.jpg)

Marketing in the mobility business is unique because your fleets – be it scooters, bikes, cars, or mopeds – are like a flexible billboard moving all over the city. Whenever someone chooses your service, they essentially parade it around town like a brand ambassador, and even when your fleet is stationary it attracts significant attention as people constantly see it on the streets.

In other words, urban mobility businesses enjoy high brand awareness.

Still, for mobility entrepreneurs, this is the norm. Namely, it's an industry baseline that everyone benefits from and it won't necessarily help you gain more customers, outperform competitors, and boost business.

To do all of those things, you still need an effective marketing strategy that reaches the right audiences and activates users.

Understanding your target audience

Vehicle-sharing customers are diverse, as are their motivations for using the services. Since you're likely operating in a very specific market, i.e. a particular city or region, it's critical to identify and understand your target audience and the different segments to not only reach and speak to the right people, but also avoid wasteful ad spend.

Determining who you're marketing to will also help you in defining the messaging and channels you use, which are key for successful campaigns.

1. Differentiating between B2C and B2B segments

The broadest categories are business-to-consumer (B2C) and business-to-business (B2B). While most people associate vehicle sharing with B2C, e.g. a person zooming on a scooter down a bike lane to make an appointment, the reality is that the far-less-visible B2B segment is thriving with initiatives like corporate car sharing schemes.

The messaging for these two – the individual on the scooter and the CEO looking to offer a convenient mobility solution to their employees – will vary greatly. Different pain points, motivations, and use cases mean that you must adapt how you talk to each segment and differentiate between the two from the get-go. That is, if you're looking to target both.

2. Conducting market research to define customer personas

Whether you're focusing on B2C, B2B, or both, you should research who are the people using/buying your services. The goal is to have your marketing efforts reach the right people, and by digging into the background of your customers, you'll gain an understanding of who they are.

To do so, dive into demographics (age, gender), use cases (how, when, and why they travel), and price sensitvity (how much they spend, do discounts affect their decisions), among other things. Companies often craft user personas by putting all of this information together and creating a profile of the average customer, which they then use to develop their messaging.

Do note that if multiple dominant categories emerge, it's completely normal to have 2-3 user personas. Plus, these can evolve over time, so make sure to conduct ongoing research and refine it according to new data.

Finding the right marketing channels

Once you know who you're targeting, it's important to find out where these people are to reach them in the most effective way possible. If your primary customers are college students, you're unlikely to find them on Facebook.

Generally speaking, we can split the marketing channels into two categories – online and offline.

Online channels

Nowadays, digital marketing is where the bulk of action happens.

Social media platforms offer a fantastic opportunity to reach your specific audience, as they typically allow advanced targeting. By narrowing down various parameters, such as location, demographics, and even related preferences (the factors we defined when creating user personas), it's possible to have very cost-effective ads that generally reach the people who are most likely to convert. Collaboration ith influencers is also an increasingly effective strategy.

However, you must carefully consider which platforms to advertise on. B2C content will thrive in places like Instagram, but, if you're targeting CEOs and CPOs for B2B services, LinkedIn may prove to be a better fit. It's extremely difficult to accurately predict which platform will perform best, hence it's wise to have a presence on multiple platforms, and allocate budgets according to observed returns.

Search engine and content marketing is another avenue worth exploring – think of it as your company showing up as the first result when somebody searches for a keyword relevant to your business, e.g. “best car-sharing in (city)”. This can be paid, where your website or app appears as a sponsored result. Or it can be organic, where you produce valuable content that ranks highly on search engine result pages.

Organic content may take longer to deliver results, however, it can offer greater long-term return on investment (ROI). For example, if your city is a burgeoning tourist destination, you can create a guide on how to get around the city and include your services as one of the best ways to do so.

Display advertising is another paid channel and, in essence, it entails paying partners to place ads/banners of your services on their website. For display advertising to succeed, finding the right partners is key. For example, it might make more sense to have your car-sharing service banner appear on a local tourism page or a student club website than a clothing e-commerce store.

