With the increasing demand for shared mobility, we've seen different business models in the car market: traditional car rental, peer-to-peer car sharing, and on-demand car sharing.

In this blog post, we're going to compare these business models. We'll look at the established traditional car rental companies and how they stack up against the newer peer-to-peer and on-demand services. We'll explore how these companies are doing financially – and make some predictions about their possible future.

Traditional car rental

Traditional car rental companies like Hertz, Enterprise, and Avis operate by owning or leasing their own fleets of vehicles. They usually have rental offices and parking lots in strategic locations such as airports and city centers. Customers looking to rent a car make reservations through the company's websites, mobile apps, or by phone. Typically, customers pay a daily or weekly rate, plus additional costs for mileage and optional services like insurance.

Avis – proving that traditional car rental is going strong

Avis was founded in 1946 in Detroit, and it quickly established itself as a major player in the car rental market. Avis is best known for its "We Try Harder" slogan, which was introduced in the 1960s and became a symbol of the company's commitment to customer service. Over the years, Avis has expanded its operations globally.

Avis had a strong second quarter in 2023. They reported $3.1 billion in revenue, with a net income of $436 million. The company saw an increase in usage compared to the same period in 2022, reaching 70.5%. Avis also performed better than expected on Wall Street, with earnings of $11.01 per share – surpassing the estimated $9.79.

At the end of Q2 2023, Avis had around $1.1 billion in liquidity and an additional $1.1 billion for fleet funding. Avis CEO Joe Ferraro credited the strong results to the company's ability to capitalize on the growing travel demand, particularly during the busy summer season.

Hertz – usage and fleet growth

Hertz was founded in 1918 in Chicago. Over the years, Hertz grew into a global brand, serving both the leisure and business travel sectors. Despite various ownership changes, it has maintained a strong presence in the car rental market.

Hertz also reported a healthy second quarter in 2023. They made $2.4 billion in revenue, mainly due to high demand – rental volume increased by 12% compared to the previous year, and their average fleet grew by 9%.

Each vehicle brought in an average of $1,516 per month during the quarter, thanks to a usage rate of 82%, which was 230 basis points higher than in Q2 2022. As of June 30, 2023, Hertz had $1.4 billion in liquidity, with $682 million in unrestricted cash. Overall, Avis' old rivals Hertz are doing quite well too.

Peer-to-peer car sharing

Peer-to-peer car sharing allows private vehicle owners to offer their cars for rent through platforms like Turo and Getaround. The vehicles are distributed across various neighborhoods and residential areas, offering a decentralized and more flexible system. Customers can use these platforms to find and reserve their vehicles of choice.

Turo – promising financials, uncertain IPO plans

Turo, founded in 2009, began as RelayRides and was later rebranded. Turo offers an online platform that allows individual car owners to rent out their vehicles to other people when they are not using them. The company provides a marketplace where people can list their cars for rent, and renters can search for and book vehicles for short-term use.

Turo has gained popularity as a more flexible and often cost-effective alternative to traditional car rental services. It allows car owners to monetize their vehicles when they're not in use and provides renters with a wide selection of cars to choose from.

Turo, valued at $1.2 billion in 2019, has seen promising financials. In 2022, they earned $746.59 million, up 59% from the previous year, with 320,000 vehicle listings. They went from substantial losses in 2019 and 2020 to a net income of $154.66 million in 2022.

Turo also grew its marketplace, engaging with 160,000 active car owners and 2.9 million riders worldwide by the end of 2022. However, according to their S-1 filing, they anticipate increasing expenses in the future, which might challenge their profitability.

Turo applied for an IPO on the Nasdaq in 2022 but didn't proceed. The IPO plans were delayed, likely due to challenges like the 2022 tech downturn. However, recently, Turo revived its plan to go public and could list their shares in the fall of 2023.

Getaround – an uncertain future

Getaround is another popular peer-to-peer car-sharing platform that allows individuals to rent out their personal vehicles to others when they are not using them. It's often referred to as the "Airbnb of cars." Introduced in 2011, it is currently accessible in over 1,000 cities in the United States and Europe.

In 2022, Getaround earned $62.3 million in revenue. However, they reported an EBITDA of -$25.0 million, indicating that its operating expenses exceeded its earnings. Overall, the company experienced a net loss of -$46.8 million for the year. Getaround's total assets were valued at $217.1 million.

During its public market debut in 2022, Getaround witnessed a significant decrease in its share value, plummeting by as much as 65%.

In March 2023, the company got a notice from the New York Stock Exchange saying it didn't meet the requirements. This was because their average global market capitalization over 30 consecutive trading days fell below $50 million, and their reported stockholders' equity was also below $50 million.

Overall, Getaround's stock market troubles and weak finances make their future uncertain for now.

