Insights and news from the ATOM Mobility team

We started our blog to share free valuable information about the mobility industry: inspirational stories, financial analysis, marketing ideas, practical tips, new feature announcements and more.

We started our blog to share free valuable information about the mobility industry: inspirational stories, financial analysis, marketing ideas, practical tips, new feature announcements and more.

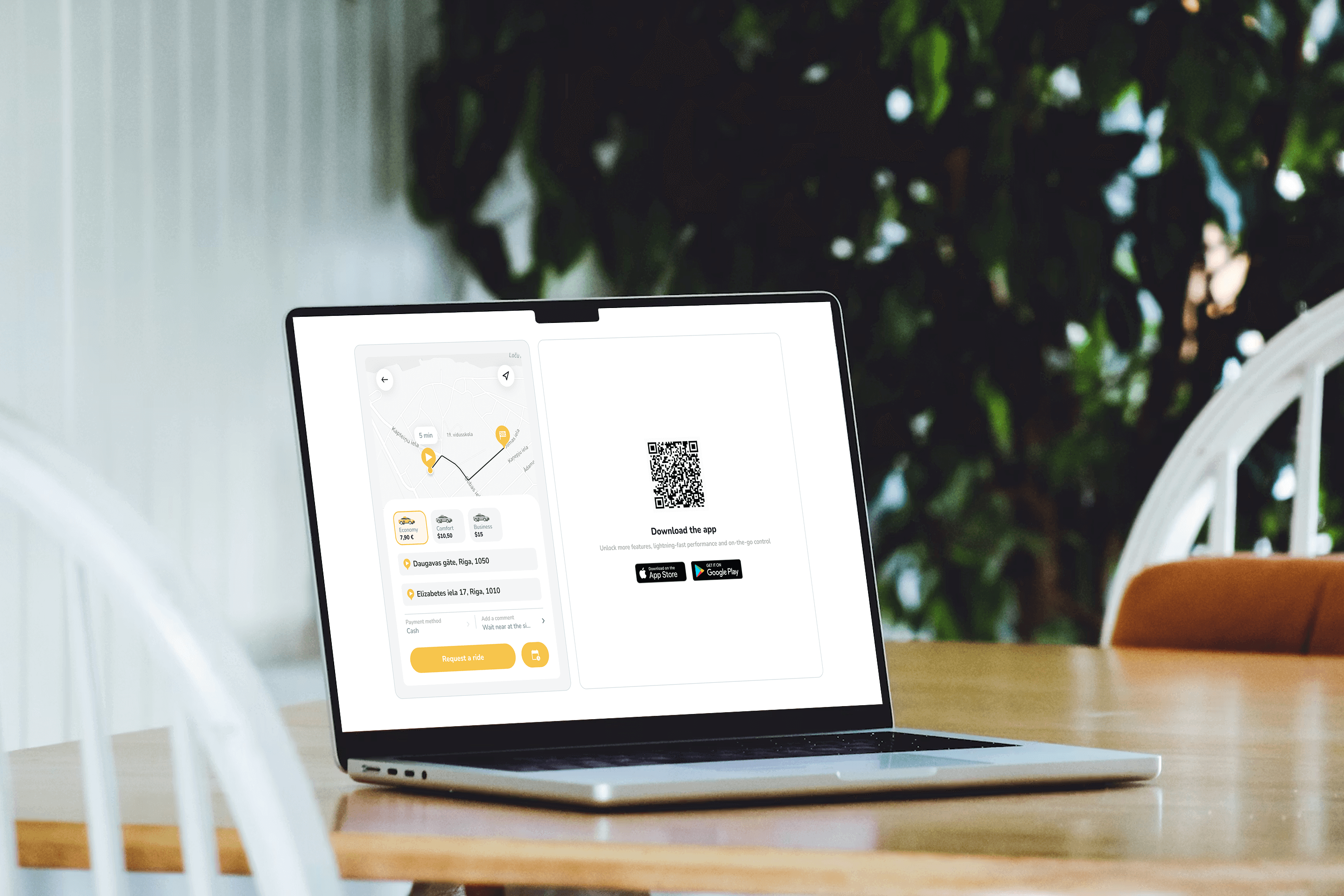

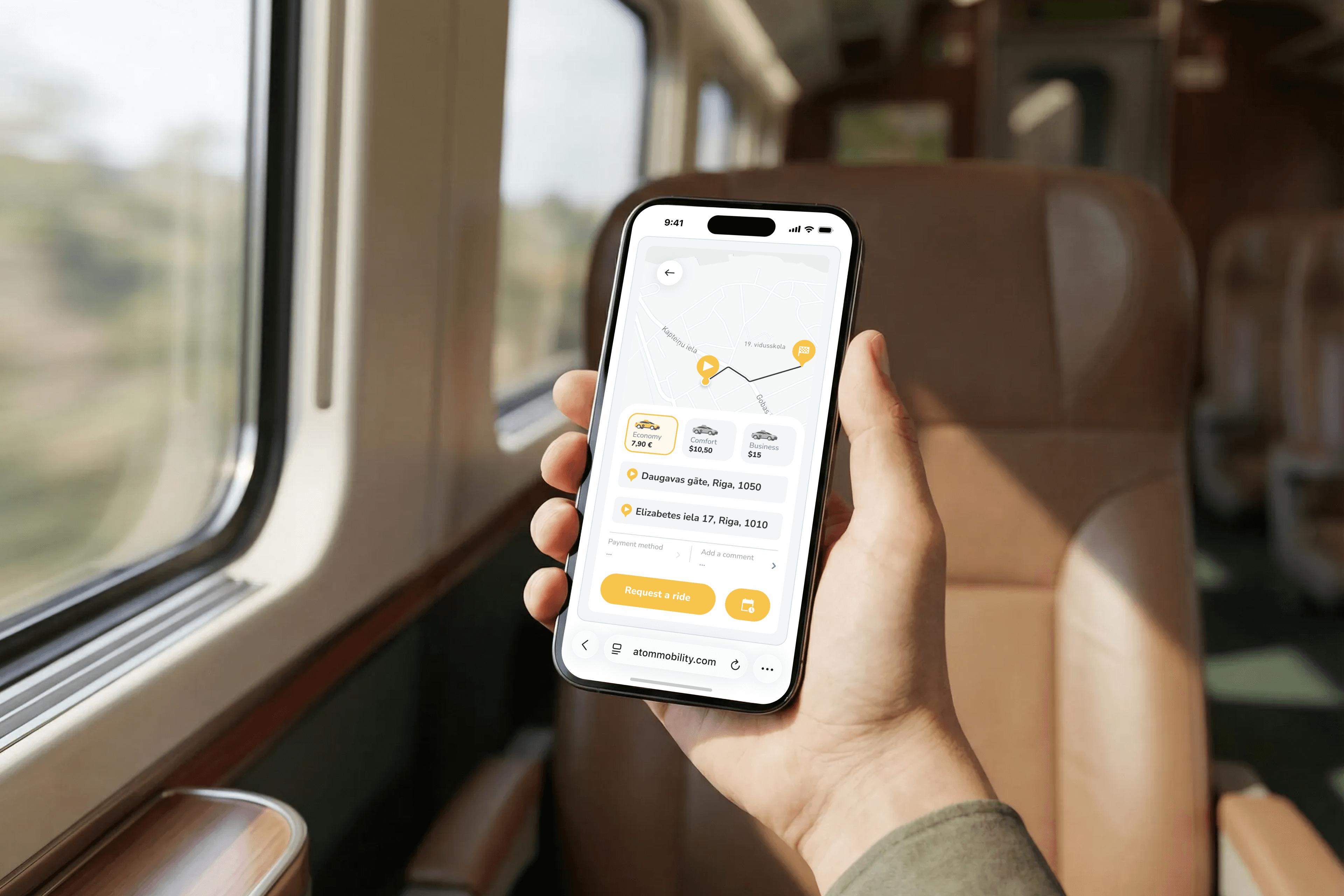

🚕 Web-booker is a lightweight ride-hail widget that lets users book rides directly from a website or mobile browser - no app install required. It reduces booking friction, supports hotel and partner demand, and keeps every ride fully synced with the taxi operator’s app and dashboard.

