Insights and news from the ATOM Mobility team

We started our blog to share free valuable information about the mobility industry: inspirational stories, financial analysis, marketing ideas, practical tips, new feature announcements and more.

We started our blog to share free valuable information about the mobility industry: inspirational stories, financial analysis, marketing ideas, practical tips, new feature announcements and more.

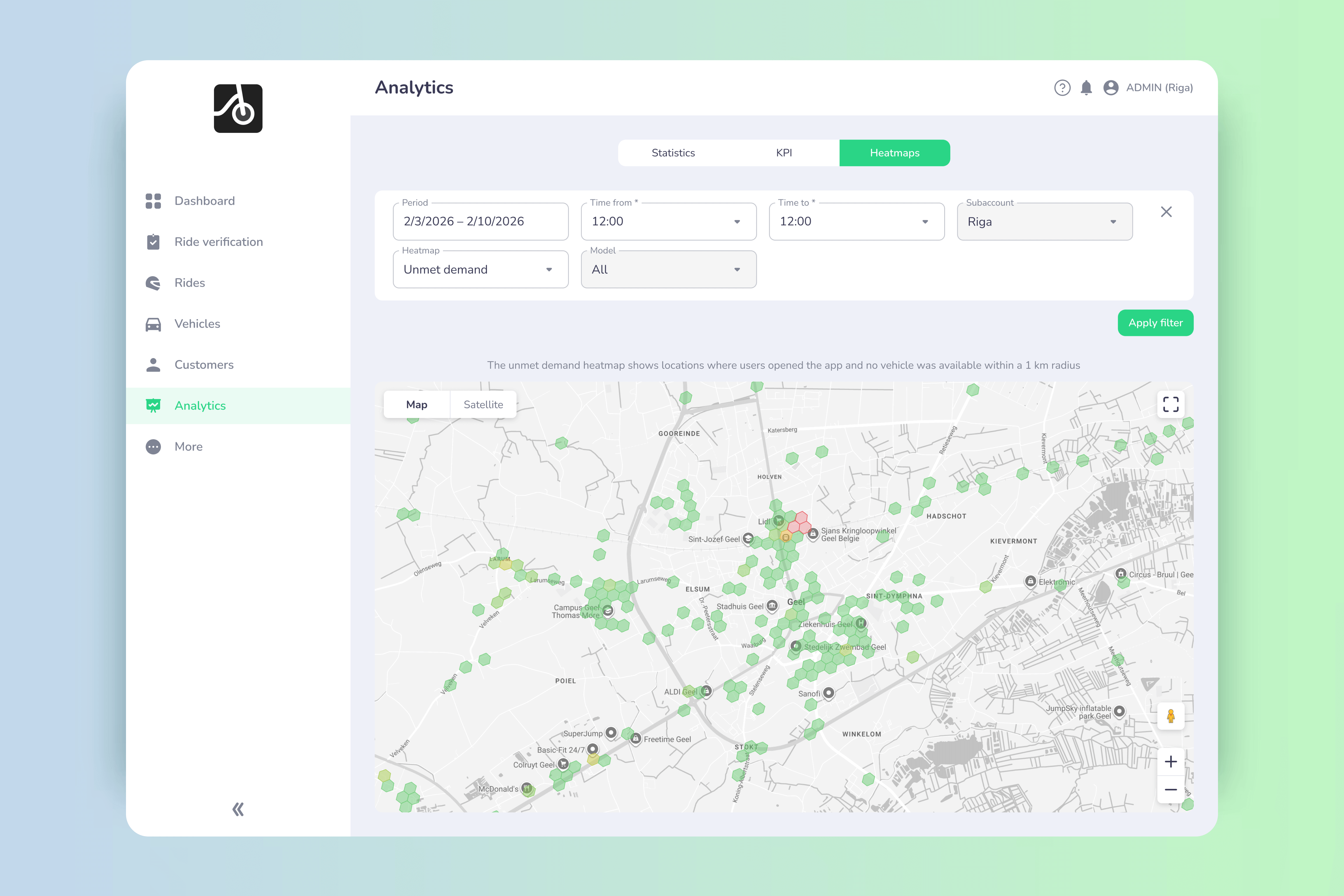

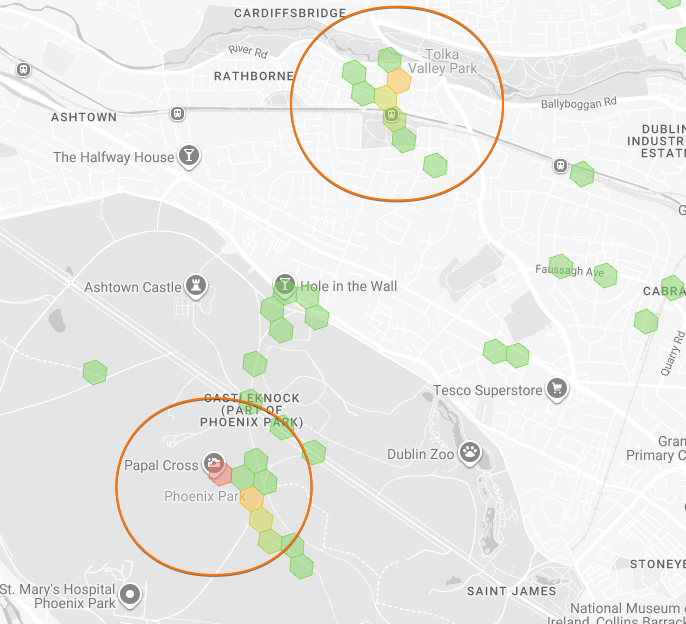

📉 Every unmet search is lost revenue. The unmet demand heatmap shows where users actively searched for vehicles but none were available - giving operators clear, search-based demand signals to rebalance fleets 🚚, improve conversions 📈, and grow smarter 🧠.

Fleet operators don’t lose revenue because of lack of demand - they lose it because demand appears in the wrong place at the wrong time. That’s exactly the problem the Unmet demand heatmap solves.

This new analytics layer from ATOM Mobility shows where users actively searched for vehicles but couldn’t find any within reach. Not guesses. Not assumptions. Real, proven demand currently left on the table.

The unmet demand heatmap highlights locations where:

In other words: high-intent users who wanted to ride, but couldn’t. Unlike generic “app open” data, unmet demand is recorded only when a real vehicle search happens, making this one of the most actionable datasets for operators.

Many analytics tools track where users open the app (ATOM Mobility provides this data too). That’s useful - but incomplete. Unmet demand answers a much stronger question:

Where did users try to ride and failed? That difference matters.

Unmet demand data is:

✅ Intent-driven (search-based, not passive)

✅ Directly tied to lost revenue

✅ Immediately actionable for rebalancing and expansion

✅ Credible for discussions with cities and partners

Here’s how the logic is implemented under the hood:

1. Search-based trigger. Unmet demand is recorded only when a user performs a vehicle search. No search = no data point.

2. Distance threshold. If no vehicle is available within 1,000 meters, unmet demand is logged.

3. Shared + private fleet support. The feature tracks unmet demand for:

This gives operators a full picture across all use cases.

4. GPS validation. Data is collected only when:

This ensures accuracy and avoids noise.

To prevent multiple searches from the same user artificially inflating demand, the system applies intelligent filtering:

- After a location is stored, a 30-minute cooldown is activated

- If the same user searches again within 30 minutes And within 100 meters of the previous location → the record is skipped

- After 30 minutes, a new record is stored - even if the location is unchanged

Result: clean, realistic demand signals, not spammy heatmaps.