You'll find further digital marketing opportunities with email marketing, referral programs, push notifications and more. With online advertising, experimentation is critical – test various methods and platforms to explore what brings the greatest ROI.

Offline channels

Offline channels include things such as traditional media (TV, radio, print), outdoor advertising, as well as partnerships and sponsorships. These can complement a strong digital marketing strategy, particularly as it relates to standing out among the competition.

Fostering brand awareness is its strong suit, as offline advertising typically struggles with driving direct conversions. That is, a bus stop poster may not give you immediate app downloads, but its primary value lies in your business being top of mind when the potential customer is looking for a mobility solution.

Of course, you don't have to – nor should you – go all-in on a single channel. Rather you should dabble in multiple to see what works, and then double down on the most effective channels.

Allocating ad spend effectively

The goal of any marketing effort is to invest $1 and get more than $1 in return. Working with a limited budget means you must carefully manage your ad spend to get the most out of it.

First, you should define measurable goals for your marketing campaigns. Setting key performance indicators (KPIs) allows you to measure the success of your campaign. These KPIs – e.g. app download, website visit, account creation, first ride, user activation – can vary between channels, platforms, and campaigns, however, they should always be conducive to achieving your business goals.

With clear goals, you can evaluate performance. Investing in various channels and seeing how they perform will provide you with insights about which should be left alone, and which are the more lucrative ones that demand prioritzation.

Still, here are some things to keep in mind:

- Adapt your campaigns to each platform. A video of a teenager dancing around your scooter might do great on TikTok and flop on LinkedIn.

- Take into account that vehicle-sharing, and e-scooters in particular, can be a very seasonal industry and your marketing goals should reflect that.

- Your campaigns should become more effective over time as you gather more data, so don't get discouraged early on.

- Always tackle low-hanging fruits first, namely, the opportunities that give you the most returns with the least amount of effort.

Effective ad budget allocation is a balancing game that you will get better at with experience. Early on, it's about defining achievable goals and finding the easiest way to reach them.

Making use of ATOM Mobility's features for marketing

Best-in-class software platforms for mobility, like ATOM Mobility, should offer various tools that help you along in your marketing journey.