What if ordering a taxi was as easy as booking a room or clicking “Reserve table” on a website?

Meet Web-booker - a lightweight ride-hail booking widget that lets users request a cab directly from a website, without installing or opening the mobile app.

Perfect for hotels, business centers, event venues, airports, and corporate partners.

👉 Live demo: https://app.atommobility.com/taxi-widget

Web-booker is a browser-based ride-hail widget that operators can embed or link to from any website.

The booking happens on the web, but the ride is fully synchronized with the mobile app and operator dashboard.

No redirects. No app-store friction. No lost users.

This keeps fraud low while preserving conversion.

Web-booker addresses one of the most common friction points in ride-hailing: users who need a ride now but are not willing to download an app first. By allowing bookings directly from a website, operators can capture high-intent demand at the exact moment it occurs - whether that is on a hotel website, an event page, or a partner landing page.

At the same time, Web-booker makes partnerships with hotels and venues significantly easier. Instead of complex integrations or manual ordering flows, partners can simply place a button or link and immediately enable ride ordering for their guests. Importantly, this approach does not block long-term app growth. The booking flow still promotes the mobile app through QR codes and store links, allowing operators to convert web users into app users over time - without forcing the install upfront.

Web-booker is not designed to replace the mobile app. It extends the acquisition funnel by adding a low-friction entry point, while keeping all bookings fully synchronized with the operator’s app and dashboard.

👉 Try the demo

https://app.atommobility.com/taxi-widget

Want to explore a ride-hail or taxi solution for your business - or migrate to a more flexible platform? Visit: https://www.atommobility.com/products/ride-hailing