Unmet demand shows exactly where vehicles are missing allowing you to:

🚚 Smarter rebalancing

Instead of guessing where to move vehicles, teams can prioritize:

🏙 Stronger city conversations

Unmet demand heatmaps are powerful evidence for:

📊 Higher conversion rates

Placing vehicles where users actually search improves:

The new unmet demand heatmap is designed to work alongside other analytics layers, including:

- Popular routes heatmap

- Open app heatmap

- Start & end locations heatmap

Operators can also:

Every unmet search is a signal. Every signal is a potential ride. Every ride is revenue. With the unmet demand heatmap, operators stop guessing and start placing vehicles exactly where demand already exists.

👉 If you want to see how unmet demand can unlock growth for your fleet, book a demo with ATOM Mobility and explore how advanced heatmaps turn data into decisions.

%20(1).png)

%20(1).png)

Meet MOBEO – an innovative Spanish company that is not only transforming how we get around but also making corporate travel more exciting.

In big cities, employees often want to avoid traffic and parking hassles, preferring an easier way to commute. Luckily, there are people ready to take on the challenge. Meet MOBEO – an innovative Spanish company that is not only transforming how we get around but also making corporate travel more exciting.

In big cities, employees often want to avoid traffic and parking hassles, preferring an easier way to commute. Luckily, there are people ready to take on the challenge. Meet MOBEO – an innovative Spanish company that is not only transforming how we get around but also making corporate travel more exciting.

We caught up with Álvaro Ventura, CEO of MOBEO, to get the inside scoop on how his company is creating corporate fleets and shaking up the world of business travel with a help from Atom Mobility.

Launch date: November 2023

Country: Spain

Web page: https://mobeosharing.com

App Store: https://apps.apple.com/us/app/mobeoshare/id6469049276

Google Play: https://play.google.com/store/apps/details?id=mobeoshare.app&hl=en_AU

Fleet: bicycles (incl. conventional, hybrid, mountain, electric bikes), pedal karts, and bicycles

for people with reduced mobility.

With 12 years of experience in the tourism industry, the MOBEO team identified an opportunity to expand their business by leveraging resources from their existing projects. This vision led to the creation of MOBEOsharing.com, a platform designed to meet the growing demand for employee transportation services. Their ambitious goal? To become the leading provider of shared private fleets for European businesses within five years.

MOBEO’s journey began with a self-funded investment of 70,000 euros, which laid a strong foundation for their operations. However, the team quickly recognized that additional capital would be essential for rapid expansion. They are now actively seeking investments to accelerate their entry into the European market and to help achieve their bold vision.

MOBEO’s mission goes beyond simply providing vehicles; they aim to transform how companies approach transportation. MOBEO works closely with clients to run campaigns that encourage employees to adopt greener travel options instead of relying on cars. Their comprehensive services include digital awareness campaigns, personalized commuting routes, and team-building events focused on sustainable transportation.

As Ventura, a key figure in MOBEO, explains, “Some clients go all-in with our full package, while others might just want us to handle the wheels. It’s like a buffet—take what you need!”. This flexibility allows MOBEO to cater to companies of all sizes and budgets, making them a preferred choice for businesses looking to modernize their transportation strategies.

On the software side, MOBEO relies on ATOM Mobility's digital rental solution, which provides MOBEO users (employees of companies that MOBEO partners with) the opportunity to create an account in the MOBEO app, upload their employee ID card (allowing the MOBEO team to verify that the individual is indeed employed by the specific company), and, once verified, gain access and pre-book vehicles for upcoming rides. The MOBEO app also features a calendar function, enabling users to schedule future bookings as needed. At the end of the month, MOBEO bills partners based on the usage of vehicles by their employees. All vehicle monitoring, unlocking, and locking are automatically managed by the ATOM Mobility platform. It’s that simple.

MOBEO is strategically expanding its presence by focusing on large companies with offices in major Spanish cities such as Madrid, Barcelona, Zaragoza, Valencia, and Seville. These cities are particularly well-suited for introducing shared mobility solutions due to their large employee bases and the strong demand for sustainable transport options. On average, an employee takes a vehicle for 1-2 days and rides 10-40 km per booking.