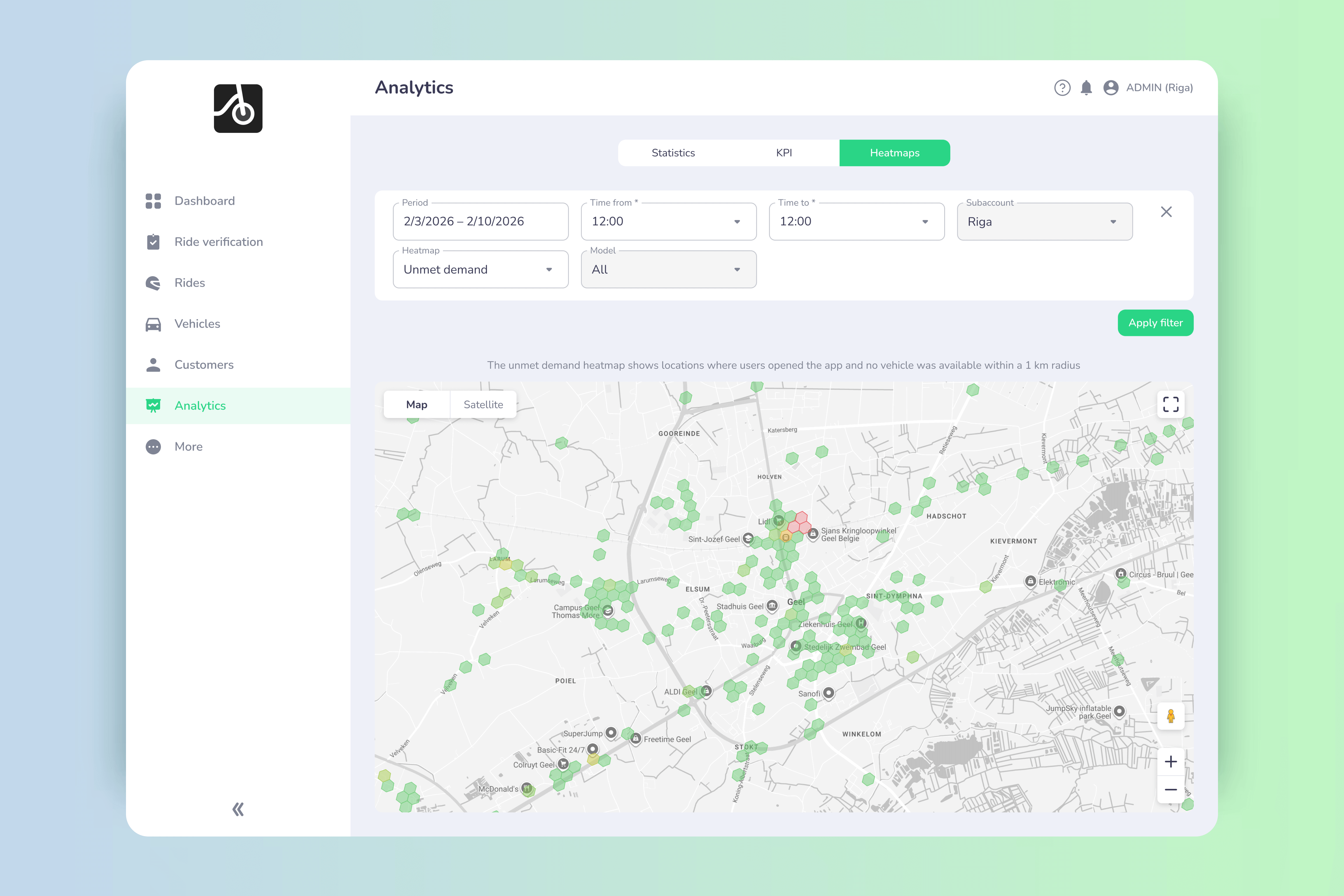

For example, ATOM Mobility can inform your overall strategy with the comprehensive analytics business owners can find in their dashboard. Ride and customer data, statistics and heatmaps, reports and insights can all help you get a better grasp of who is using your services and where. This, in turn, may aid in defining user personas and ensure you don't have to start your marketing from scratch.

More directly, ATOM Mobility also offers inbuilt advanced marketing tools:

- Loyalty and referral programs that drive word-to-mouth marketing,

- Integrated email marketing, in-app messages, and push notifications that help stay top of mind and re-activate existing users,

- Discounts, promos, and bonus zones that appeal to deal-chasing customers.

This article has mostly focused on customer acquisition, however, retention and activation should also have a prominent place in your strategy. By leveraging your own organic communication channels – your app, email subscribers, social media – you can increase customer lifetime value, boosting revenue at low expense to yourself.

Level up your mobility business

A well-executed marketing strategy can elevate your business. Putting one together takes effort and resources, but it can be the difference between struggling to make ends meet and a thriving mobility enterprise.

So, identify your customers, target them where they hang out, iterate and optimize. And make sure to use tools and platforms that help you along the way.

Click below to learn more or request a demo.