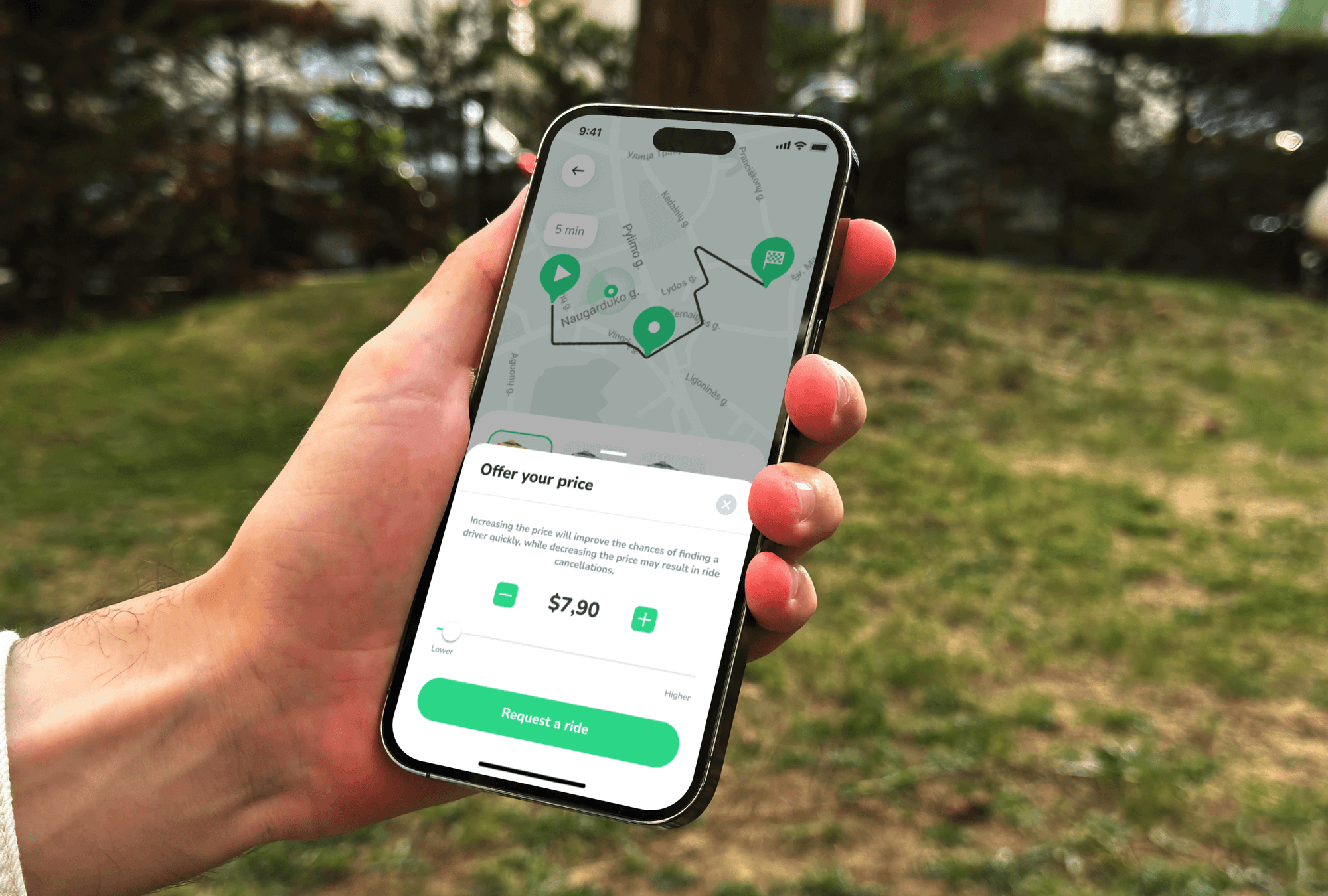

💸 ATOM Mobility launches “Offer your price” - a rider-controlled pricing feature. Riders can suggest higher or lower fares within pre-set limits. Boosts demand & helps stand out in competitive ride-hail markets 🚖🌍