On-demand car sharing

On-demand car sharing services like Zipcar and Share Now (formerly Car2Go) maintain their own fleets, which are parked throughout cities in designated spots or on the streets. Customers can access these vehicles in real-time using mobile apps. The pricing structure usually includes fuel, maintenance, and insurance.

Share Now – downsizing, acquired by Stellantis

Share Now, a German carsharing firm born from the merger of Car2Go and DriveNow, now operates as a subsidiary of Stellantis' Free2Move division, offering car sharing services in European urban areas. It has over four million registered members and a fleet of 14,000+ vehicles across 18 European cities.

In late 2019, ShareNow announced the closure of its North American operations due to competition, increasing operational costs, and limited support for electric vehicles. Service in London, Brussels, and Florence was also discontinued.

On May 3, 2022, Share Now was acquired by Stellantis, with the ownership now managed by Stellantis subsidiary Free2Move, following the closure of the acquisition on July 18, 2022.

CityBee – a success story in Baltics

CityBee, founded in 2012 in Lithuania, started as a car-sharing service primarily aimed at businesses. It now operates in the whole Baltic region. Customers can choose from a variety of vehicles, including cars, vans, bikes, and electric scooters. The fleet also includes electric and hybrid cars. CityBee takes care of insurance, fuel, and parking fees in CityBee areas.

In 2022, CityBee reported a sales revenue of €33,168,028, slightly down from the previous year's €39,814,173. However, the company's profitability surged, with a profit before taxes of €2,193,820 – a substantial increase from the €968,722 in 2021. This also resulted in a higher profit margin of 6.61% in 2022, compared to 2.43% in 2021.

CityBee saw its net profit rise to €1,857,517 in 2022, a substantial increase from the €876,986 in 2021. The company's equity capital also grew to €4,688,176, indicating a stronger financial foundation. CityBee shows that on-demand car sharing can succeed with the right approach in the right market.

There's room for different business models

The shared car mobility market is large enough for different solutions to exist together – especially with car ownership costs going up. Companies like Hertz and Avis demonstrate that the traditional rental model remains relevant and holds significant profit potential.

Despite financial challenges, peer-to-peer car sharing and on-demand car sharing are attracting a fresh customer base. Peer-to-peer car sharing offers a more personal touch by letting people rent their own vehicles. On-demand car-sharing services are a great solution for urban residents, offering quick pay-as-you-go access to vehicles.

While the position of traditional car rental giants might seem unshakeable, it's a fast-moving, evolving market. Regional success stories – such as CityBee – certainly prove that challengers are not asleep.

If you own a fleet, operate a car rental business, or are looking to get into one, ATOM Mobility can equip you with an end-to-end software suite that will put you miles ahead from competition.

Click below to learn more or request a demo.

The micromobility industry doesn’t need another generic mobility conference. 🚫🎤 It needs real conversations between operators who are actually in the field. ⚙️ That’s exactly what ATOM Connect 2026 is built for. 🎯🤝

The shared mobility industry is evolving rapidly. Operators are navigating scaling challenges, regulatory complexity, hardware decisions, fleet optimization, and new integration models, all while aiming for sustainable growth.

That’s exactly why ATOM Mobility is organizing ATOM Connect 2026.

Our previous edition of ATOM Connect brought together professionals from the car sharing and rental industry for focused, high-quality discussions and networking. This year, we are narrowing the focus and dedicating the entire event to one fast-moving segment of the industry: shared micromobility.

ATOM Connect 2026 is designed specifically for operators, partners, and decision-makers working in shared micromobility. It is not a broad mobility conference or a public exhibition. It is a curated space for industry professionals to exchange practical experience, insights, and lessons learned.

On May 14th, 2026 in Riga, we will once again bring the community together, this time with a clear focus on micromobility.

What to expect

This year’s agenda will address the real operational and strategic questions shaping shared micromobility today:

- Scaling fleets sustainably

- Multi-vehicle operations beyond scooters

- Regulatory cooperation and long-term city partnerships

- Data-driven fleet optimization

- MaaS integration and ecosystem collaboration

- Marketing and automation for growth

As usual, we aim to host both local and international operators from smaller, fast-growing fleets to established large-scale players alongside hardware providers and ecosystem partners.

On stage, you’ll hear from leading shared mobility companies - including Segway on hardware partnerships, Umob on MaaS integration, Anadue on data-driven fleet intelligence, Elerent on multi-vehicle operational realities and more insightful discussions.

The goal is simple: meaningful discussions with people who understand the operational realities of the industry.

A curated, industry-focused event

ATOM Connect is free to attend, but participation is industry-focused (each submission is manually reviewed and verified). We are intentionally keeping the audience relevant and aligned to ensure high-quality conversations and valuable networking.