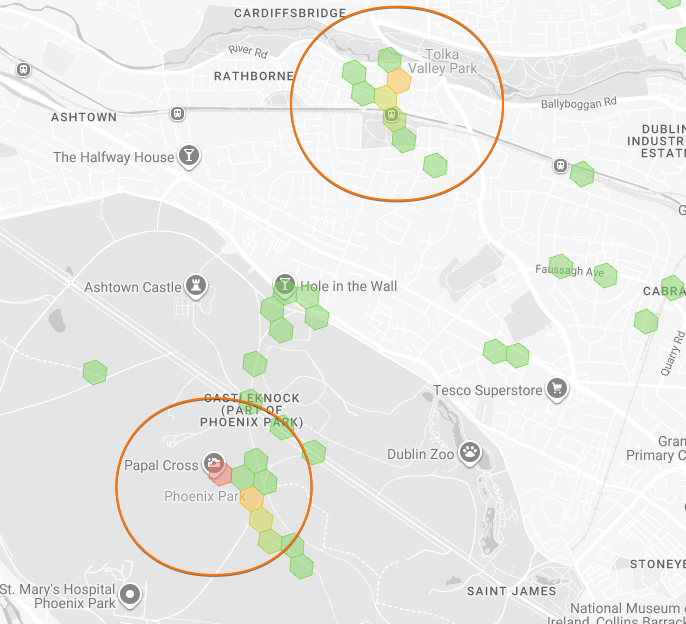

📉 Every unmet search is lost revenue. The unmet demand heatmap shows where users actively searched for vehicles but none were available - giving operators clear, search-based demand signals to rebalance fleets 🚚, improve conversions 📈, and grow smarter 🧠.

Fleet operators don’t lose revenue because of lack of demand - they lose it because demand appears in the wrong place at the wrong time. That’s exactly the problem the Unmet demand heatmap solves.

This new analytics layer from ATOM Mobility shows where users actively searched for vehicles but couldn’t find any within reach. Not guesses. Not assumptions. Real, proven demand currently left on the table.

What is the unmet demand heatmap?

The unmet demand heatmap highlights locations where:

- A user opened the app

- Actively searched for available vehicles

- No vehicle was found within the defined search radius

In other words: high-intent users who wanted to ride, but couldn’t. Unlike generic “app open” data, unmet demand is recorded only when a real vehicle search happens, making this one of the most actionable datasets for operators.

Why unmet demand is more valuable than app opens

Many analytics tools track where users open the app (ATOM Mobility provides this data too). That’s useful - but incomplete. Unmet demand answers a much stronger question:

Where did users try to ride and failed? That difference matters.

Unmet demand data is:

✅ Intent-driven (search-based, not passive)

✅ Directly tied to lost revenue

✅ Immediately actionable for rebalancing and expansion

✅ Credible for discussions with cities and partners

How it works

Here’s how the logic is implemented under the hood:

1. Search-based trigger. Unmet demand is recorded only when a user performs a vehicle search. No search = no data point.

2. Distance threshold. If no vehicle is available within 1,000 meters, unmet demand is logged.

- The radius can be customized per operator

- Adaptable for dense cities vs. suburban or rural areas

3. Shared + private fleet support. The feature tracks unmet demand for:

- Shared fleets

- Private / restricted fleets (e.g. corporate, residential, campus)

This gives operators a full picture across all use cases.

4. GPS validation. Data is collected only when:

- GPS is enabled

- Location data is successfully received

This ensures accuracy and avoids noise.

Smart data optimization (no inflated demand)

To prevent multiple searches from the same user artificially inflating demand, the system applies intelligent filtering:

- After a location is stored, a 30-minute cooldown is activated

- If the same user searches again within 30 minutes And within 100 meters of the previous location → the record is skipped

- After 30 minutes, a new record is stored - even if the location is unchanged

Result: clean, realistic demand signals, not spammy heatmaps.

Why this matters for operators

📈 Increase revenue

Unmet demand shows exactly where vehicles are missing allowing you to:

- Rebalance fleets faster

- Expand into proven demand zones

- Reduce failed searches and lost rides

🚚 Smarter rebalancing

Instead of guessing where to move vehicles, teams can prioritize:

- High-intent demand hotspots

- Time-based demand patterns

- Areas with repeated unmet searches

🏙 Stronger city conversations

Unmet demand heatmaps are powerful evidence for:

- Permit negotiations

- Zone expansions

- Infrastructure requests

- Data-backed urban planning discussions

📊 Higher conversion rates

Placing vehicles where users actually search improves:

- Search → ride conversion

- User satisfaction

- Retention over time

Built for real operational use

The new unmet demand heatmap is designed to work alongside other analytics layers, including:

- Popular routes heatmap

- Open app heatmap

- Start & end locations heatmap

Operators can also:

- Toggle zone visibility across heatmaps

- Adjust time periods (performance-optimized)

- Combine insights for strategic fleet planning

From missed demand to competitive advantage

Every unmet search is a signal. Every signal is a potential ride. Every ride is revenue. With the unmet demand heatmap, operators stop guessing and start placing vehicles exactly where demand already exists.