In 2019, MOBEO began with a small software provider that met their initial needs but lacked the capacity for growth. Recognizing the need for a more robust solution, MOBEO partnered with ATOM Mobility—a decision that proved pivotal for scaling their operations.

ATOM Mobility, a leader in shared mobility software solutions, is known for its comprehensive platform and exceptional customer service. Their software empowers businesses like MOBEO to manage fleets efficiently, offer seamless user experiences, and scale operations smoothly. MOBEO frequently encountered positive feedback about ATOM Mobility during hardware discussions, prompting them to explore and eventually adopt ATOM Mobility's services.

This partnership has been instrumental in MOBEO’s success, providing them with the tools and support necessary to expand and innovate in the competitive European market.

.webp)

For those looking to enter the shared mobility sector, Ventura offers sage advice: “This industry is going places, but it’s not a walk in the park. Good financial planning is key because regulatory changes are like a rollercoaster ride—you’ve got to hang on and adapt quickly.”

MOBEO is setting new standards for corporate mobility, thanks to their innovative approach and strategic partnership with ATOM Mobility. Together, they are on track to revolutionize how businesses manage transportation in Spain.

As MOBEO continues to pioneer advancements in corporate mobility, their collaboration with ATOM Mobility remains a cornerstone of their success. With shared values and a commitment to innovation, MOBEO and ATOM Mobility are poised to lead the transformation of business transportation across Europe.

.png)

Boost efficiency, enhance user experience, ensure every job gets done right, and monitor tasks from a single dashboard —say hello to the Task Manager for fleet operators! 🚀

If you’re managing a fleet, you know that keeping track of all the moving parts can feel like holding a dozen plates spinning at once. That's why ATOM Mobility's latest feature is about to become your new best friend: say hello to the Task Manager for fleet operators!

The new Task Manager feature is based on direct feedback from our Sharing and Rental clients. They needed a more efficient way to organize their on-site teams and manage tasks. We heard their requests loud and clear and have developed a tool that streamlines operations and reduces headaches.

Instead of drowning in a sea of sticky notes and spreadsheets, you now have a sleek, intuitive Task Manager that allows you to:

.png)

Let’s break down the main benefits:

Let’s see how this might look in real life. Imagine you’re managing a fleet of cars. One of your team members noticed that a tire is flat Using the Task Manager, they can quickly create a task, link it to the specific car, set a high priority (because nobody likes a flat tire), and assign it to the team member responsible for maintenance.

You can then monitor this task from the dashboard, ensuring it’s completed on time. The result? A happy customer who didn’t have to deal with a flat tire and a team that knows exactly what’s expected of them.

Excited to try out the Task Manager for yourself? Head over to your ATOM Mobility dashboard and start exploring this game-changing feature. It’s designed to be intuitive and user-friendly so you can hit the ground running.

At ATOM Mobility, we’re committed to making fleet management as smooth and efficient as possible. The new Task Manager is just one of the many ways we’re helping you stay ahead of the game. By centralizing task creation, assignment, and monitoring, we give you the tools to operate like a well-oiled machine.

So, put on your superhero cape (or just your favorite work shirt), and let the Task Manager take your fleet operations to the next level.

🌐 There’s no denying it – we are quickly entering a world we cannot imagine without Artificial Intelligence. That also means changes for the micromobility industry, as AI can help address its challenges, including damage detection, safety, and pricing strategies. 💡 But how is AI transforming the industry? Let’s dive in.

Artificial Intelligence (AI) is revolutionizing various sectors, and micromobility is no exception. By integrating AI into e-scooters, e-bikes, cars and other small vehicles, the industry is becoming smarter, safer, and more efficient. AI’s prowess in data processing, predictive analytics, and machine learning is driving this transformation, making operations more innovative and productive, and setting a bright future for micromobility.

Let's explore how AI is making a significant impact on the micromobility industry through smart parking, dynamic pricing and rebalancing, and damage detection.