If you work in shared micromobility and would like to join the event, you can find the full agenda and register here:

👉 https://www.atommobility.com/atom-connect-2026

In the coming weeks, we will be revealing more speakers and additional agenda updates. We look forward to bringing the industry together again.

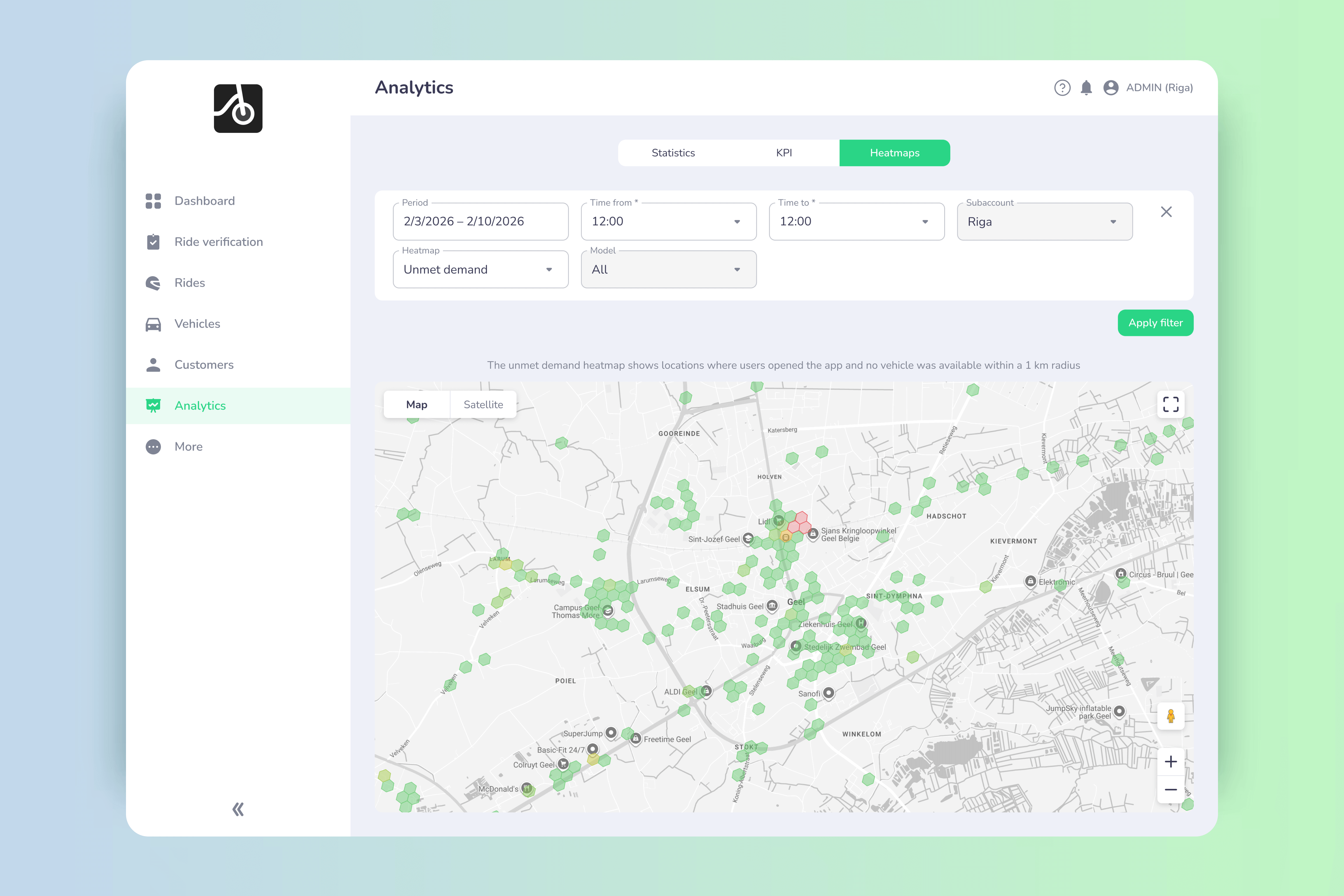

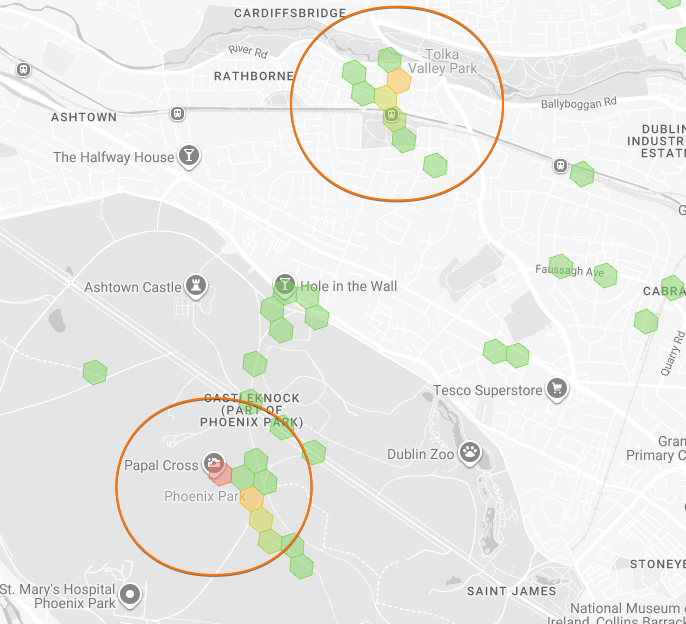

📉 Every unmet search is lost revenue. The unmet demand heatmap shows where users actively searched for vehicles but none were available - giving operators clear, search-based demand signals to rebalance fleets 🚚, improve conversions 📈, and grow smarter 🧠.

Fleet operators don’t lose revenue because of lack of demand - they lose it because demand appears in the wrong place at the wrong time. That’s exactly the problem the Unmet demand heatmap solves.

This new analytics layer from ATOM Mobility shows where users actively searched for vehicles but couldn’t find any within reach. Not guesses. Not assumptions. Real, proven demand currently left on the table.

What is the unmet demand heatmap?

The unmet demand heatmap highlights locations where:

- A user opened the app

- Actively searched for available vehicles

- No vehicle was found within the defined search radius

In other words: high-intent users who wanted to ride, but couldn’t. Unlike generic “app open” data, unmet demand is recorded only when a real vehicle search happens, making this one of the most actionable datasets for operators.

Why unmet demand is more valuable than app opens

Many analytics tools track where users open the app (ATOM Mobility provides this data too). That’s useful - but incomplete. Unmet demand answers a much stronger question:

Where did users try to ride and failed? That difference matters.

Unmet demand data is:

✅ Intent-driven (search-based, not passive)

✅ Directly tied to lost revenue

✅ Immediately actionable for rebalancing and expansion

✅ Credible for discussions with cities and partners

How it works

Here’s how the logic is implemented under the hood:

1. Search-based trigger. Unmet demand is recorded only when a user performs a vehicle search. No search = no data point.

2. Distance threshold. If no vehicle is available within 1,000 meters, unmet demand is logged.

- The radius can be customized per operator

- Adaptable for dense cities vs. suburban or rural areas