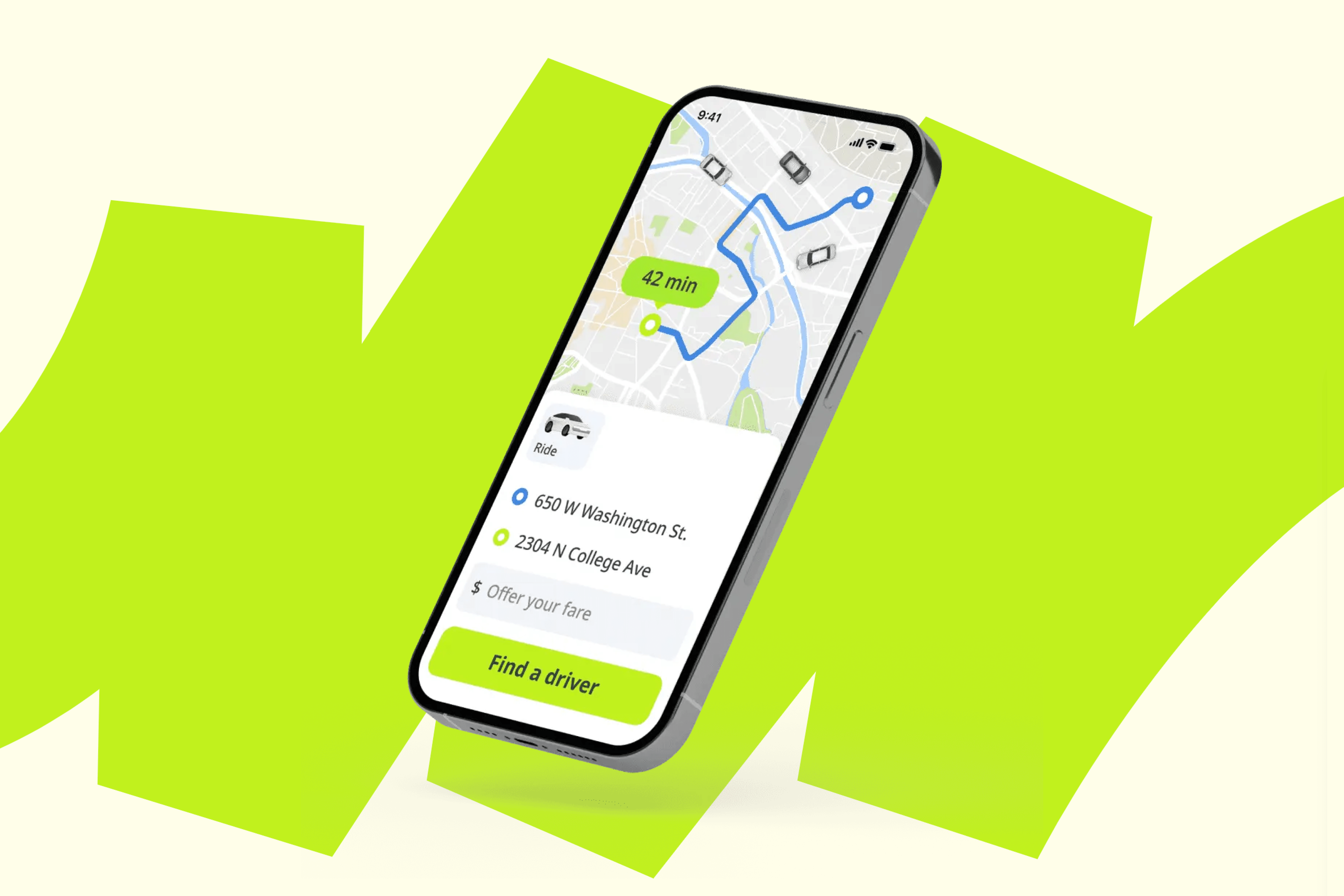

The ride-hailing market is always changing. From Latin America to Eastern Europe, platforms like inDrive have popularized a new norm: letting riders suggest what they want to pay. Now, in response to this growing global trend, ATOM Mobility is proud to introduce: Offer your price – a fully configurable pricing feature built right into your rider app.

Available on all ride-hail projects, this feature lets riders propose a price – higher or lower than the default fare – within operator-set limits. Drivers can then accept or decline based on the offer.

Here’s how it reshapes the experience:

Your admin dashboard defines the limits – say, up to +500% from regular price and down to -30% – and the app calculates step sizes automatically:

Slider position adapts dynamically, depending on your defined range. And yes – the button color and style can be customized to match your brand 🎨.

You’ll find complete control and clarity:

In the driver app:

Real-world companies are already proving that rider-defined pricing works:

🚘 inDrive (LATAM, Africa, Asia)

Now one of the top global ride-hailing players outside the U.S. (over 200M downloads, active in 700+ cities across 45+ countries), inDrive built its brand around rider-negotiated pricing. It helps them stand out in price-sensitive markets and win over both drivers and passengers with more transparent pricing dynamics.

🚖 Comin (France)

A local success story, Comin has embraced flexible rider pricing to gain traction in several French cities (onboarded 6,000+ drivers). The feature gives them an edge against larger platforms, offering more freedom for users and better utilization for drivers.

These examples show that letting riders bid their price isn’t just a gimmick – it’s a growth strategy.

From our previosu blog “How to Find Your Niche in the Ride-Hail Market”, we saw how localisation and user control drive loyalty and conversion.

This new pricing flexibility supports:

This is just one of the 300+ features available in ATOM’s white-label ride-hailing platform.

Let’s talk about how to launch or upgrade your app with “Offer your price”, advanced pricing logic, and more tools to dominate your niche.

👉 Contact our team and explore how to become the market leader: www.atommobility.com

🚗💡 Is car sharing still a profitable business in 2025? Short answer – yes, if done right. From rising fleet costs to smarter user behavior and green transport trends, the shared mobility game is changing fast. Learn what makes a car sharing business work today – and why some succeed while others shut down. 👉 Real stories, data-backed tips, and practical advice for operators and mobility founders.

In 2024, the global car-sharing market was valued at approximately €8.9 billion, with Europe accounting for over 50.2% of that total. Analysts forecast it will grow at a CAGR of 11.8% between 2025 and 2033, reaching roughly €24.4 billion by 2033. This blend of urbanization, environmental regulation and a growing preference for flexible mobility continues to create fertile ground for operators - yet not every service finds a clear path to profitability.

Success hinges on your location, business model, fleet, operations and local market dynamics. There are strong success stories, but also many high-profile failures. Here’s a closer look at what really affects profitability in today’s car-sharing market - and what you can learn from real-world cases.