From automating routine tasks to providing deep insights through data analysis, AI is reshaping how we navigate urban environments. Its ability to learn from vast amounts of data and make real-time decisions is crucial for developing efficient, sustainable, and user-friendly transportation solutions.

Micromobility refers to small, easy-to-maneuver vehicles like e-scooters, e-bikes, and shared bicycles that operate at speeds typically below 25 km/h. The rise of micromobility is driven by the need for convenient, cost-effective, and eco-friendly urban transport. AI helps tackle critical challenges in the micromobility industry, including parking management, pricing strategies, fleet rebalancing, and damage detection. Companies like SWITCH are leading the way by using advanced algorithms to generate synthetic data, predict demand, optimize fleet distribution, and support strategic planning.

Improper parking can clutter sidewalks and create accessibility issues, frustrating many urban dwellers. AI-driven parking analysis provides a practical solution:

Results? Studies show AI parking analysis can drastically improve compliance. For instance, 52% of improperly parked vehicles are correctly re-parked on the second attempt, rising to 82% by the third attempt.

If you're interested in exploring these solutions further, you can read a case study by ATOM Mobility in collaboration with Captur's AI-Powered Photo Verification solution.

AI enhances fleet utilization and customer satisfaction through dynamic pricing and rebalancing strategies:

A case study revealed that scooters placed in AI-recommended areas saw a 6% increase in average revenue, and rebalanced vehicles experienced a 10.8% usage increase within 24 hours.

Maintaining vehicle condition is crucial for safety and longevity. AI-powered damage detection systems offer a solution:

Automating damage detection helps operators maintain high safety standards and reduces downtime from manual inspections. Companies such as FocalX streamline the damage detection functionality.

Integrating AI in micromobility is revolutionizing the industry by enhancing operational efficiency, user experience, and safety. As AI technology continues to evolve, its role in shaping the future of micromobility will grow, driving the industry toward smarter, more sustainable urban transportation solutions.

For micromobility operators, embracing AI technologies is not just an option but a necessity to stay competitive and meet the growing demands of urban commuters. The future of micromobility is intelligent, efficient, and AI-driven.

Ready to dive deeper into the world of shared mobility and learn how to use AI to transform your business? Join the ATOM Academy for FREE expert knowledge, practical insights, and innovative strategies that will help you stay ahead in the rapidly evolving micromobility industry. Visit ATOM Mobility to learn more. Let's drive the future of urban transportation together!

.jpg)

The world of taxi apps is booming, but the idea of building your own from scratch can be daunting. 🚕 What if there was a faster, more cost-effective way to launch your ride-hailing service? Enter white label taxi apps. These pre-built solutions provide a shortcut to your business while skipping the lengthy and costly software development process. In this guide, we'll explore the many advantages of white label taxi apps, from quicker launch times to features that help you attract and retain riders.

The world of taxi apps is booming, but the idea of building your own from scratch can be daunting.

What if there was a faster, more cost-effective way to launch your ride-hailing service?

Enter white label taxi apps.

These pre-built solutions provide a shortcut to your business while skipping the lengthy and costly software development process.

In this guide, we'll explore the many advantages of white label taxi apps, from quicker launch times to features that help you attract and retain riders. We'll also guide you through the process of building your vision, from defining your target audience to crafting a unique selling proposition.

Why build a taxi app using white label software?

The answer is simple – white label taxi app solutions help to bridge your business idea with reality. There’s no need to build a taxi app from ground zero, since the solutions are already there – tried, tested and waiting for your branding.

If you’re still not sure about the benefits of using a white label taxi platform over building your own, consider these advantages:

White label apps are pre-built, allowing you to launch your service much quicker and skip the lengthy and expensive process of custom development. In addition, such mobility software is continuously updated and developed, complying with the latest regulations and meeting user demands in specific markets.

Building a custom app requires significant investment. White label solutions like ATOM Mobility offer a cost-effective alternative, allowing you to test and refine your concept without breaking the bank.

Once your app is up and running, white label taxi app platforms help you reduce operational costs by automating tasks and increasing operational efficiency for your taxi business.

