet, book a demo with ATOM Mobility and explore how advanced heatmaps turn data into decisions.