Profitability in car sharing boils down to securing enough paid usage while keeping costs under control. Every unused hour or unnecessary expense erodes margins.

Key factors:

The operators who win are those who combine solid daily usage with lean operations.

29 March 2025 marked the end of Panek’s car-sharing experiment. Despite peaking at 2 700–3 000 vehicles, Panek never turned a profit in over seven years.

Faced with persistent losses, Panek’s leadership refocused on profitable core segments: daily/weekly rentals, corporate leasing and Fleet-as-a-Service.

WiBLE (50/50 joint venture between Kia Europe and Repsol) launched in 2018 and has just closed its second consecutive year with positive EBITDA.

Key enablers:

After five years of absorbing fixed-cost drag and depreciation, WiBLE now leverages Madrid’s regulatory environment (low-emission zones, parking benefits) and delivers lean, tech-driven operations.

SOCAR (backed by SoftBank, SK Inc. and Lotte Group) operates 20 000 vehicles, generates nearly €300 million in annual turnover and has 20% of South Koreans signed up.

By pairing massive scale with savvy car lifecycle management, extra-long rental duration, SOCAR converts high utilization into robust profitability.

30 August 2024: Carguru (est. 2017) acquired EV-focused OX Drive (est. 2021), adding 200+ Tesla to the fleet.

Outcome: A combined ICE, hybrid and EV fleet—backed by local expertise and strategic acquisitions - has driven strong growth and high utilization.

With clear benchmarks and smart execution - drawing on lessons from Panek, WiBLE, SOCAR and Carguru - car sharing can still be a highly profitable component of a modern mobility portfolio.

If you’re planning to start or improve your service, ATOM Mobility is ready to help. We’ve built the platform and supported dozens of teams worldwide - reach out, and we’ll share what we’ve learned.

Image credit: https://kursors.lv/2018/03/13/carguru-palielina-autoparku-un-paplasina-darbibas-zonas-mikrorajonos

✅ ATOM Mobility has launched OpenAPI v1 - giving vehicle-sharing, rental, and ride-hailing operators full control to integrate their services into MaaS platforms, websites, and partner apps. Discover how this powerful tool can help you expand reach, automate operations, and drive more bookings.

We’re thrilled to announce the launch of the ATOM Mobility OpenAPI v1 - a major step toward enabling mobility operators to seamlessly integrate their services with third-party platforms, partner systems, and custom applications.

With the OpenAPI, ATOM Mobility opens up new possibilities for businesses running vehicle-sharing, rental, and ride-hailing services to extend their digital reach, enhance customer experience, and unlock new revenue streams.

An OpenAPI (or application programming interface) is a set of standardized protocols that allows external software systems to interact with your platform. In simple terms, it acts like a bridge between your mobility service and the outside world — enabling secure data sharing and functional integration.

For mobility businesses, OpenAPIs have become a key tool for:

While many mobility providers offer GBFS (General Bikeshare Feed Specification) to share read-only data (ATOM Mobility will continue supporting GBFS) - such as vehicle locations and availability - these feeds are typically limited to visibility. Users still need to switch to a provider's app to complete the ride.

ATOM Mobility’s OpenAPI is different. It offers full read-write access to the core functions of your platform - similar to what operators can already do in the back-office dashboard. This means that third-party apps can not only display your vehicles but also handle booking, payments, and ride management entirely within their own interface.

This is a game-changer for expanding your service footprint beyond your app.

The first version of the OpenAPI supports all core modules — Vehicle sharing, Digital rental, and Ride-Hailing — with both public and private endpoints for:

Here are some examples of how mobility operators are already planning to use the ATOM OpenAPI:

Connect your fleet to fast-growing MaaS platforms, for example:

Allow users to book rentals or ride directly from your website without needing to download an app upfront. This is especially useful for tourists, first-time users or hotels. The app would only be needed to unlock the vehicle or track the driver (in case of ride-hailing).

Want to offer mobility through hotels, offices, or real estate platforms? Now they can show your vehicles and complete bookings within their apps - driving high-value B2B usage without manual overhead.