Don't be fooled by the "white label" – your branding can make your taxi app unique. A white label platform gives you the freedom to completely customize the app's look and feel without worrying about the technical intricacies of the app’s operation.

How exactly do you personalize your app’s brand identity? It’s simple and fun – start by adding your logo, choosing your color scheme, and creating in-app copy to match your brand’s voice. Think about creating a seamless user experience that reflects your unique concept and resonates with your target audience.

White label solutions are designed to be scalable, allowing you to easily add features and accommodate a growing user base. If you choose to build your taxi app with ATOM, you get a user-friendly booking and dispatch software and a powerful admin panel to manage drivers, customers and follow the stats. With time, you can quickly expand to other business verticals and create your unique superapp, keeping it all customized for your brand.

Gone are the days of hailing cabs or waiting on hold. Your white label taxi app should have the option to get a ride in seconds, with features that are meticulously designed to be as intuitive as possible. With just a few taps, customers should be able to create accounts, book rides, and track their driver's arrival in real time.

When building custom taxi fleet software, this level of convenience and sense of control can take years. White label taxi apps have refined their features to enhance customer satisfaction and build loyalty. Thus you won’t have to lose customers due to technical glitches or slow features.

Before you take the first steps in building your white label taxi app, take a moment to solidify your vision. What will be special about your app and who will be its target users? This roadmap will guide your decisions and ensure your app caters to a specific need within the market.

Lay out a plan including important aspects of your vision, such as:

It sure is tempting to offer your services to all the taxi riders on the market, but in reality, differentiation works much better. We recommend defining a user segment that would be the primary target audience for your taxi app. Will you focus on budget-minded students, busy business travelers, or families with young children? Choose a niche that's large enough to be sustainable, but targeted enough to stand out.

Your USP is what will differentiate your app. For example, are you known for eco-friendly vehicles, flat fares, or focusing on specific areas? Maybe you’re a kid and pet-friendly company that offers extras like different-size booster seats and cartoons on board.

It’s also important to consider what app features are imperative for your business. Which functionalities should definitely be there besides having a rider app, driver app, and admin panel? For example, do you want to offer in-app chat, rider verification options, multiple payment options, etc., or any other special features?

Let’s imagine you’ve already launched your white label taxi app by selecting the right platform (like ATOM Mobility), choosing your branding and integrating the desired functionalities. What next?

To ensure long-term success, ongoing marketing and customer acquisition strategies are crucial for the success of your ride-hailing business.

Here's how to hit the ground running:

Know your riders

Leverage built-in analytics within your taxi fleet software to understand rider behavior and preferences. This allows you to create detailed user personas – representations of your ideal customers. By understanding their needs and habits, you can tailor your marketing efforts for maximum impact.

Targeted acquisition

Armed with your user personas, launch targeted advertising campaigns across relevant channels. Social media platforms, local publications, and strategic partnerships with businesses frequented by your target audience can be effective avenues for reaching potential riders.

Loyalty programs to stay top-of-mind

Entice new customers with attractive introductory offers and discounts. Once you've hooked them, implement loyalty programs that reward repeat rides. This could include points systems for free rides, different memberships with exclusive benefits, or referral programs that incentivize existing riders to spread the word.

Harnessing the power of "deals"

Don't underestimate the power of discount codes and promotions. Strategic use of these tools can attract deal-conscious customers and encourage them to try your service.

Top taxi fleet software, like ATOM Mobility, offers various marketing tools, from loyalty and referral programs to integrated email marketing and push notifications that help stay top of mind and re-activate users.

The world of taxi apps is brimming with potential, and white label solutions empower you to claim your share.

If you’re ready to turn your dream into reality, choose trustworthy taxi fleet software like ATOM Mobility to eliminate all technological headaches. Instead, you can focus on marketing and operations and grow your business with unlimited possibilities.

Contact ATOM Mobility today for a free consultation and explore how we can transform your vision into a thriving ride-hailing business.