3. Shared + private fleet support. The feature tracks unmet demand for:

- Shared fleets

- Private / restricted fleets (e.g. corporate, residential, campus)

This gives operators a full picture across all use cases.

4. GPS validation. Data is collected only when:

- GPS is enabled

- Location data is successfully received

This ensures accuracy and avoids noise.

Smart data optimization (no inflated demand)

To prevent multiple searches from the same user artificially inflating demand, the system applies intelligent filtering:

- After a location is stored, a 30-minute cooldown is activated

- If the same user searches again within 30 minutes And within 100 meters of the previous location → the record is skipped

- After 30 minutes, a new record is stored - even if the location is unchanged

Result: clean, realistic demand signals, not spammy heatmaps.

Why this matters for operators

📈 Increase revenue

Unmet demand shows exactly where vehicles are missing allowing you to:

- Rebalance fleets faster

- Expand into proven demand zones

- Reduce failed searches and lost rides

🚚 Smarter rebalancing

Instead of guessing where to move vehicles, teams can prioritize:

- High-intent demand hotspots

- Time-based demand patterns

- Areas with repeated unmet searches

🏙 Stronger city conversations

Unmet demand heatmaps are powerful evidence for:

- Permit negotiations

- Zone expansions

- Infrastructure requests

- Data-backed urban planning discussions

📊 Higher conversion rates

Placing vehicles where users actually search improves:

- Search → ride conversion

- User satisfaction

- Retention over time

Built for real operational use

The new unmet demand heatmap is designed to work alongside other analytics layers, including:

- Popular routes heatmap

- Open app heatmap

- Start & end locations heatmap

Operators can also:

- Toggle zone visibility across heatmaps

- Adjust time periods (performance-optimized)

- Combine insights for strategic fleet planning

From missed demand to competitive advantage

Every unmet search is a signal. Every signal is a potential ride. Every ride is revenue. With the unmet demand heatmap, operators stop guessing and start placing vehicles exactly where demand already exists.

👉 If you want to see how unmet demand can unlock growth for your fleet, book a demo with ATOM Mobility and explore how advanced heatmaps turn data into decisions.