Support agents can pull up a rider’s active trip data in external helpdesk tools using ride ID endpoints - improving efficiency and resolution speed.

Build your own reporting layer by pulling real-time and historical ride, user, and revenue data into tools like Power BI, Tableau, or custom CRMs.

The OpenAPI is available to all ATOM clients on the Premium Plan, which includes:

Whether you’re exploring new channels, seeking B2B integrations, or joining a MaaS platform, the ATOM OpenAPI gives you the tools to scale faster and smarter. Want to learn more or schedule a call with our integrations team?

Contact us: https://www.atommobility.com/ask

In a significant move signaling further consolidation within the micro-mobility software sector, industry leader ATOM Mobility announced its strategic acquisition of ScootAPI. The deal, finalized on June 1, 2025, strengthens ATOM Mobility's dominant position in the B2B SaaS Micro-Mobility market.

In a significant move signaling further consolidation within the micro-mobility software sector, industry leader ATOM Mobility announced its strategic acquisition of ScootAPI.

The deal, finalized on June 1, 2025, strengthens ATOM Mobility's dominant position in the B2B SaaS Micro-Mobility market. This deal also marks a successful and timely exit for ScootAPI founder, George Kachanouski, who is already channeling his entrepreneurial energy into a new AI Venture in stealth mode for now.

For years, both ATOM Mobility and ScootAPI have been key players, providing essential software solutions for micro-mobility operators worldwide. This acquisition sees ATOM Mobility, led by CEO Arturs Burnins, proactively solidifying its market leadership. The move was driven by a strategic imperative to win the top spot in a competitive landscape by integrating ScootAPI’s valuable assets and client base.

About ATOM Mobility:

Founded in 2018 by Arturs Nikiforovs and CEO Arturs Burnins, ATOM Mobility empowers entrepreneurs to launch and scale mobility platforms worldwide, including vehicle sharing (scooters, bikes, mopeds, cars), digital rental, and ride-hailing businesses. With a suite of products including customizable rider apps, comprehensive dashboards, operator apps, and robust analytics, ATOM Mobility supports over 200 projects and 35,000 vehicles, facilitating over 1,000,000 rides monthly. The company is committed to providing reliable, agile, and well-designed technology with a strong focus on customer revenue growth and system stability, aiming to be the leader in B2B SaaS for micro-mobility.

About ScootAPI:

Founded in 2019 by CEO George Kachanouski, ScootAPI established itself as a significant player in the micro-mobility software space. The company delivered a robust white-label SaaS platform that empowered entrepreneurs and operators worldwide, successfully launching more than 50 distinct micro-mobility projects across diverse international markets. ScootAPI was dedicated to fostering 'smart' city transportation, thereby contributing to reduced CO2 emissions and an improved quality of urban life for communities worldwide.

"This is an acceleration moment for ATOM Mobility and the micro-mobility SaaS market as a whole," said Arturs Burnins, CEO of ATOM Mobility. "Acquiring ScootAPI aligns with our strategy to lead the industry and provide the most comprehensive, reliable, and innovative solutions to operators globally. We're excited to welcome ScootAPI’s clients into the ATOM Mobility platform, further accelerating the growth and efficiency of shared mobility worldwide."

For George, this move wasn't initially on his roadmap. He was invested in ScootAPI's growth. However, the recent explosion in AI technology sparked a new, compelling passion. “Selling ScootAPI wasn't something I was planning to do," George admitted. "We had built a good product, and the journey was far from over in my mind. But then the AI revolution really took off, and I found myself completely captivated by the potential of agentic workflows to automate business processes. The idea of building a new company in the AI space, something potentially even bigger and on a brand new frontier, became incredibly exciting."

As the transition moves ahead, George remains confident that ScootAPI's clients are in good hands. “ATOM Mobility has a clear vision and the technical depth to support operators long-term,” he said. “That was important to me. I didn’t want to hand things over to just anyone – I wanted to be sure the people relying on our platform would still be supported and able to grow.”

The integration of ScootAPI into ATOM Mobility promises a smooth transition for clients, who will now benefit from an expanded suite of features and robust support under the ATOM Mobility umbrella, further streamlining operations for micro-mobility entrepreneurs globally.