👉 If you want to see how unmet demand can unlock growth for your fleet, book a demo with ATOM Mobility and explore how advanced heatmaps turn data into decisions.

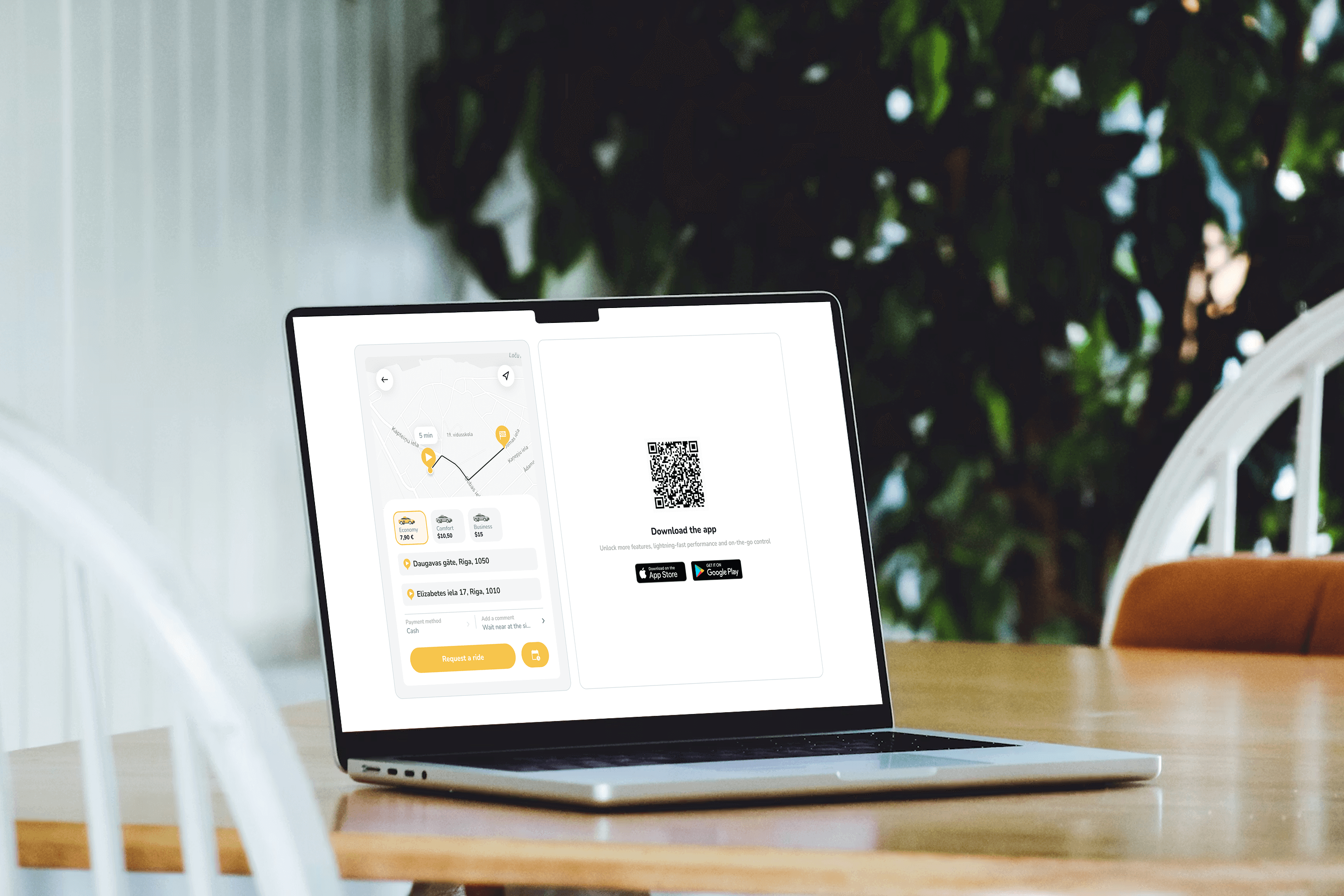

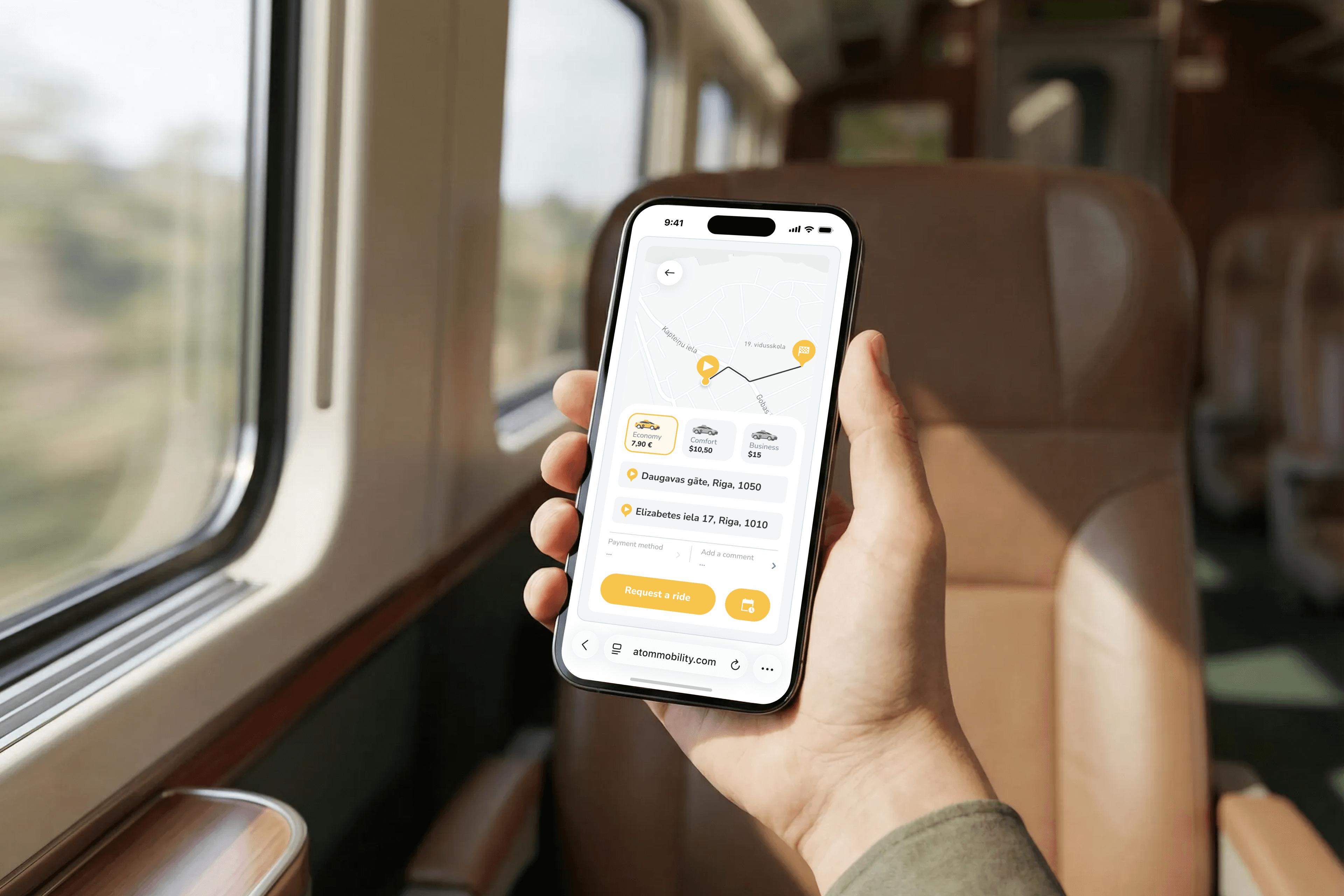

🚕 Web-booker is a lightweight ride-hail widget that lets users book rides directly from a website or mobile browser - no app install required. It reduces booking friction, supports hotel and partner demand, and keeps every ride fully synced with the taxi operator’s app and dashboard.

What if ordering a taxi was as easy as booking a room or clicking “Reserve table” on a website?

Meet Web-booker - a lightweight ride-hail booking widget that lets users request a cab directly from a website, without installing or opening the mobile app.

Perfect for hotels, business centers, event venues, airports, and corporate partners.

👉 Live demo: https://app.atommobility.com/taxi-widget

What is Web-booker?

Web-booker is a browser-based ride-hail widget that operators can embed or link to from any website.

The booking happens on the web, but the ride is fully synchronized with the mobile app and operator dashboard.

How it works (simple by design)

No redirects. No app-store friction. No lost users.

- Client places a button or link on their website

- Clicking it opens a new window with the ride-hail widget

- The widget is branded, localized, and connected directly to the operator’s system

- Booking instantly appears in the dashboard and mobile app

Key capabilities operators care about

🎨 Branded & consistent

- Widget color automatically matches the client’s app branding

- Feels like a natural extension of the operator’s ecosystem

- Fully responsive and optimized for mobile browsers, so users can book a ride directly from their phone without installing the app

📱 App growth built in

- QR code and App Store / Google Play links shown directly in the widget

- Smooth upgrade path from web → app

⏱️ Booking flexibility

- Users can request a ride immediately or schedule a ride for a future date and time

- Works the same way across web, mobile browser, and app

- Scheduled bookings are fully synchronized with the operator dashboard and mobile app

🔄 Fully synced ecosystem

- Country code auto-selected based on user location

- Book via web → see the ride in the app (same user credentials)

- Dashboard receives booking data instantly

- Every booking is tagged with Source:

- App

- Web (dashboard bookings)

- Booker (website widget)

- API

🔐 Clean & secure session handling

- User is logged out automatically when leaving the page

- No persistent browser sessions

💵 Payments logic

- New users: cash only

- Existing users: can choose saved payment methods

- If cash is not enabled → clear message prompts booking via the app

This keeps fraud low while preserving conversion.

✅ Default rollout

- Enabled by default for all ride-hail merchants

- No extra setup required

- Operators decide where and how to use it (hotel partners, landing pages, QR posters, etc.)

Why this matters in practice

Web-booker addresses one of the most common friction points in ride-hailing: users who need a ride now but are not willing to download an app first. By allowing bookings directly from a website, operators can capture high-intent demand at the exact moment it occurs - whether that is on a hotel website, an event page, or a partner landing page.

At the same time, Web-booker makes partnerships with hotels and venues significantly easier. Instead of complex integrations or manual ordering flows, partners can simply place a button or link and immediately enable ride ordering for their guests. Importantly, this approach does not block long-term app growth. The booking flow still promotes the mobile app through QR codes and store links, allowing operators to convert web users into app users over time - without forcing the install upfront.

Web-booker is not designed to replace the mobile app. It extends the acquisition funnel by adding a low-friction entry point, while keeping all bookings fully synchronized with the operator’s app and dashboard.

👉 Try the demo

https://app.atommobility.com/taxi-widget

Want to explore a ride-hail or taxi solution for your business - or migrate to a more flexible platform? Visit: https://www.atommobility.com/products/ride-hailing